As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Used cars were flying off the lots this year—and in the face of surging prices.

Used car prices are about 42% higher than they were in the first quarter of 2020.

The price gap between new and used cars has shrunk rapidly since November of 2020, when the difference was 10.8%. This summer, on average, a gently-used vehicle cost only 3.1% less than its new counterpart. In some cases, available and in-demand used models went for more than their new counterparts.

Rising prices are caused by the chip shortage and high consumer demand.

“The industry has had strikes and material shortages before that have left us short of inventory, but I’ve never seen anything like this,” said Mark Scarpelli, the owner of two Chevrolet dealerships near Chicago. “Never, never, never.”

Used car dealerships saw higher profits on their used cars this year. Did this impact their advertising? To put it simply: Absolutely.

MediaRadar Insights

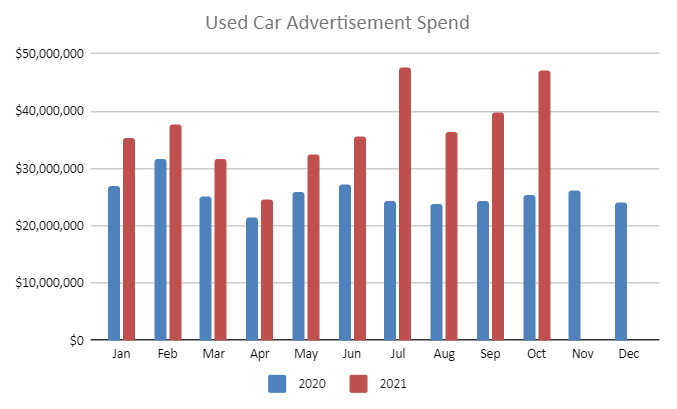

Amid all the frenzy of used car shopping, advertising spend increased significantly. Advertising spend in this category is up 44% year-over-year.

Brands have spent the most on TV ads—totaling $231 million, which is up 14% from last year.

The biggest increase was unsurprisingly found in digital. Brands upped their spend by 165%, reaching up to $134.6 million.

Print is down 18%. Brands spent nearly $3.1 million in this format.

Number of Advertisers

While the increase in spend is impressive, the number of new advertisers is even greater. 914 advertisers spent $368.7 million in 2021 compared to 477 advertisers spending $256.4 million in 2020. This is a 91% increase in the number of advertisers, reflecting how hot the market is right now.

Advertiser Retention and Shift in Top Advertisers

Used automotive advertisers had a 52% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Carvana, LLC

Carvana, LLC. is the top advertiser in this category, dedicating 100% of their overall budget to ads promoting used car sales. Even though they are the top advertiser in a growing category, Carvana’s ad spend is down 13% in comparison to last year.

But they have made significant investments in OTT and Mobile ads, both of which saw spending increases of over 1000%.

Of the $74 million spent on TV advertisements, $8.6 million is spent on broadcast ads, while over $66 million is allocated to cable ads, which accounts for 69% of overall ad spending.

$21 million was spent on digital advertisements, which is a 136% increase since last year.

Below is a breakdown of Carvana LLC’s ad spend thus far in 2021. MediaRadar can help you connect with 2 key contacts at Carvana.

2. CarMax Business Services, LLC

CarMax Business Services, LLC is another big advertiser in this category, dedicating 80% of their overall budget to ads promoting used car sales. CarMax’s ad spend is up 84% in comparison to last year.

Their investment in digital advertising is up 90% year-over-year at $35.4 million. $28 million of digital spending goes toward Facebook ads, which is a 278% increase since last year. Their digital spending also saw significant investments in OTT and Podcast advertising, both of which saw an over 1000% increase.

CarMax Business Services’ in TV are up 81% year-over-year, with nearly $52 million allocated to cable ads.

Below is a breakdown of CarMax’s spend thus far in 2021. We predict they will likely have one upcoming RFP issued. MediaRadar can help you connect with 16 key contacts at CarMax Business Services, LLC.

3. AAGP, LLC

AAGP, LLC is also a prominent advertiser in this category, dedicating 100% of their overall budget to ads promoting used car sales.

AAGP’s ad spend is up 72% in comparison to last year with their investment in TV advertising up 74% year-over-year and their investment in digital up 57% year-over-year.

They began advertising in podcasts this year, and have made significant investments in OTT and Native advertising, spending has been up over 1000% in both categories.

Almost $42 million is being allocated to cable TV advertisements and over five million dollars is going to digital ads.

Below is a breakdown of AAGP’s spend thus far in 2021. MediaRadar can help you connect with 3 key contacts at the company.

4. CarSavvy.com

CarSavvy.com is a big advertiser in this category, dedicating 100% of their overall budget to ads promoting used car sales. CarSavvy’s ad spend is up over 1000% in comparison to last year.

They have made significant investments in digital spending, with $43 million going into Facebook, which is over a 1000% year-over-year increase.

Below is a breakdown of CarSavvy.com’s spend thus far in 2021.

5. DriveTime Automotive Group, Inc.

DriveTime Automotive is another top spender in this category, with 100% of their overall budget to ads promoting used car sales.

DriveTime’s sales are down 13% in comparison to last year, although their spending on digital mediums is up 4% year-over-year, with their investments in OTT and Native advertising up over 1000%. Display advertising is up 115%.

Below is a breakdown of DriveTime Automotive Group’s spend thus far in 2021. MediaRadar can help you connect with 3 key contacts at DriveTime Automotive.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.