As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

With the stress of 2020, Americans began to drink alcohol at home more often. At the beginning of the pandemic, drinking frequency was up 14%.

Soaring alcohol sales were largely fueled by ready-to-drink beverages, including Hard Seltzers. Prior to the 2020, Hard Seltzers were already going through a craze, but stay-at-home orders and stress made consumers up their White Claw and Truly game.

In 2020, global sales of hard seltzers and canned cocktails grew 43%. But halfway through 2021, the saturated market started to show signs of waning.

According to Business Insider, sales were down 165% from 2020, Molson Coors discontinued Coors Seltzer and Truly’s parent company dumped millions of cases that could not be sold due to their limited shelf life.

Hard Seltzers are now part of the American alcohol market—that’s not changing. But growth has slowed down. Instead of 50 different seltzer brands on retailer’s shelves, we’ll soon see the bigger players take more market share.

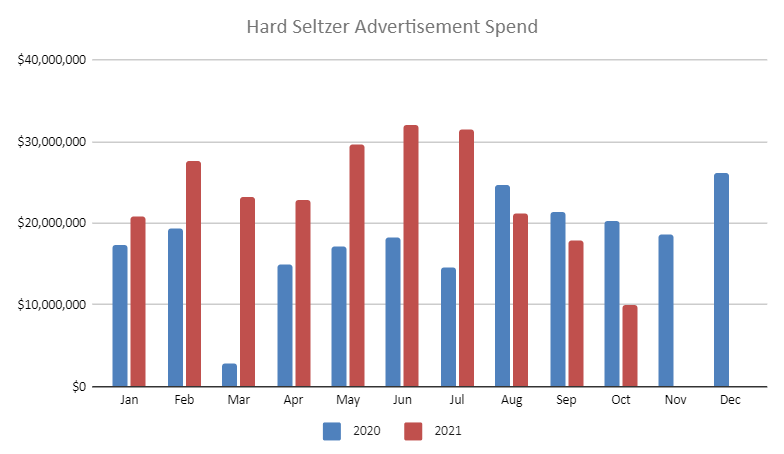

How’s the shakedown impacting advertising spending?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

Overall, spend in the hard seltzer category is up 39% year-over-year through October. And all formats are benefiting.

We see the largest increase in digital spend, which grew 63% year-over-year. Hard Seltzer brands spent $41.8 million in digital advertising between January and October 2021.

Though buyers shifted more into digital more than any other category, TV is still the biggest channel for this category by far. Brands spent nearly $194.5 million across TV channels, which is a 35% increase from the year before.

Print spend also grew. Investments increased 20% from $541 thousand to $649 thousand.

Number of Advertisers

50 advertisers spent $237 million in 2021, compared to 20 advertisers spending $170 million in 2020.

Advertiser Retention and Shift in Top Advertisers

In the top 22 advertisers in 2020, 7 advertisers maintained their dominance in the category. This is a retention rate of 32% among the top advertisers. Overall, the hard seltzer category saw a 65% advertiser retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Anheuser-Busch InBev SA/NV

Anheuser-Busch InBev SA/NV is a top advertiser in this category, dedicating 31% of their overall budget to ads promoting their Hard Seltzer. Anheuser-Busch InBev SA/NV ad spend is down 14% in comparison to last year with their investment in digital down 2% year-over-year.

Though they have made significant investments in OTT, Mobile, and Facebook ads with over $14 million being allocated to Facebook ad pushing.

Below is a breakdown of Anheuser-Busch InBev SA/NV ad spend thus far in 2021. We predict they will likely have 6 upcoming RFPs issued, MediaRadar can help you connect with 54 key contacts at this company.

2. The Boston Beer Company

The Boston Beer Company is another big spender within Hard Seltzer.

Thirty-one percent of their budget is allocated to their Hard Seltzer product lines. The Boston Beer Company has increased investment across all advertising sectors—digital, print and national TV with the most marked push coming in digital.

This is up 274% compared to last year. More specifically this digital push has been in Facebook, OTT, and Snapchat. With Facebook being up 386% and OTT 368%. Snapchat advertising is up over 1,000%!

MediaRadar can connect you with 19 key media buyers from The Boston Beer Company and their agencies.

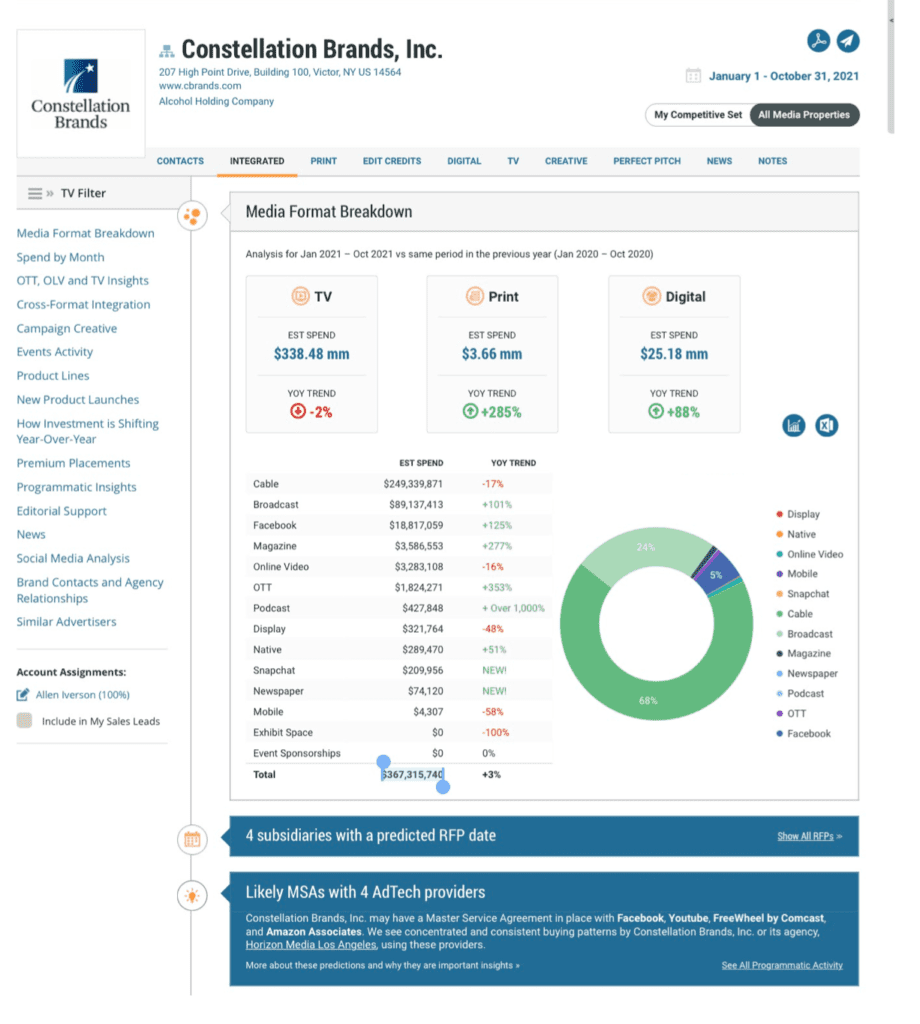

3. Constellation Brands, Inc.

Constellation Brands, Inc is spending most heavily in print, where they’re up over 285% from last year. 11% of their overall ad spend is going to the Hard Seltzer category.

We’re also seeing a shift away from TV advertising, where they’re down 2% from last year but a push in digital that has them up 88%. Facebook and Magazine advertising are seeing a 125% and 277% increase respectively.

We predict 4 upcoming RFPs coming for Constellation Brands and MediaRadar can connect you with 42 contacts.

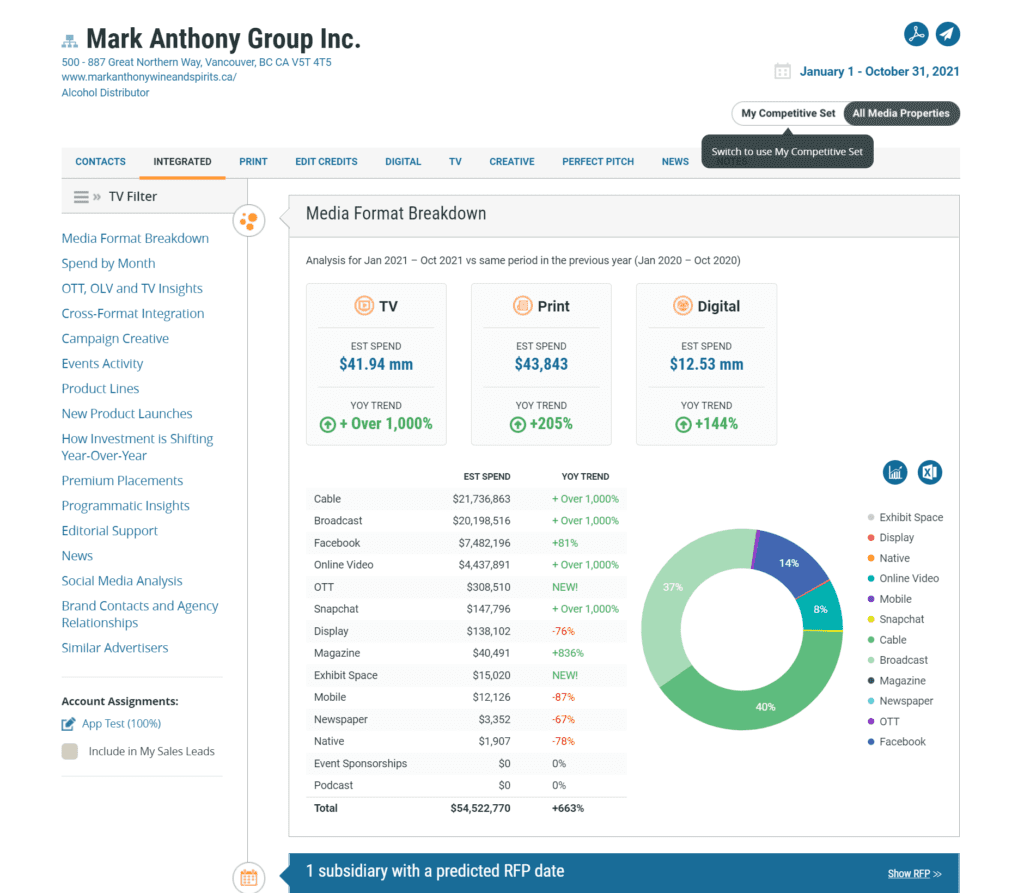

4. Mark Anthony Group Inc.

Mark Anthony Group Inc. is another player amongst the top five top advertisers in Hard Seltzer.

They have had a very expansive year in terms of branching out and pushing into new advertising formats. TV, print and digital ad spend are up over 1000%, 205% and 144% respectively, with 69% of their overall ad spend going to Hard Seltzer.

Overall ad spend is up 663%. The advertising push in TV consists of two equally significant pushes in Broadcast and Cable which are up over 1000% YoY. Additionally, online video and Snapchat saw large increases in ad spending.

Get ready to pitch! MediaRadar can connect you with 10 contacts at Mark Anthony Group Inc.

5. Molson Coors Beverage Company

Molson Coors Beverage Company is last on our list for top five advertising. They saw their largest growth sector in advertising on the digital frontier with print coming in at 46% behind digital which saw a 51% growth.

Their largest sectors of increase in the breakdown are Podcasts and OTT. Overall ad spending is up a total of 15% year-over-year despite a downtrend in TV ad spending.

See a detailed breakdown of Molson Coors Beverage Company’s ad spend below. We predict that it’s likely that they will have 7 RFPs coming up in the near future. MediaRadar can help you connect with 49 key contacts at this Molson Coors Beverage Company.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.