Over 80 million U.S. households now use OTT services, and streaming remains a key way for advertisers to reach audiences projected to move away from cable TV. However, subscription saturation and consumers trimming back on services have softened ad spending growth this year. MediaRadar analyzed ad trends across six top streaming platforms to see how brands are connecting with streaming audiences.

OTT Ad Revenue Down 8% Year-Over-Year

Streaming faces mounting short-term struggles on multiple fronts – substantially increasing content costs, platform-hopping enabled by shared credentials, and budget-conscious consumers amidst recession worries. These services still command enormous advertising interest and investments, although this cash flow now shows some cracks.

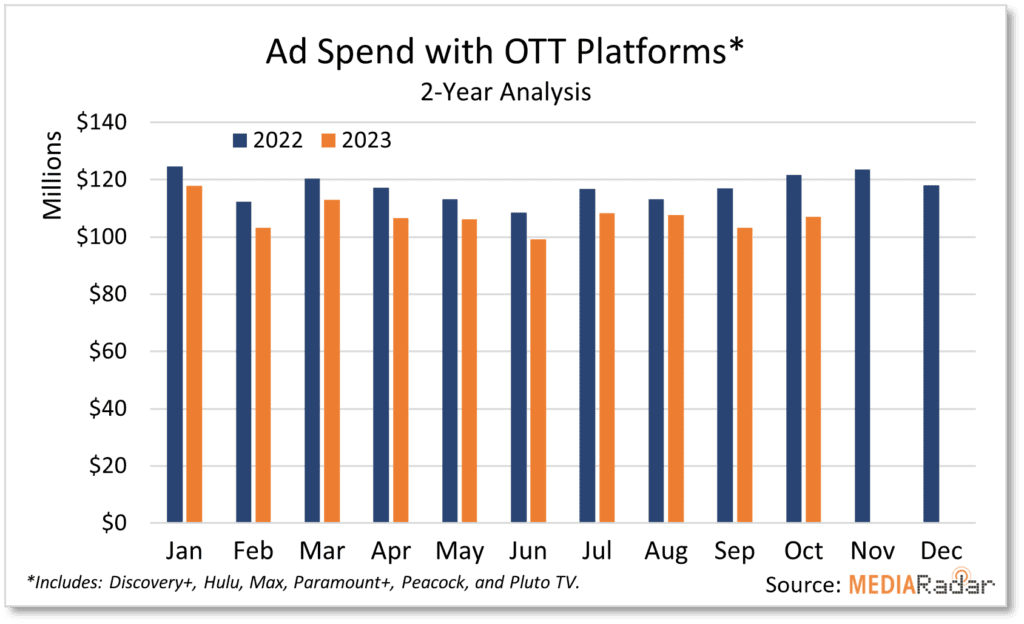

MediaRadar analyzed ad spend on six top streaming platforms: Discovery+, Hulu, Max, Paramount+, Peacock, and Pluto TV. The analysis shows these OTT platforms have generated $1 billion in estimated ad revenue year-to-date 2023. This lags 8% behind the $1.2 billion generated through October 2022 with each month seeing a YoY decline.

Key 2022 Advertisers Pulled Back Their OTT Ad Spend

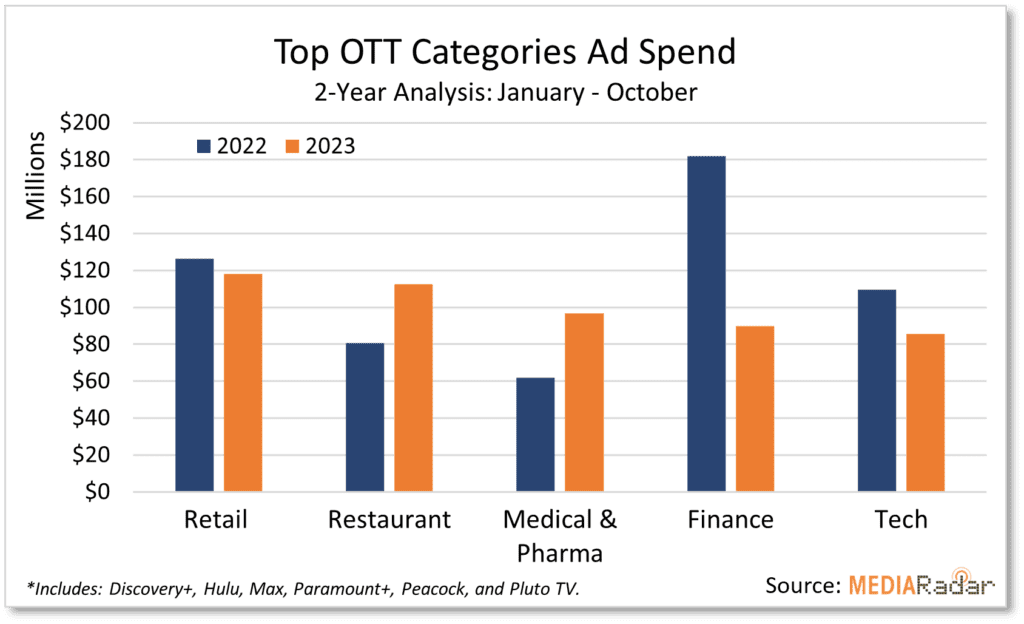

Retail, finance, and technology were the top OTT ad categories during Q4 2022. Together they combined for $135 million in ad spend.

However, these three categories have sharply cut OTT ad investments this year. Collectively, retail, finance, and tech spent $293 million on OTT advertising through October 2023, down 30% compared to the same period last year.

The insurance category faced the steepest drop. They reduced OTT ads by 74% January to October year-over-year. GEICO, State Farm, and Progressive all significantly decreased ad spend. Meanwhile, general retailers like Target and Walmart trimmed OTT spend by 17%.

These categories still make up a substantial portion of OTT ad revenue. Retailers represent 13-14% of spend on Hulu and Pluto TV. Finance has contributed 10% of ad dollars for Paramount+ in 2023.

Restaurants and Pharma Increase OTT Spend in 2023

While other categories pulled back, restaurants and pharmaceutical advertisers increased OTT ad spend.

Fast food chains led rising ad spend from restaurants, up 38% on OTT year-over-year. McDonald’s, Subway, and Wendy’s are among the brands running holiday-themed ads on streaming services to connect with viewers. Restaurant spend makes up 13% of Hulu’s OTT ad mix this year.

Pharmaceutical companies also boosted spending, with OTT ad investments up 66% over the last holiday season. AbbVie, GSK, and Pfizer are using streaming to promote prescription and over-the-counter medications for the holiday cold and flu season.

Streaming Still Presents Engaging Ad Opportunity

Despite some advertiser pullbacks, OTT still offers a valuable channel for brands. With many consumers unwinding with streaming services and binge-watching their favorite shows, OTT ads can resonate and drive purchase interest.

Retailers are able to connect with audiences through OTT before key holiday shopping days. Pharma brands can promote cold medicine ahead of predicted illness spikes, while restaurants can tout holiday meal deals and catering options.

Even though economic conditions, over-saturation, and lack of differentiation have tempered OTT ad growth this year, the media remains essential for connecting with streaming-first audiences.

MediaRadar Arms You with Ad Intelligence

These OTT ad spending insights are made possible by MediaRadar’s cross-channel ad intelligence platform. Tracking brands across TV, print, online, and radio, MediaRadar gives marketers the competitive intelligence needed to optimize ad investments and maximize ROI.

See for yourself how MediaRadar can expose competitor spend, creative trends, and audience analytics to improve your marketing and branding strategy. Sign up today for a free demo.