As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

The pandemic has been good for the Food and Beverage industry.

“You’re seeing a legacy industry in many respects go through a rebirth,” said Geoff Freeman, president and CEO of the Consumer Brands Association.

McKinsey & Company reported a 12% year-over-year growth in food and beverage in 2020, with increased shopping continuing into 2021.

Supply chain issues and a labor shortage are causing shelves to be less stocked than typical years, but as long as consumers keep in mind the products they need for the holidays and buy sooner rather than later, they’ll have what they need.

As we enter 2022, we expect to see companies build more resistant supply chains, place an emphasis on sustainability, and invest more in enterprise software to optimize operations. For now, we see them upping their advertising spend and investing in first-party data collection.

MediaRadar Insights

Overall Spending and Breakdown Across Formats

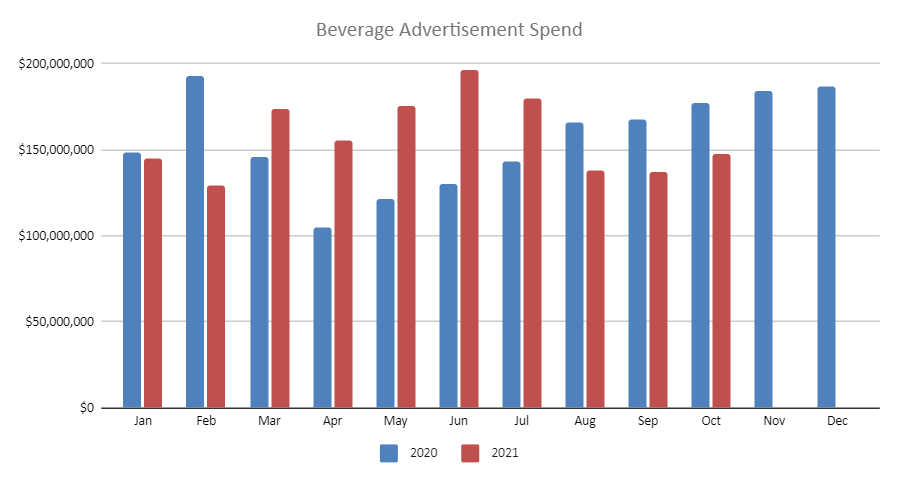

Beverage marketing teams slightly increased their advertising budgets this year by 6% year-over-year.

‘

TV is the most traditional advertising format for beverage brands. Together, brands spent $994.1 million on TV placements, which is down 13% from last year.

Digital increased by 135%, reaching $492 million.

Print fell by 28% to $94.8 million.

Number of Advertisers

2. 2 thousand advertisers spent $1.6 billion in 2021 compared to 1.7 thousand advertisers spending $1.5 billion in 2020.

Advertiser Retention

In the overall category, beverage advertisers had a 59% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. PepsiCo, Inc.

PepsiCo is the top advertiser in the beverage category. They dedicate 49% of their overall budget on ads promoting their beverage products.

Their ad spend is up 9% since last year.

Digital spending up 240%, reaching $144 million . They have made significant investments in native advertising, in which their spending has gone up over 1000% since last year. Spending on online video saw an increase of 206%. $46 million was spent on Facebook ads, a 338% increase since last year.

PepsiCo spent over $459 million on TV advertisements, with $311 million allocated for cable ads and $147 million for broadcast ads.

Below is a breakdown of PepsiCo, Inc’s ad spend thus far in 2021. We predict they will likely have 14 upcoming RFPs issued. MediaRadar can help you connect with 115 key contacts at PepsiCo, Inc.

2. The Coca-Cola Company

The Coca-Cola Company is another top advertiser in the beverage category, with 100% of their overall budget on ads promoting their beverage products. Spending by The Coca-Cola Company went up 29% since last year.

Digital advertising increased by 255% year-over-year, with major investments in Facebook, OTT, and Native advertisements, all of which saw an over 1000% increase in spending. Digital advertising accounts for $61 million of The Coca-Cola Company’s ad spend, with over $27 million going to Facebook, and nearly $24 million going towards online video ads.

Coca-Cola allocated $198 million to TV advertisements, with $112 million, 43% of ad spend, going to cable ads, and $85 million sent to broadcast ads.

Below is a breakdown of The Coca-Cola Company’s ad spend thus far in 2021. We predict they will likely have 6 upcoming RFPs issued. MediaRadar can help you connect with 93 key contacts at The Coca-Cola Company.

3. Starbucks Corporation

The Starbucks Corporation is also a top advertiser in the beverage category, with 93% of their overall budget on ads promoting their beverage products.

They increased their spending on advertising by 22% since last year.

Their spending on digital advertising increased by 84% year-over-year. Native advertising saw an increase of over 1000%, and other digital media such as online video ads, Snapchat ads, and OTT advertisements all saw increases of spending by over 100%.

TV advertisements accounted for nearly $95 million of Starbucks’ ad spending, with $57 million allocated for broadcast ads and $37 million allocated for cable ads.

Print advertising, in which Starbucks spent $4.76 million, primarily went to magazine ads. $419 thousand was allocated for newspaper ads.

Below is a breakdown of The Starbucks Corporation’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 39 key contacts at Starbucks Corporation.

4. Red Bull GmbH

Red Bull GmbH is another top advertiser in the beverage category, with 95% of their overall budget on advertisements promoting their beverage products.

They increased spending by 11% since last year, with their spending in print advertising and digital advertising by 83% YOY and 64% YOY respectively.

Red Bull increased investments in digital media advertisements like online video and Snapchat by over 100%. And they began investing in native advertising this year.

TV advertisements make up 80% of Red Bull’s ad spending, with over $87 million allocated to cable advertisements and $12 million to broadcast ads.

Below is a breakdown of Red Bull GmbH’s ad spend thus far in 2021. MediaRadar can help you connect with 12 key contacts at Red Bull GmbH.

5. Nestle S.A.

Nestle S.A. is also a top advertiser in the beverage industry, with 19% of their overall budget on advertising their beverage products, with their ad spend up 2% since last year.

They increased their investments in digital advertising by 73%, reaching a spend of $80 million. They increased their native advertisements by 995% and their OTT ads by over 1000%. They also began advertising on Snapchat this year.

Nestle also spent nearly $318 million on TV advertisements, with nearly $253 million allotted to cable ads and over $65 million on broadcast ads.

Below is a breakdown of Nestle S.A.’s ad spend thus far in 2021. We predict they will likely have 27 upcoming RFPs issued. MediaRadar can help you connect with 158 key contacts at Nestle S.A.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.