Marketing Intelligence for the Future of the Ad Ecosystem

Always-on insights that empower brands, agencies, publishers & platforms to achieve peak performance.

On the Blog

Instacart Scales Off-Platform Partnership Opportunities Across Streaming TV, Social & More Using MediaRadar

Be bold. We've got you.

Our platform is built on broader and deeper advertising coverage than any single provider in the market. Dream big—our insights will help you get there.

Brands

Develop ad strategies that resonate.

Build stand-out creative & media strategies to reach, engage and convert customers – and drive clear ROAS.

Agencies

Build impactful media plans.

Power agile planning and media optimization with always-on insights into competitive media mix shifts and investment strategies.

Publishers & Platforms

Win more deals.

Drive strategic sales planning, prospecting and insights-driven pitches that win more business, more effectively.Seeing more means winning more

brands

media channels

LEVELING UP THE ENTIRE ADVERTISING ECOSYSTEM

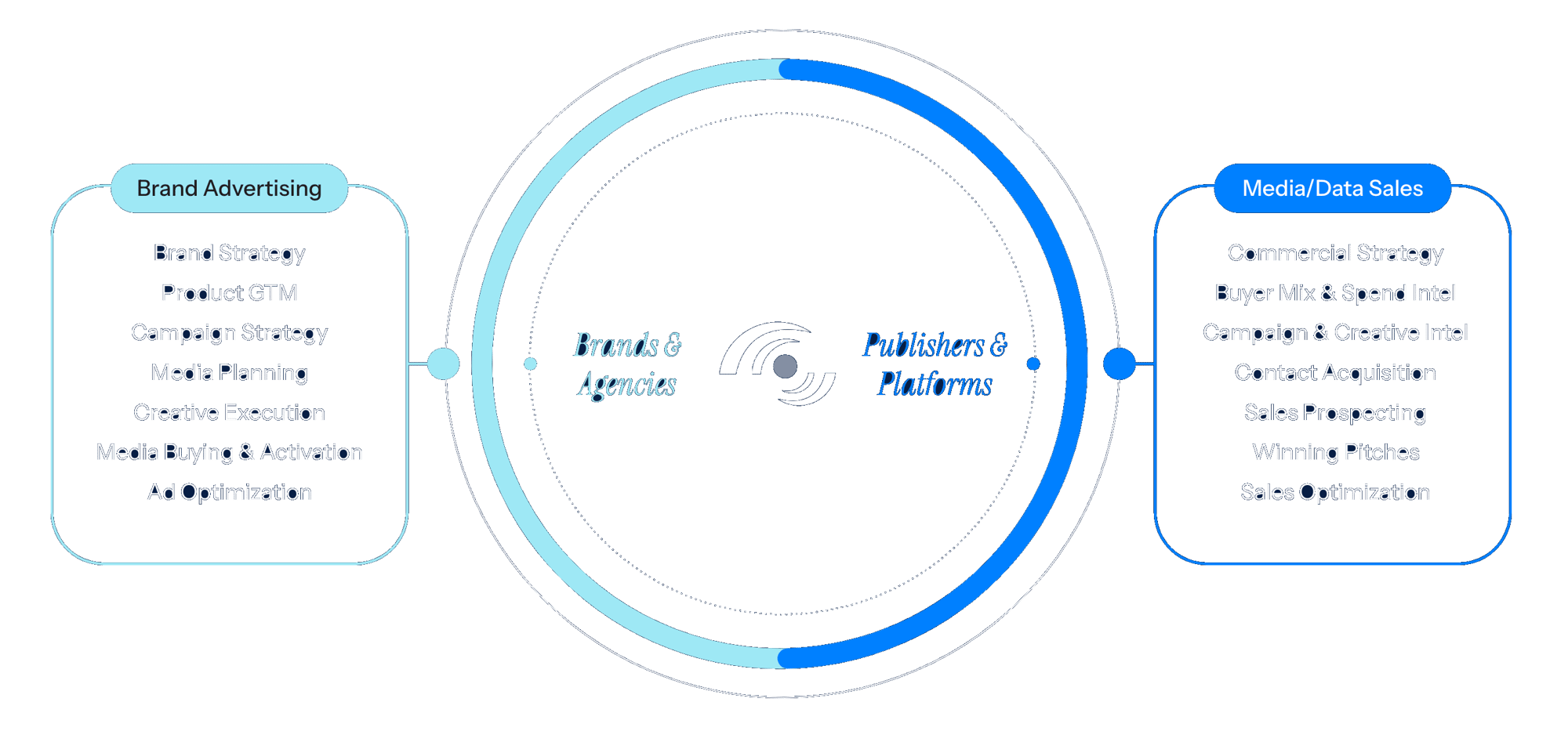

Indispensable Insights Across Brand Advertising & Media/Data Sales Use Cases

Be a Master of Change

With the largest creative and campaign library in North America at your fingertips, you’re the first to catch every market move. Find new players, track channel growth and place bigger bets with confidence.

Get Money Wise

Follow the money – win your next customer. From assessing your share of wallet to setting targets based on TAM, our media investment insights help you succeed.

Stay Relevant

Trends from millions of creative assets make you an instant creative strategy expert. Engage in the media conversation with ease, no matter where it goes.

MediaRadar provides high-level insights as well as in-depth granularity that you can't get anywhere else. It helps our team sell more effectively.

It is light years ahead...We haven't seen anything like this. Kudos to you for listening to your clients and responding.

MediaRadar paints a clear picture on spend, trends and strategies. The team are problem solvers—they are always available and consistently coming up with solutions to better the product and process.

We work much more efficiently with MediaRadar. From prospecting to trending insights, it's an amazing solution.

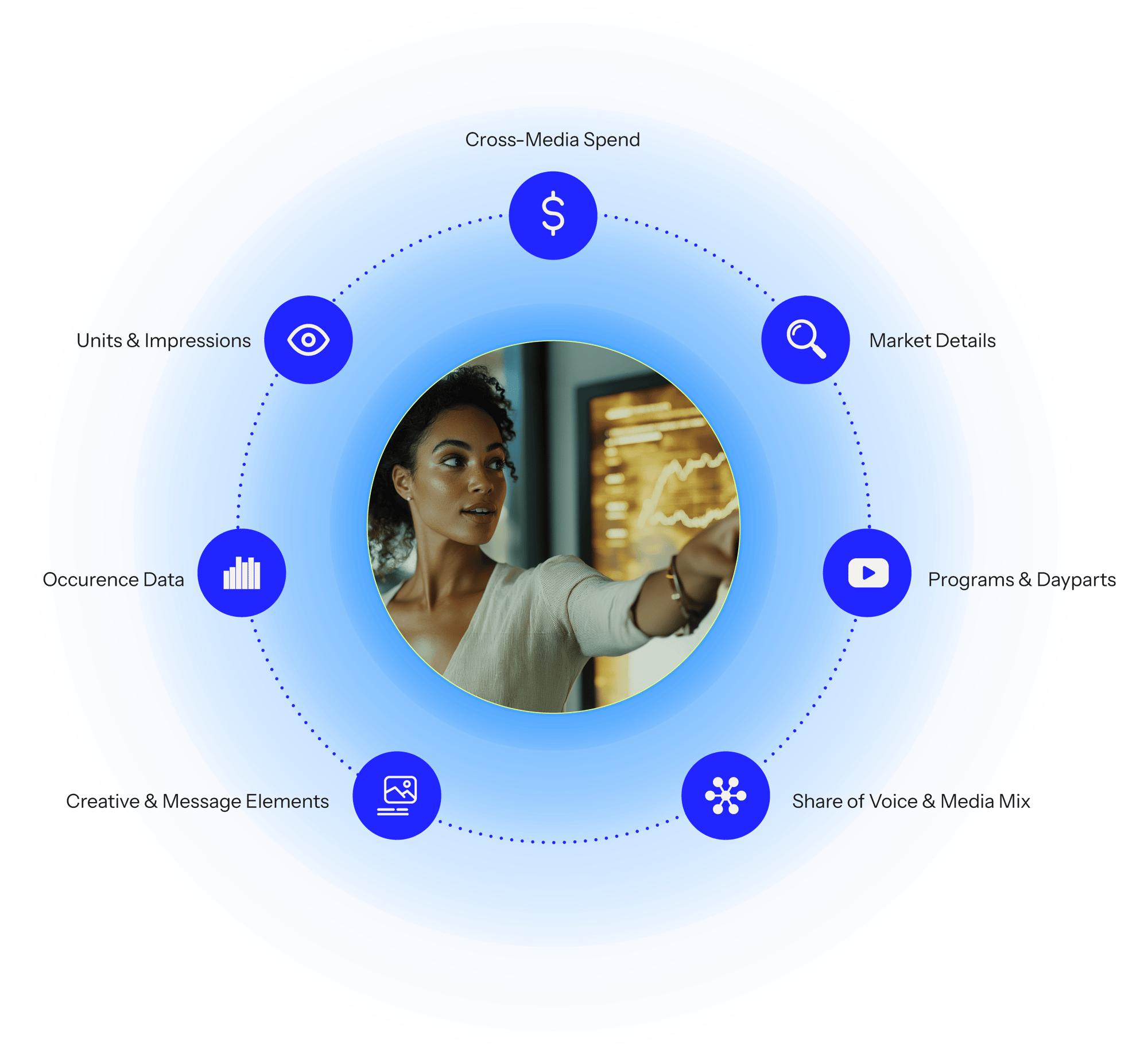

All dimensions of advertising at your fingertips.

NEW REPORT

MediaWatch® Streaming TV Report: The 2025 Upfronts & Newfronts Edition

OUR LATEST CONTENT

Stay informed. Stay inspired. Stay ahead.

Stay ahead of the curve with the latest news, insights, and trends shaping the world advertising. Explore our cutting-edge articles, expert analyses, and in-depth reports that will help you navigate the ever-evolving digital landscape.

.jpeg?width=2000&name=AdobeStock_804293832%20(1).jpeg)

MEDIAWATCH® REPORT

Investment Blueprint 2025: Total Media Report

The MediaWatch Investment Blueprint 2025 is a comprehensive report that provides a roadmap into the media landscape, focusing on media spending trends, strategic approaches by advertisers, and the evolution of both digital and traditional media channels.

REPORT

Future Titans of Pharma & Healthcare Report

This report offers a comprehensive exploration of the pharmaceutical industry's advertising landscape and the standout brands at the forefront. Uncover how these brands are adapting to the changing retail environment.

![]()

.jpg?width=1398&height=783&name=sm_AdobeStock_585413272%20(1).jpg)

REPORT

Future Titans of Retail Report

This focused analysis offers a deep dive into the retail industry, revealing key differences in how retail brands manage their advertising budgets. Discover the strategies that set these brands apart and how they are navigating the evolving retail landscape.

![]()

ALREADY A CLIENT?

If you are a current client and need help email our customer support.

Speak to a Consultant

Brands & Agencies

Boost your marketing ROI by understanding your competitors’ media mix, campaigns and creative strategies.

Publishers & Platforms

Drive stronger sales with strategic planning, targeted prospecting and data-backed pitches.

Consultancies & Data Partners

Recommend high impact marketing strategies built on a foundation of unmatched creative & media data—every time.

We're always here for you!

OUR PARTNERSHIPS