As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

There are many things about working in an office that people aren’t looking forward to, and stiff, uncomfortable professional clothing is one of them.

During the pandemic, professionals became accustomed to wearing pajamas or athletic wear in their home offices. We saw the rise of ‘athflow’—loose, comfortable, yet stylish clothing that you can pull off in a professional setting. According to Pinterest, athflow is “professional enough for the ‘office,’ stretchy enough for the yoga mat, and comfy enough for the couch.”

At the same time the athleisure market is piping hot. Companies like Gymshark, Vuori, Spanx all gained unicorn status during the pandemic. And one of the top athletic clothing market leaders, Under Armour, saw shares rise 16% despite supply chain issues.

As companies saw sales rise, how much of the profit did they put back into ads?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

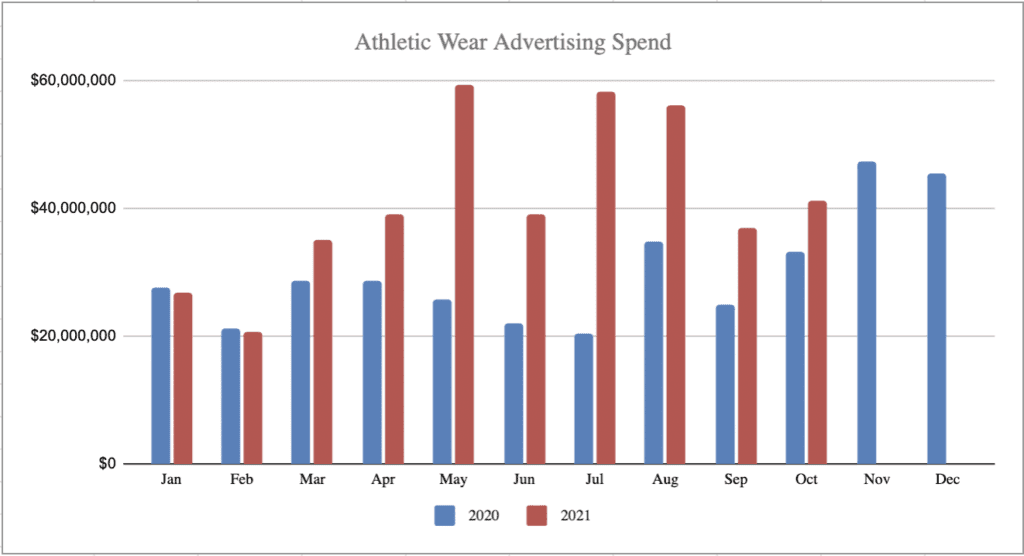

Working from home was a huge change for many professionals—but at least they could work in comfortable clothes. Athletic wear marketing teams jumped on the opportunity. Overall, athletic wear companies spent $412.4 million in 2021, a 58% increase year-over-year.

Most of this spending went to digital—$237.5 million, which is a 63% increase.

TV investment consisted of $140.3 million, a 65% increase.

Print increased 15%, reaching $34.6 million.

Number of Advertisers

1.4 thousand advertisers spent $412.4 million in 2021 compared to 1.1 thousand advertisers spending $261.1 million in 2020.

Advertiser Retention

In the overall category, advertisers had a 46% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Nike

Nike Inc. is a top advertiser in this category, dedicating 79% of their overall budget to ads promoting their athletic wear. Nike’s ad spend is up 210% in comparison to last year.

Digital investment is up over 100% YoY. They have made significant investments in Facebook and Snapchat ads.

TV is up 447%. Over $50 million is being allocated to national TV ads. $33 million is going toward Broadcast spots while $17 million is being placed with cable TV.

Below is a breakdown of Nike Inc.’s ad spend thus far in 2021. We predict they will likely have two upcoming RFPs issued, MediaRadar can help you connect with 64 key contacts at Nike.

2. Adidas Group

Adidas Group is another big spender within Athletic Wear. Seventy-four percent of their budget is allocated to their athletic wear product lines.

Adidas has increased investment across digital, print and national TV in comparison to last year.

TV grew the most—by 255%, reaching $26.73 million.

We see significant growth across other video platforms. Online video is up 573% YoY, Broadcast is up 149% and OTT is up over 1000% year-over-year.

MediaRadar can connect you with 8 key media buyers from adidas and their agencies.

3. IdeaVillage Products

IdeaVillage Products (owner of the Copperfit athletic brand) is spending heavily in Digital, where they’re up over 87% from last year. 59% of their overall ad spend is going to the Athletic Wear category.

We’re seeing a shift away from print and TV advertising. Print is down to no spending, while TV is down 37% from last year.

Facebook and Native advertising are new to their advertising mix this year, where they’re spending approximately $33 thousand and $268 thousand respectively.

As they make the shift into digital, MediaRadar can connect you with 4 key media buyers from IdeaVillage and their agencies.

4. Under Armour

A major global player in athletic wear is Under Armour. It’s no surprise to see their heavy investment in this category. Under Armour’s spend is up dramatically in Digital, rising an incredible 238% over last year, which accounts for 50% of their total ad spend.

Their TV and Print investments continue to grow as well.

TV is up to $17 million, a 38% increase over last year. Their print spend is up as well to $465.7 , thousand, a 9% increase over last year.

Under Armour’s spend is heavily invested in the Digital space, where we predict this trend to continue in 2022. MediaRadar can help you reach 8 media buyers at Under Armour and their agencies.

5. VF Corporation

With household names in the athletic space including Vans, The North Face, Timberland and many more, VF Corporation’s spend in the Athletic Wear category is impressive. 57% of their overall ad investment is in this category.

They have been shifting ad dollars into digital, with an increase in their investment by 7% over last year. This brought their spend to $24.7 million. Two areas where their spend has increased dramatically are Native & OTT where they’ve increased spend by 1000%.

They’ve also shifted into print by increasing their spend by 18%, reaching $2.75 million.

Take a look at the detailed breakdown of VF Corporation’s spend below. In addition to these insights, MediaRadar gives you access to 59 verified media buyers across VF and their agencies.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.