As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Direct-to-consumer (DTC) brands are facing challenges beyond supply chain issues and inflation. For most brands, Facebook was their primary advertising channel.

Since Apple released their new privacy issues, about 80% of global users have opted out of tracking, per the New York Times. This has severed Facebook’s ability to deliver real-time campaign and purchase data. Many brands feel like they are guessing when delivering creative to potential customers.

“I think that the data is just less reliable on Facebook than it had been,” said DTC growth marketer Simon Wool to Morning Brew. “In the past, we could segment all our data by age, gender, location. Now if you go to these breakdowns you can see spend going to different ages, genders, locations etc., but purchases are attributed only to ‘null,’”

It’s more important than ever for DTC brands to diversify their media spends and find alternative ways of tracking customers.

According to Polly Wong, president of the full-service marketing strategy firm Belardi Wong, retail brands are testing out direct mail catalogs, podcasts and large-scale television campaigns to diversify their marketing mix. Others are trying celebrity endorsements or opening up their first stores.

How much did DTC brands advertisers spend this year—and how are the top spenders diversifying their media mixes?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

With the marketing challenges DTC brands faced this year, it’s not surprising to see that their collective spend is 11% less than it was last year (through October.) Together, they spent $7.6 billion.

DTC brands spend the most across TV placements—$4.2 billion, which is a 17% decrease from last year.

They spend $3 billion on digital placements. Digital was the only format that saw an increase this past year, but just barely. Spending increased 1%.

TV decreased by 13%, hitting $350 million.

Number of Advertisers

3.5 thousand advertisers spent $7.6 billion in 2021 compared to 3.5 thousand advertisers spending $8.5 billion in 2020.

Advertiser Retention

In the overall category, travel advertisers had a 68% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

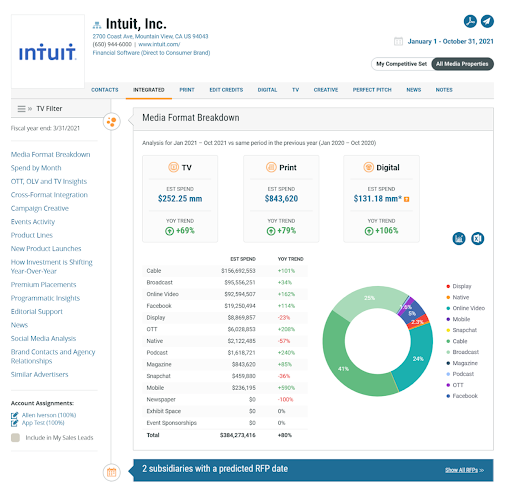

1. Intuit, Inc.

Intuit is the top DTC advertiser this year. They spent heavily in digital, print and TV. Overall, Intuit’s spend is up 80% YoY.

Their digital spend is up 106% YoY. Their print spend is up 79% YoY and in TV their spending is up over 69% YoY. Some notable formats Intuit is investing in include: online video, Facebook, OTT, Podcasts & Mobile. All of these categories are up at least 100% year-over-year.

Below is a breakdown of Intuit’s ad spend thus far in 2021. We predict they will likely have two upcoming RFPs issued, MediaRadar can help you connect with 45 key contacts at Intuit.

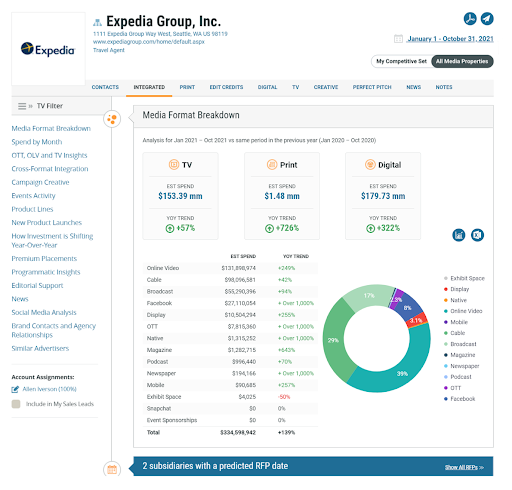

2. Expedia Group, Inc.

Expedia Group has been spending heavily across formats.

Their digital spend is up 322%. Their print spend is up an incredible 726%. In TV their spend is up 57%. Notable formats where their spend is up over 1000% include, Facebook, OTT, native and newspapers.

Below is a breakdown of Expedia’s ad spend so far in 2021. We predict they will likely have two upcoming RFPs issued, MediaRadar can help you connect with 43 key contacts at Expedia.

3. Uber Technologies

Uber has increased its spend in TV and Digital formats this year. Overall, their spend is up 164% year-over-year.

Their digital spend is up over 158%. Their TV spend is also up at 171%. Their spend is increasing considerably across online video and magazines which are both up over 1000%.

Take a look at Uber’s ad spend so far in 2021 below. We predict they will likely have 4 upcoming RFPs issued, MediaRadar can help you connect with 23 key media buyers at Uber and their agencies.

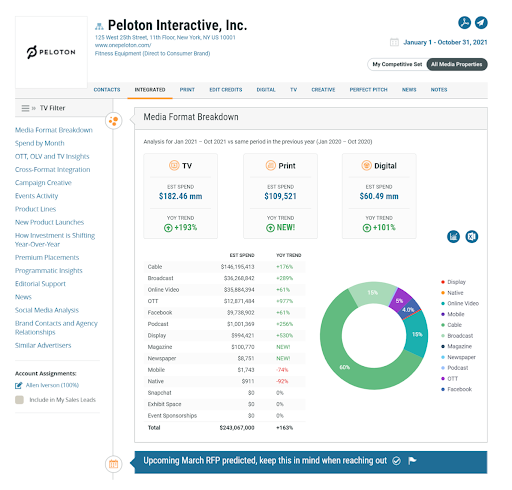

4. Peloton Interactive, Inc.

Peloton has been heavily increasing spend across the board in 2021.

They’re spending heavily on digital and TV. Their digital spend is up 101% year-over-year, while their TV spending is up 193%. Their investment in print is new this year, in which they spent about $109.5 thousand. Peloton is also increasing their spend in broadcast, online video, OTT among others.

You can see Peloton’s detailed 2021 ad spend breakdown below. We predict they will likely have one upcoming RFP issued, MediaRadar can help you connect with 18 key media buyers at Peloton and their agencies.

5. Denali Holding Inc.

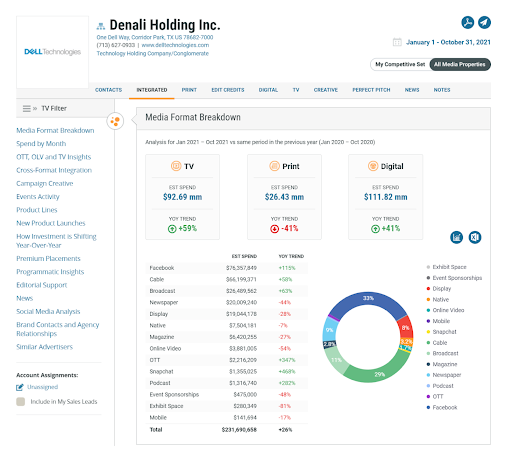

Denali Holding Inc was a big DTC advertiser this year. Overall, Denali’s spend is up 26% year-over-year.

They’ve been investing heavily in digital and TV. Their digital spend is up 41% YoY, while their TV spend has increased 59%. They’re heavily invested in OTT and Snapchat advertising. OTT spend is up 347%. Snapchat advertising is also up 468%.

Take a look at Denali’s ad spend so far in 2021 below. MediaRadar can help you connect with 33 key media buyers at Denali and their agencies.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.