As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

After explosive growth during the first phase of the pandemic, streaming companies needed to move fast to keep the buzz up in 2021.

We’ve seen companies take different approaches to attract new customers and reduce churn.

Netflix is investing heavily in original content, and with each big release, like global sensation Squid Game, it gathers more user data across categories as diverse as action blockbusters, Korean soaps, anime, sci-fi, Sundance films, zombie shows, and kids cartoons.

“We are making great headway with our slate of original series, which is a rapidly growing proportion of our spending,” said Netflix. “Any linear network would be proud to show them. Our success is due in part to great creative execution by our team as well as the power of our large on-demand service.”

In the Spring of 2021, Amazon signed an agreement to acquire MGM Entertainment for $8.45 billion. MGM has an exciting collection of films released this year, including: House of Gucci, No Time to Die, Respect, and The Addams Family 2. MGM also owns a catalogue featuring 17,000 TV shows, including fan favorites like The Handmaid’s Tale, Fargo, and Vikings.

This deal is Amazon’s second largest acquisition, behind Whole Foods, showing how key streaming will be in Amazon Prime services. This deal came right after AT&T’s announcement of a $43 billion deal between WarnerMedia and Discovery.

Discovery+ and HBO Max are on track to finalize their merger in mid-2022, which will allow the companies to combine each one’s best features into one new single platform.

And remember Redbox? It’s no longer just a kiosk in your local grocery store. The company recently went through a merger and went public. Next year, the company will release SVOD channels and claims it wants to be the “Switzerland” of streaming. They want to be an independent player, who is a good partner to everyone.

Companies are making big deals to take on the Netflix’s, Disney+’s, and Amazon’s of streaming. And they’re using their ad dollars to support their strategies.

MediaRadar Insights

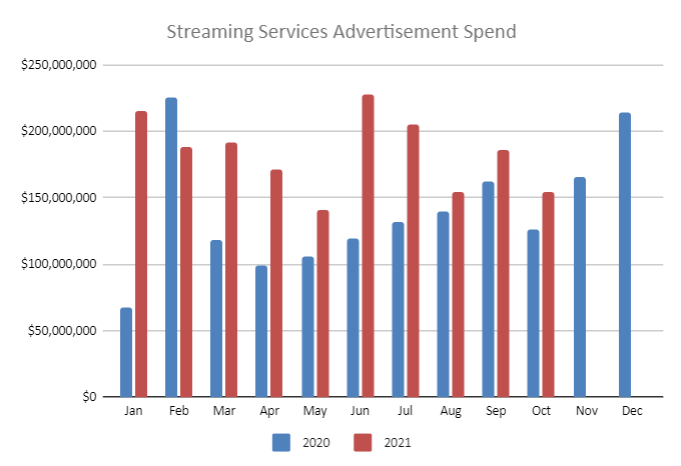

Overall Spending and Breakdown Across Formats

Overall, spend in the Streaming Services category is up 41% YoY (January – October, 2021 vs 2020).

The largest increase took place in print spend, which grew 124% year-over-year, to reach $79.6 million. The format that receives the most investment is digital. Advertisers spent $913.6 million on digital advertising in 2021 (through October), which is a 11% increase year-over-year.

Number of Advertisers

681 advertisers spent $1.8 billion in 2021, compared to 486 thousand advertisers who spent $1.3 billion in 2020.

Retention and Shift in Top Advertisers

Of the top 22 advertisers in 2020, 10 advertisers remained top advertisers.

New advertisers in the top 22 were new streaming services such as: Discovery+, Paramount+, Peacock, and DirecTV stream.

In the overall category, streaming service advertisers had a 60% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

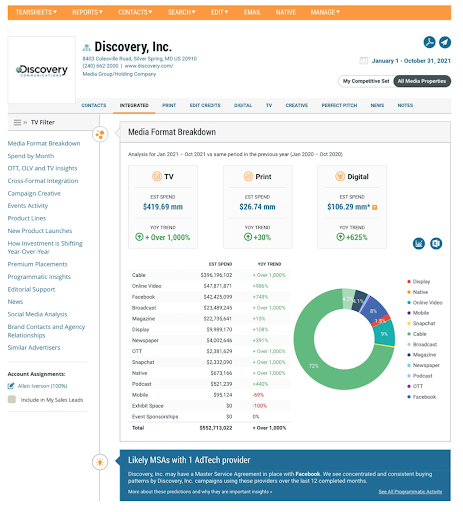

1. Discovery, Inc.

Discovery Inc. is a top advertiser in the streaming category, dedicating 73% of their overall budget to ads promoting their media properties. Discovery, Inc.’s ad spend is up 1000% in comparison to last year, with their investment in digital up over 625% YoY.

They have made significant investments in Broadcast, Native, Snapchat and OTT ads, all up over 1000% over last year. About $420 million is going to their TV ad spend. Their total ad spend stands at over $552 million.

Below is a breakdown of Discovery, Inc.’s ad spend thus far in 2021. MediaRadar can help you connect with 42 key contacts at Discovery, Inc.

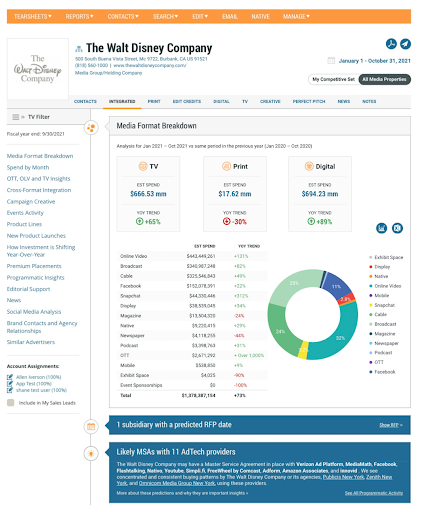

2. The Walt Disney Company

The Walt Disney Company is investing heavily in the Streaming category, which makes up 73% of their total spend.

Their overall spend stands at over $1.3 billion. Their investment in digital is up over 89% to over $694 million, while their TV spend is up 65% YoY to over $666 million. Their print spend is down 30% to over $17 million.

Below is a breakdown of The Walt Disney Company’s ad spend so far in 2021. MediaRadar can help you connect with 171 key contacts at The Walt Disney Company and we predict that 1 RFP is likely.

Will The Walt Disney Company’s ad spend continue to focus in the digital and TV space? Will their print spend continue its decline? We’ll keep watching.

3. AT&T

AT&T Inc. is unsurprisingly investing heavily in the streaming category with 19% of their total spend going into the category. In digital AT&T has spent over $470 million which is a 78% increase over last year.

Their TV spend is down 27% to approximately $414 million, while they’ve increased their print spend over 30% to over $44 million year-over-year. Their total ad spend is over $929 million.

Be ready to pitch! Below is a breakdown of AT&T’s ad spend so far in 2021. MediaRadar predicts 3 likely RFPs and can connect you with 207 media buyers at AT&T and their agencies.

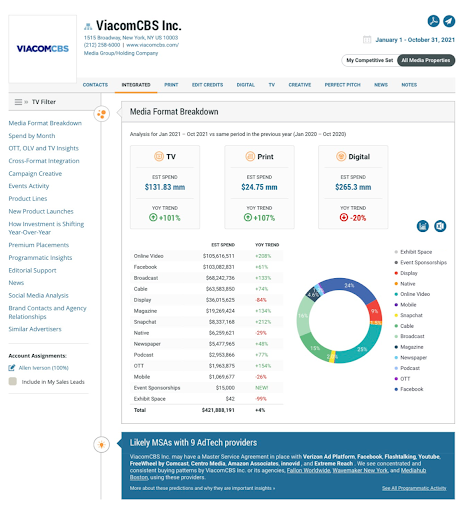

4. ViacomCBS Inc.

ViacomCBS is spending heavily in the streaming category spending over $143 million in the category.

This makes up 34% of their total ad spend. Overall, their digital spend is down to $265 million year-over-year, which is a 20% decrease.

However, their TV and Print spend is up to over $131 million for TV and over $24 million for Print. This is over a 100% increase for both. ViacomCBS has been making even greater investments in Snapchat, Broadcast and online video – all up over 200%.

Their overall ad spend hovers around $421 million.

Below is a breakdown of ViacomCBS’ ad spend so far in 2021. MediaRadar can connect you with 138 media buyers at ViacomCBS and their agencies.

5. Amazon.com Inc.

Among its many investments in advertising, Amazon invests in the streaming category. Overall, they’ve spent over $1.2 billion in advertising. 9% of that (or over $119 million) of their advertising was spent in the streaming category.

Their digital spend is up to over $507 million, a 19% increase, while their print spend is also up to over $25 million, an 82% increase YoY. Their OTT spend is up over 1000% to over $10 million YoY.

Below is a breakdown of Amazon’s ad spend thus far in 2021. MediaRadar can help you connect with 134 key contacts. We predict 7 likely RFPs at Amazon.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.