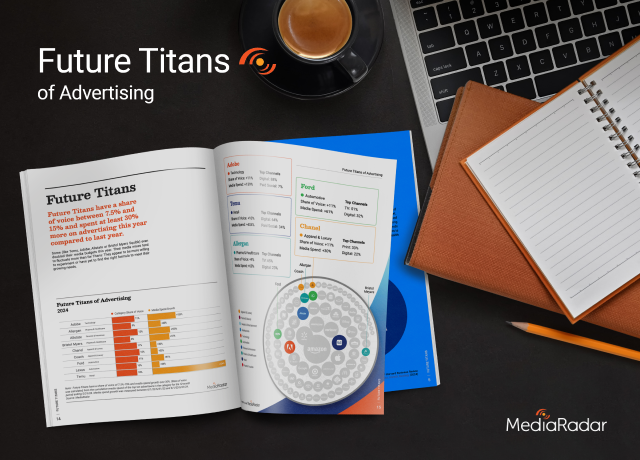

This year, we’re bringing in the end of the year with a series: 12 Days ‘til New Years. We’ll continue our tradition of highlighting the most notable brands and spending across ad tech platforms, consumer media, and B2B industries.

Programmatic advertising fared well amid the pandemic as brands sought effective and flexible ways to reach audiences. Up to this point in 2020, MediaRadar data shows that 173 thousand native programmatic advertisers have collectively spent $2.75 billion.

As our countdown to New Years continues, we’d like to highlight the ten brands who spent the most on programmatic advertising.

10 Top Spending Programmatic Advertisers in 2020

COVID-19 changed marketing plans for companies across every industry, pushing many to prioritize the automated bidding, highly targeted, and flexible nature of programmatic. The following programmatic advertisers in 2020 collectively spent $153 million.

1. Lending Tree

The Lending Tree, an online peer-to-peer lending company, spent $23M on programmatic advertising in 2020. The pandemic-induced recession caused many Americans to struggle financially and seek lines of credit. However, as the unemployment rate spiked, banks tightened lending standards and reduced lines of credit. Lending Tree provided a lifeline for many struggling individuals to consolidate and pay down high-interest debt.

2. Editor X

Editor X, a new creation platform for designers and web developers from Wix, spent $18 million on programmatic advertising this year. Editor X was released in February and is currently in open beta, meaning all agencies or web designers can explore the new tool.

3. GEICO Insurance

GEICO spent $16 million on programmatic advertising this year. Part of this was due to an increase in advertising from the insurance industry as a whole.

As Bain & Co points out, nearly 20% of those affected by COVID-19 are looking to switch their insurance plans this year, which is much higher than in 2019. This led to an increase in advertising from the insurance industry as they look to retain current clients, as well as attract switching clients from competitors.

Another factor at play here was the lack of live sports. For example, GEICO boosted ad spending on OTT when sports were suspended back in March. When the NFL returned in September, GEICO OTT ad spend fell as dollars shifted back to linear TV.

4. Verizon Wireless

Verizon spent $11 million on programmatic advertising this year. Though Verizon fared well enough compared to competitors, it wasn’t completely shielded from economic repercussions this year. It brought in less revenue from roaming charges and overage fees as people stayed closer to home. Consumers also purchased fewer devices than previous years.

5. Amazon

Amazon spent $7 million on programmatic advertising this year. It’s not surprising that Amazon had an extraordinary year in sales. Earlier this year, it announced record profits, and this year’s holiday season is Amazon’s biggest yet. As a result, Amazon didn’t need to spend an extravagant amount on advertising, but it’s still at the top of the programmatic list.

6. State Farm

Another insurance company, State Farm built awareness of its wide variety of insurance plans. The company spent $6 million on programmatic advertising this year. With fears of COVID, not to mention the environmental disasters going on, upgrading to premium plans and preparing for emergencies were priorities for consumers.

7. Target

Target also spent $6 million on programmatic advertising this year. The popular big-box retailer performed well during COVID, largely due to digital decisions it made in 2017. Executives believe its growth will last beyond the pandemic because it strengthened relationships with customers during a critical time.

“We have long known that engagement with guests at a time when their habits are changing is an incredibly important factor in deepening long-term loyalty,” explained Target CFO Michael Fiddelke.

8. Walmart

Similar to Target, Walmart spent $5.7 million on programmatic ads. Online sales from the retailer soared this year, near-doubling in the second quarter. Though leaders don’t know if growth will continue post-COVID, it’s clear the retailer was a winner this year.

9. Chewy

Chewy, the online pet store worth $30 billion, spent $5.5 million on programmatic advertising. As people sheltered-in-place, people felt a new need for a companion and realized they could take care of a pet as they now worked from home. Animal shelters across the country consistently reported elevated demand for “pandemic puppies.” Chewy, along with Amazon, were the top two popular online stores for pet supplies.

10. Office Depot

Office Depot—an initial beneficiary from the pandemic, as people urgently purchased home office supplies—spent $5.2 million on programmatic advertising. In its First Quarter Results, Office Depot announced that it achieved its “highest net cash position in two years.” However, according to the Wall Street Journal, it can’t “coast on pandemic gains.” It appears there will be store closures and significant restructuring over the next three years.

These were the top ten spending programmatic advertisers this year. Up next in our holiday series will be 9 OTT buyers.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.