Before COVID-19, podcasts were one of consumers’ favorite media formats to listen to while driving to work, cleaning the house or exercising at the gym.

At the start of COVID-19, podcasts experienced a slump—but are proving resilient. Consumption is expected to rebound in the later half of 2020. Here’s the latest on what’s going on in the world of podcasts.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Podcast ad revenue was hit, but is still growing

Podcasts weren’t immune to the cuts in advertising spend early in the pandemic. Despite the decrease in spend, advertising revenue is still growing year-over-year (YoY).

According to IAB, podcasting ad revenue is expected to grow by 14.7% YoY this year, but last year it grew by 48% YoY. Despite the drop in growth rate, ad revenue will reach nearly $1 billion.

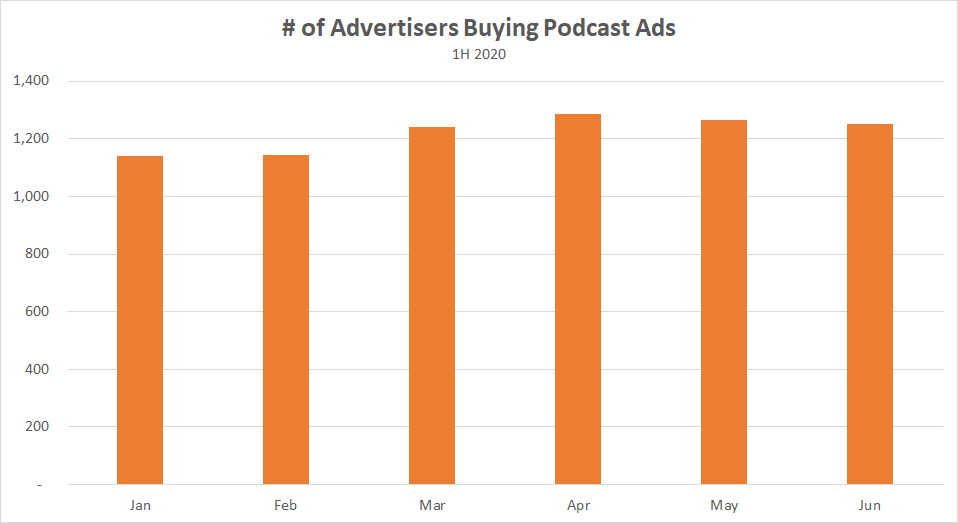

According to MediaRadar data, between January and June, the number of advertisers we saw in our sample of podcasts grow 10%.

The Top 5 advertisers YTD are:

- Betterhelp

- ZipRecruiter

- Best Friends (a video game)

- SquareSpace

- TD Ameritrade.

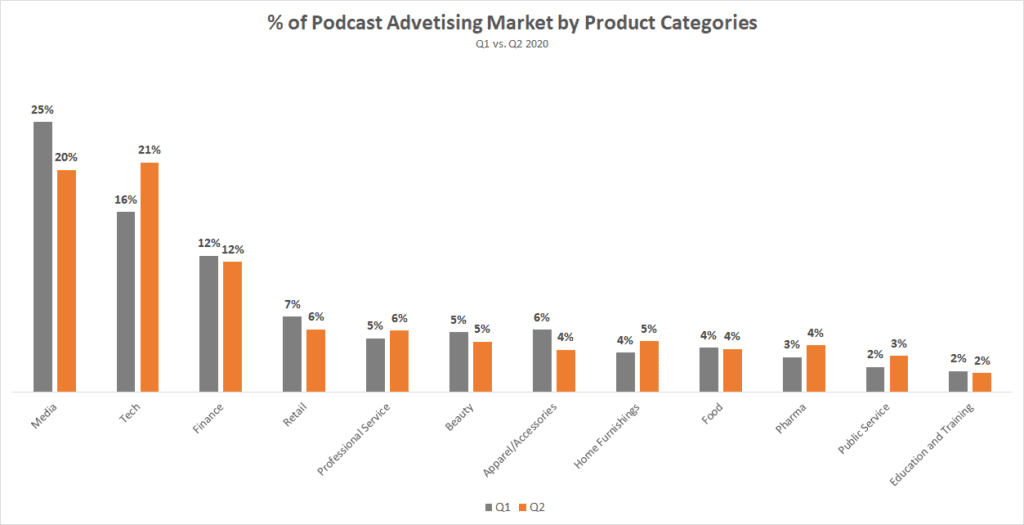

Looking at Q1 vs Q2 we saw the top two categories buying ads trade places. Other than that, much of the rest of the market held steady.

We did see some trends we can attribute to COVID. Among the top fifty advertisers, job-focused brands (like Indeed and ZipRecruiter) and workplace brands (like Salesforce, Trello, and Netsuite) cut podcast ad spend from Q1 to Q2.

Meanwhile brands like BetterHelp, Drizly, and Simplisafe upped their spending on podcasts in Q2.

Even though COVID-19 has impacted this media format for now, industry leaders aren’t deterred. Spotify and SirusXM have both made recent investments, suggesting COVID-19 won’t hinder the industry long-term.

Spotify strengthens its position in the podcast universe

Spotify has made two major moves in the last couple months. In May, it signed an exclusive $100 million contract with Joe Rogan. The Joe Rogan Experience will be solely available on Spotify by the end of this year.

“We need to give [listeners] a reason to think of Spotify when it comes to podcasts,” one Spotify employee familiar with their podcasting strategy told TheWrap last October. “And having shows they want and can’t find anywhere else is only going to help us gain more [users].”

In addition to the exclusive partnership with Joe Rogan, Spotify is boosting its user experience.

On July 14th, it launched podcast charts to help listeners find new shows. The first two charts are ‘Trending’ (what’s growing quickly in terms of number of listeners) and ‘Top’ (the top 200 most popular shows, organized by region).

The ‘Top’ chart can also be broken down into categories: business, news, sports, etc. This categorization previously existed to a smaller extent, but users now have new ways of finding content they’ll love.

SiriusXM puts skin in the game

SiriusXM is also betting on the popularity of podcasts. It recently purchased Stitcher from Scripps for $325 million.

Stitcher was an early player in the podcasting industry and has been around for over a decade. Since 2010, the number of podcasts published on the platform has grown over 129,000%.

According to Stitcher, podcast listening began to return to pre-pandemic levels in mid-April.

“The opportunity for Stitcher and its employees to join a large pure-play audio company ensures it will expand upon its success,” said Scripps President and CEO Adam Symson. With the investment of SiriusXM, its podcast service will continue to grow.

According to SiriusXM, “With the acquisition, SiriusXM’s combined properties will contain the largest addressable audience in the U.S. across all categories of digital audio – music, sports, talk, and podcasts.” SiriusXM’s acquisition bolsters its share in the digital audio ad marketplace.

There are already estimated to be between one and two and a half million U.S.-based podcasts. With these recent investments, it seems like there is still room to grow.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.