As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Casinos and sports betting had an incredible year.

In the third quarter, casinos hit a new quarterly record in winnings—$14 billion. Now, they are on track to break the annual record of $43.65 billion, set in 2019.

After being restricted to their homes, people were eager to get back to betting. And new groups of people were ready to try this entertainment in-person for the first time.

“The explosive growth of internet gaming during the pandemic engaged a new audience of consumers who may have become curious about brick-and-mortar casinos and the in-person gaming experience,” said Jane Bokunewicz, director of the Lloyd Levenson Institute at New Jersey’s Stockton University. “Encouraged by casino marketing and loyalty programs they may have decided to try something new.”

Online gambling and sports betting continue to rise in popularity. The global online gambling market is expected to grow from $64.13 billion in 2020 to $72.02 billion in 2021.

As online betting grows rapidly, which top betting platforms should you be making pitches to?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

Online gambling advertisers increased their spending by 62% year-over-year (January – October 2021).

TV and digital investments increased dramatically—69% and 56% respectively.

Advertisers spend the most on TV, which adds up to nearly $289 million in spending.

In contrast, they spent $113 million in digital and $10.8 million in print.

Number of Advertisers

526 advertisers spent $413 million in 2021 compared to 489 thousand advertisers spending $255 million in 2020.

Advertiser Retention

In the overall category, advertisers had a 59% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Flutter Entertainment Plc

Flutter Entertainment is the top advertiser in this category, dedicating of 86% their overall spend to the category.

They’ve spent over $30 million on digital, a 97% increase over last year. They have made significant investments in TV, spending an impressive $173 million on the format which is up 33% year-over-year. They’re also making a heavy investment in podcasts with a $2.5 million investment, a 567% increase over last year.

We’ll continue to monitor Flutter’s ad spend to see if they do make an even bolder move into podcast advertising, or if they increase their spend elsewhere. Be prepared to pitch with MediaRadar’s detailed insights.

Below is a breakdown of Flutter’ ad spend so far in 2021. MediaRadar can help you connect with 20 key media buying contacts at Flutter.

2. DraftKings, Inc.

The popular online betting platform has been consistent with its ad spend across TV, Print & Digital. Overall, they’ve invested over $147 million in advertising, with 72% of that spend in the Online Gambling category.

In Digital they’ve invested $44 million in advertising which is a 6% increase over last year.

Spend on TV is up 7% to $102 million, while their print investment is $682 thousand, an increase of 5%. Their investment in OTT has increased by over 1000% to over $11 million.

Below you can see a detailed breakdown of DraftKings’ spending. MediaRadar can show you with 21 media buyers at DraftKings and their agencies.

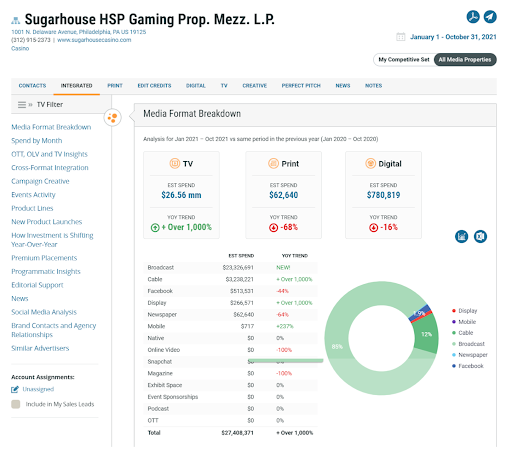

3. Sugarhouse HSP Gaming Prop. Mezz. L.P.

Sugarhouse has invested over $27 million in advertising this year. Unsurprisingly, 98% of their total ad spend is focused on Online Gambling.

They’ve decreased their spend in print and digital by 68% and 16% respectively. Their strategy is highly concentrated on TV.

Their TV spend is up over 1000% to over $26 million. Their Cable and Display advertising is up over 1000%.

MediaRadar can connect you with 1 media buyer at Sugarhouse and their agencies.

4. Caesars Entertainment Corporation

Caesars is a top spender in the Online Gambling category. They’ve spent a total of over $76mm on advertising – an increase of 934%.

They’ve heavily invested across formats this year, except for print where their investment decreased 52% to $1 million.

In TV, spending is up over 1000% to over $68 million. In Digital they’re up 235% to $7.25 million. Specific formats they’ve been investing heavily in include Online Video and Mobile advertising. They’re new to Snapchat this year with an investment of over $137 thousand.

You can see a detailed breakdown of Caesars’ ad spending in the chart below. MediaRadar can connect you with 1 media buyer at Sugarhouse and their agencies.

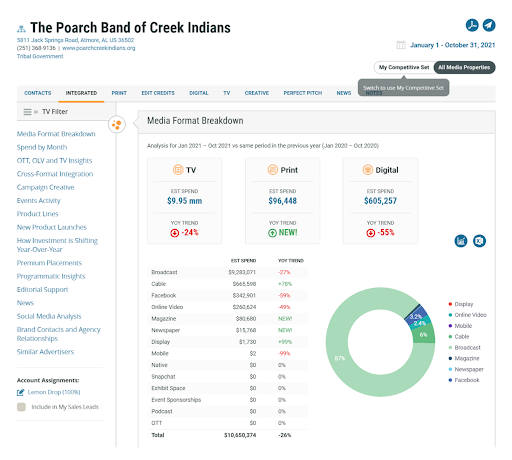

5. The Poarch Band of Creek Indians

This casino group is spending heavily in Print, Digital and TV. 99% of their spend is within the Online Gambling category. Overall advertising spend is over $10mm which is down 26% from last year.

Their TV spend is almost $10 million, though their investment in this format is down 24% from last year.

Their Digital investment is down 55% to over $605 million.

They’re new to the print with an investment of over $96 thousand—with the majority going to magazines. The Poarch Band of Creek Indians is new to magazine advertising and has spent over $80 thousand this year.

You can see a detailed breakdown of The Poarch Band Of Creek Indians ad spending in the chart below. MediaRadar can connect you with 7 media buyers at The Poarch Band of Creek Indians and their agencies.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.