According to a study by market research firm Mordor Intelligence, the global apparel market is forecasted to record a CAGR of 5.5% between 2020-2025. For apparel and accessories brands, this growth means ad spend increases as well as shifts in spend across formats as brands look to target their ideal buyers. It’s important to note that supply chain, sustainability and authenticity, and diversity representation will be sure to alter the apparel landscape, and subsequently, the advertising outlook in 2022.

Here are 12 Apparel & Accessories advertisers you should keep an eye on during 2022 and beyond.

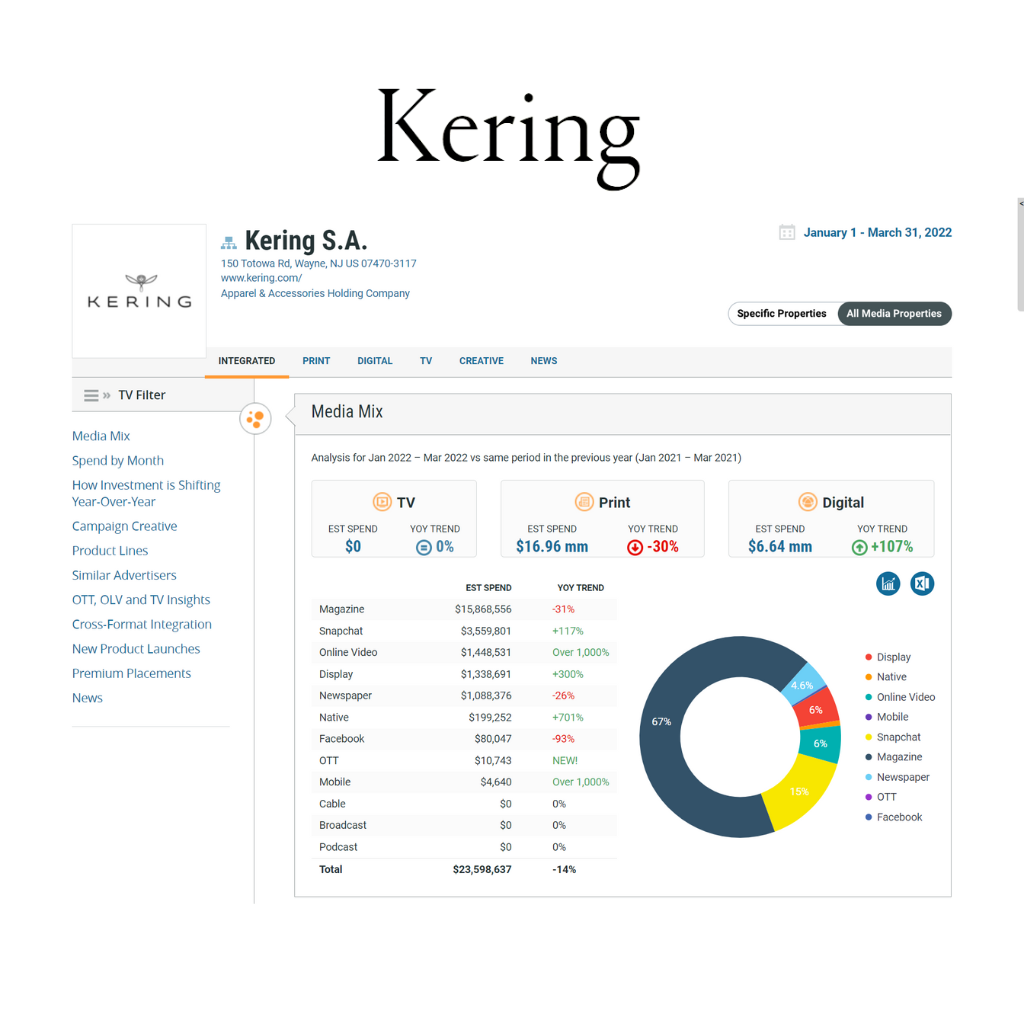

1. Kering, the French luxury apparel brand juggernaut (i.e. Gucci, Balenciaga, Saint Laurent, Alexander McQueen, etc.), advertised 13% less in Q1 2022 and still made the over $20mm list. The decrease in ad spend for handbags (down 64% QoQ) and men’s designer fashion (down 56%) contributed to the overall QoQ decline in 2022 for Kering. Its advertising spend was focused on print at 73% and the remaining spend was digital at 27%.

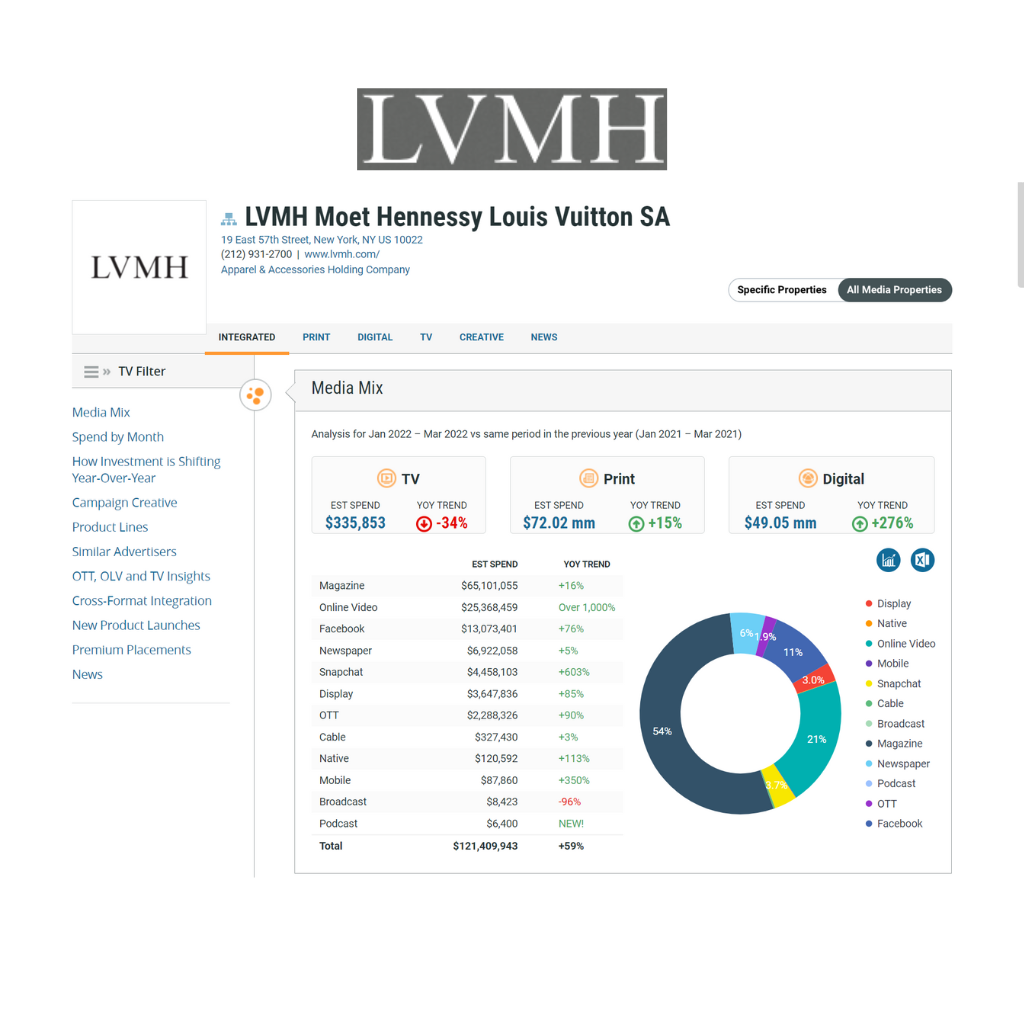

- 2. LVMH Moët Hennessy Louis Vuitton (LVMH), the Paris headquartered luxury conglomerate, spent 50% of its ad investment in apparel, 39% for accessories, 10% for its brands (Louis Vuitton, Tiffany & Co, Dior, Fendi, Bulgari, etc.) and 1% for baby/children’s apparel and accessories. LVMH’s Q1 2022 spend is 42% compared to the same period last year. LVMH invested in a mix of 28% digital and 72% print investment. Facebook ad buys are 67% of the quarter’s digital spend, followed by Snapchat at 15%, digital display at 11% and online video ad spend was 6%.

- 3. Pandora, the Danish jewelry manufacturer known for its customizable charm bracelets, designer rings, earrings, necklaces and watches, increased its ad spend nearly 270% QoQ during the 1st quarter of 2022. Most of their spend was in digital ads at 70%, followed by TV at 26% and print with 4%. Of their digital spend, Facebook received 84% of the investment and digital display received 13%, with online video at 2% and Snapchat at 1%.

- 4. Skechers’ the American footwear brand’s first quarter spend increased 24% QoQ compared to 2021. The majority of spend was in the TV at 52%. The brand aired a Super Bowl commercial with Wille Nelson to “legalize comfort.” Print was at 37% of the investment and digital received the remaining 10% of ad dollars.

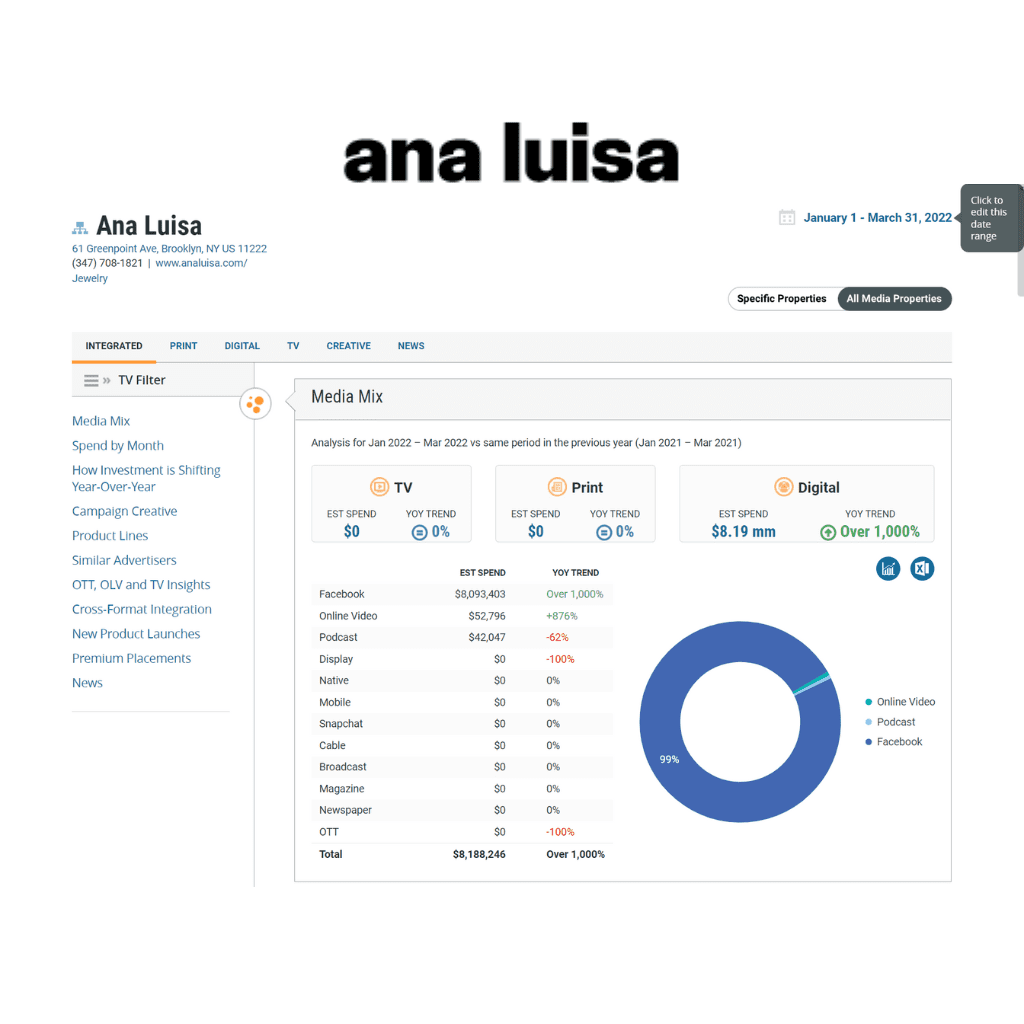

- 5. Ana Luisa, the eco-friendly jewelry brand’s Q1 2022’s ad spend was 77% of the last year’s total. 100% was digital spend – with 99% of that going towards Facebook ads.

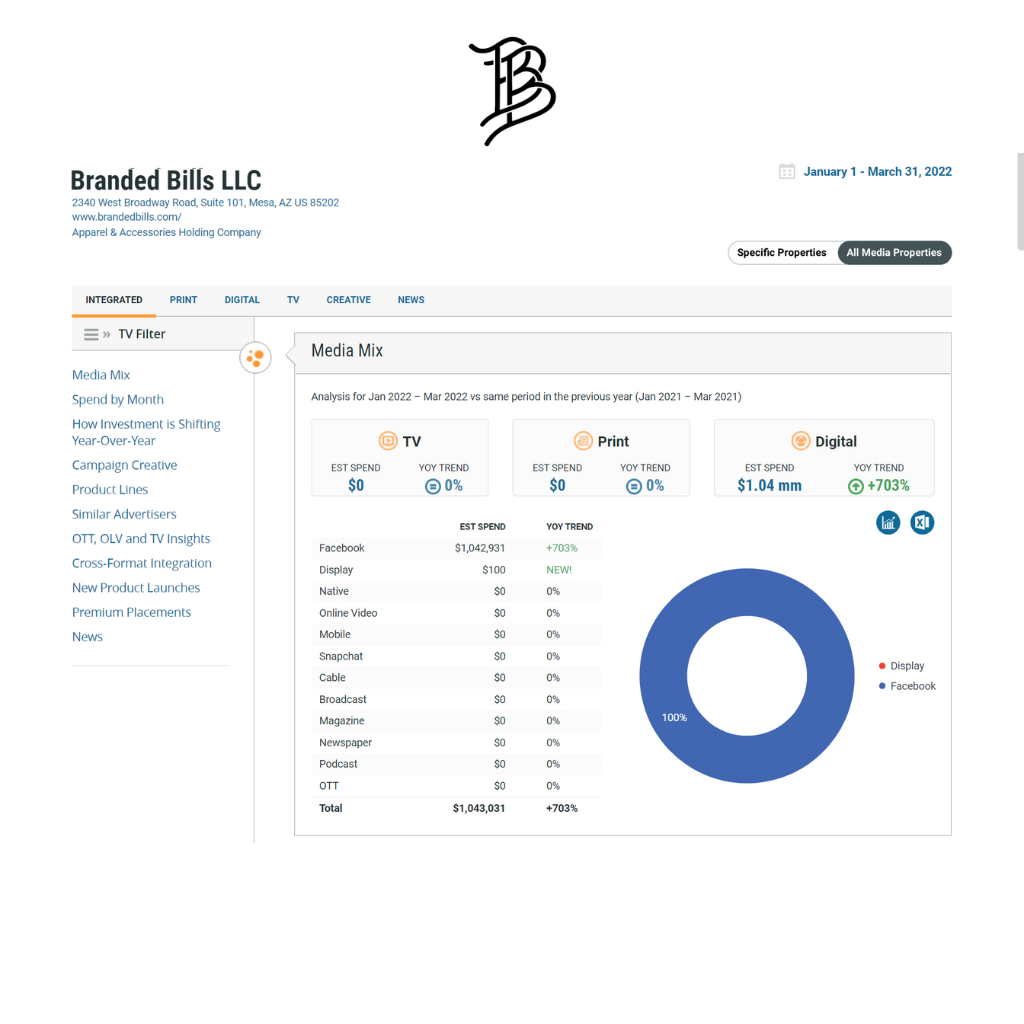

- 6. Branded Bills the customizable apparel brand advertised 100% on Facebook targeting headwear connoisseurs during the first quarter of 2022. This company is starting hot out of the gate – its Q1 advertising was 3x 2021’s total spend for the brand.

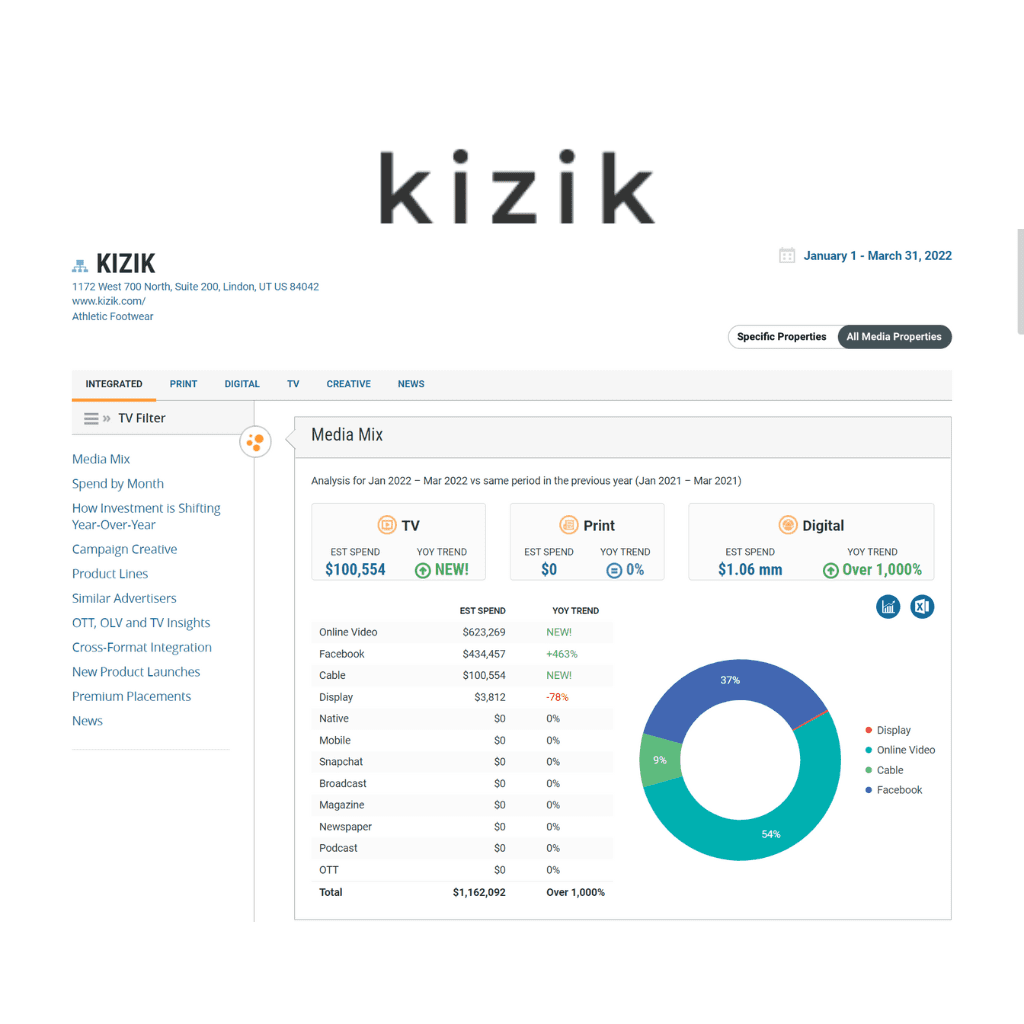

- 7. KIZIK, brands itself as an “easy – hands free” shoe brand. Their 1st quarter’s ad spend exceeded last year’s total spend. Their advertising strategy was focused on 52% Facebook ad buys and while the remaining 47% went towards online video.

- 8. TOMS’ the footwear and accessories brand’s advertising strategy was nearly 100% in Facebook during the first quarter – there was less than a .05% spend in digital display. We’ll see if this brand increases their digital display investment as the year progresses. TOMS’ first quarter’s spend in 2022 is 3x of 2021’s total spend.

- 9. Vitaly Design, a men’s apparel and accessories provider’s investment is nearly 100% Facebook focused 2022 so far. This brand’s Q1 2022 spend was also 3x times that of last year’s total investment.

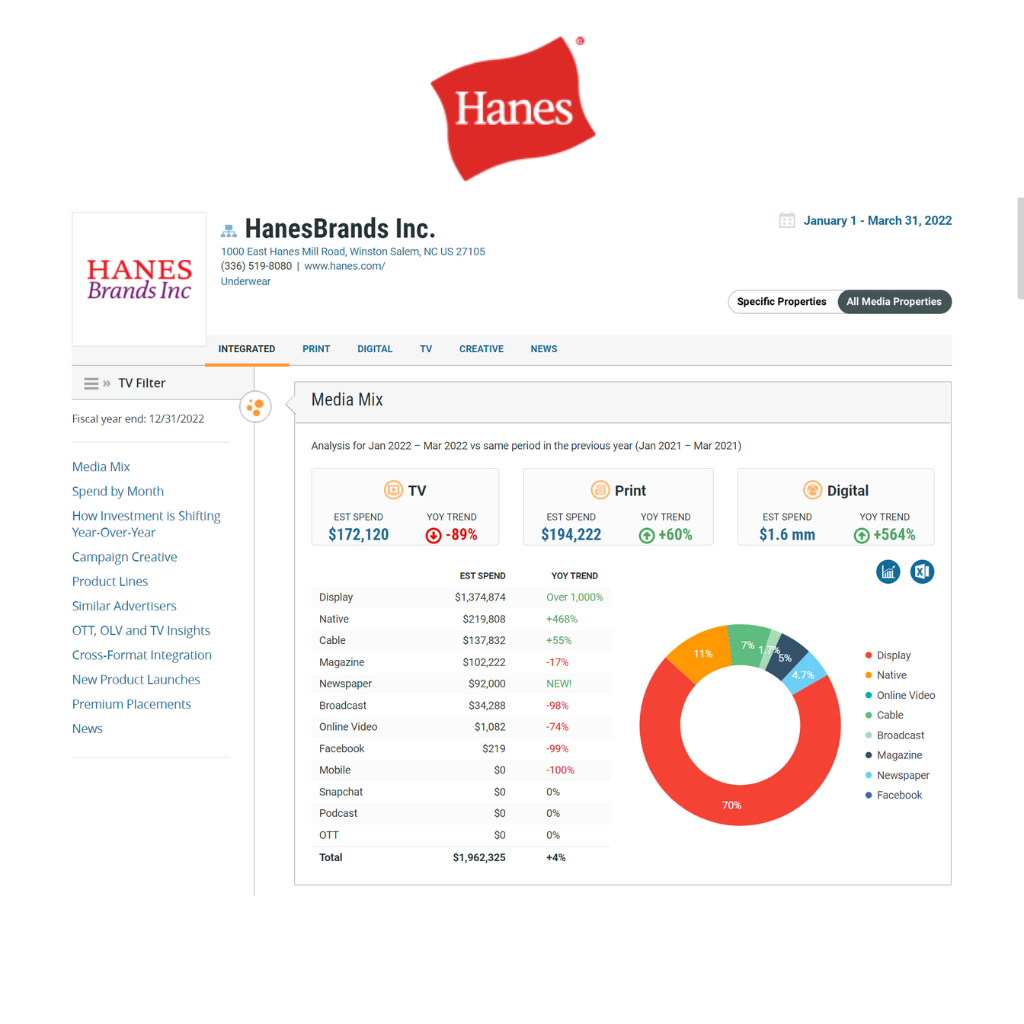

- 10. Hanes brands’ retail site ad spend is 12% of its Q1 2022 digital investment. The 1st quarter’s spend had a slight QoQ increase at 4% advertising with a mix of digital at 85%, print was 6% of its spend and TV was 9% of the quarter’s investment.

- 11. Levi Strauss & Co. invested 9% of its Q1 2022 digital spend in retail site ads. The denim jean name known worldwide advertised 90% in Q1 2022 and was up 37% QoQ compared to 2021’s first quarter. A whopping 54% of digital spend went to Snapchat. Levi’s also utilizes TV advertising – which was 10% of the first quarter’s spend.

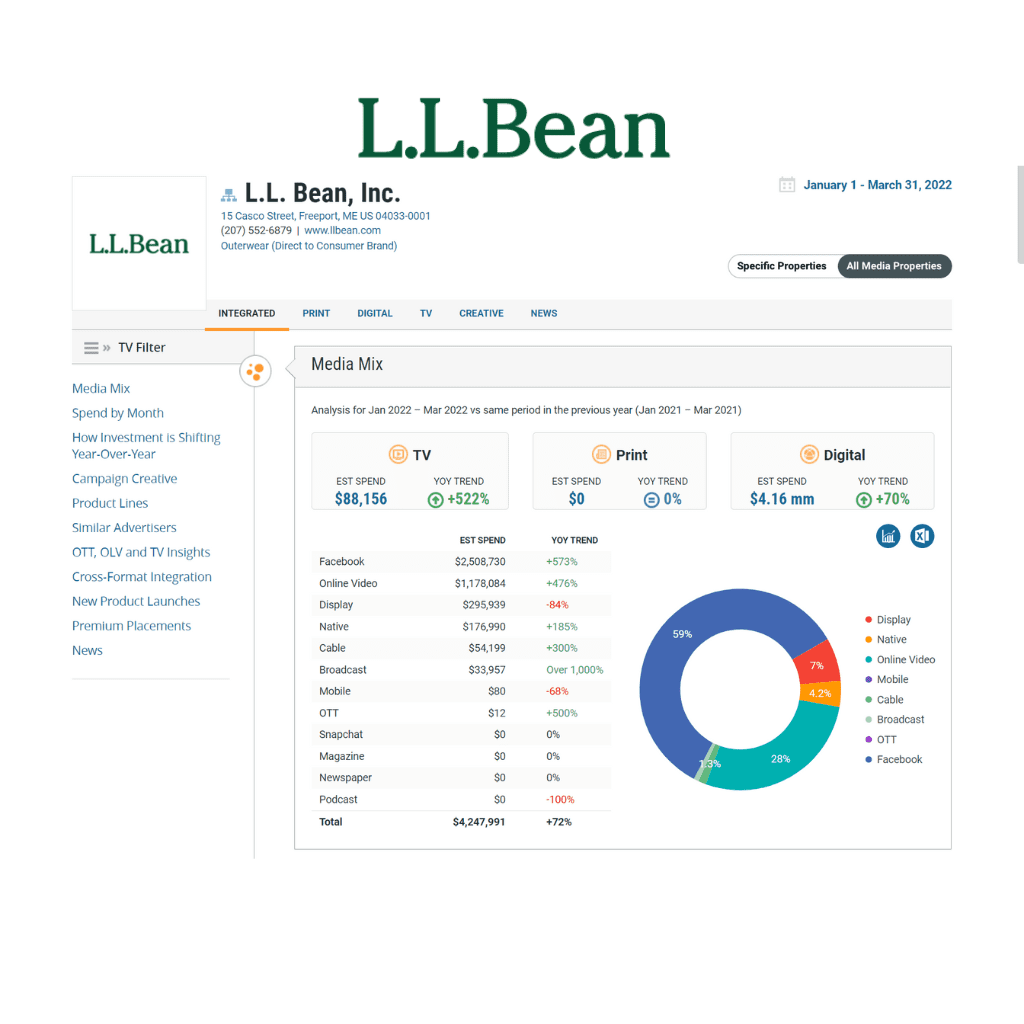

- 12. L.L. Bean an apparel brand and retailer, increased its overall spend 154% in Q1 2022 and 99% of that was digital with mostly Facebook ads (72%). Retail site ad buys were only 6% of the L.L. Beans’ Q1 2022 digital spend.