As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

The video game industry had an exciting, yet strange, year.

Many great games came out. Sales were up 12% year-over-year.

But major companies believe supply chain issues will begin to hamper sales. Nintendo has urged shoppers to begin holiday shopping early.

“We are working hard to get the systems into the market,” said David Young, assistant manager of public relations at Nintendo of America. “Again, if you want a Switch system for this holiday season and you see one, I recommend you buy it right away.”

The industry is also wrestling with the idea of remote work moving forward. On the one hand, individuals are often more productive at home. On the other hand, creative work is sparked by hallway conversations and team camaraderie.

Employees need to be at peak creativity right now as companies continue to build their metaverses and include user-generated content and interactive advertising within their digital worlds.

The video game industry is growing and innovating rapidly. This competitive environment is great news for the advertising industry. Ad spending is climbing.

MediaRadar Insights

Overall Spending and Across Formats

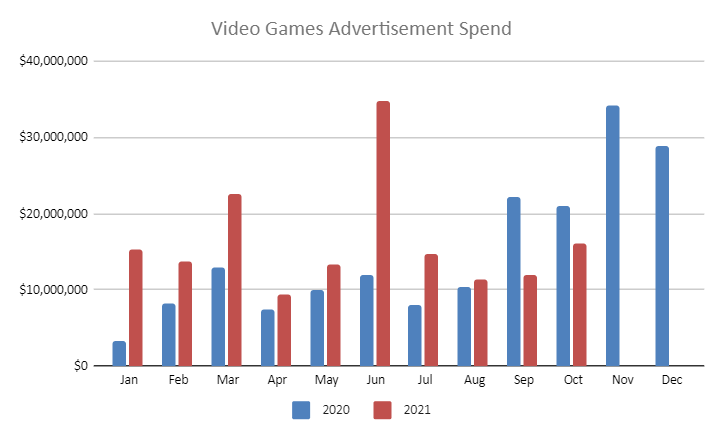

Overall, spend in the video game category is up 41% YoY (January – October, 2020 vs 2021).

We see the largest increase in print spend, which grew 364% to $4.1 million. Though this percent increase is staggering, it’s a small dollar amount compared to the media format with the most largest investments: digital.

Video game advertisers spent about $117.7 million on digital advertising between January and October, which is a 66% year-over-year increase.

Meanwhile, TV advertising fell 5%, adding up to $41.2 million in spending.

Number of Advertisers

297 advertisers spent $162.9 million in 2021, compared to 220 advertisers spending $115.3mm in 2020.

Retention and Shift among Top Advertisers

In the top 22 advertisers in 2020, 7 advertisers maintained their dominance in the category. This is a retention rate of 32% among top advertisers.

Looking at the overall category, our data shows that the video game category maintained a 35% advertiser retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Nintendo Co., Ltd.

Nintendo Co., Ltd. is a top advertiser in the video game industry, devoting 77% of their overall budget to advertising their video game products. Their ad spend is up 49% since last year, increasing their investments in digital advertising by 138% YOY.

Investments in Facebook, display, OTT, and native advertisements have gone up by 149%, 118%, 964%, and over 1000% respectively.

Below is a breakdown of Nintendo’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 12 key contacts at Nintendo Co., Ltd.

2. Microsoft Corporation

Microsoft Corporation is a top advertiser in the video game industry. Their ad spend is up 49% since last year, increasing their investments in Print and Digital advertising by 226% and 103% respectively since last year.

Investments in digital media, like Facebook, online video, OTT, advertisements have all had an increase of over 100% since last year.

Below is a breakdown of Microsoft’s ad spend thus far in 2021. We predict they will likely have 5 upcoming RFPs issued. MediaRadar can help you connect with 109 key contacts at Microsoft Corporation.

3. Sony Corporation

Sony Corporation is another big advertiser in the video game industry. Since last year, they’ve increased their overall ad spend 5%.

Sony’s investments in print ads has gone up 36%, and their investment in digital ads have increased 18% YOY. Sony’s biggest increase in spending was in native advertising, which went up 446%.

Below is a breakdown of Sony’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 68 key contacts at Sony Corporation.

4. Cloud9 Esports, Inc.

Cloud9 Epsorts, Inc. is another big spender in the video game industry, devoting 100% of their overall budget on promoting their video game products. Cloud9’s ad spend is up 407% YOY. All of their marketing is done digitally, primarily on Facebook, which saw a 426% increase in investment.

Below is a breakdown of Cloud9’s ad spend thus far in 2021. MediaRadar can help you connect with 68 key contacts at Cloud9 Epsorts, Inc.

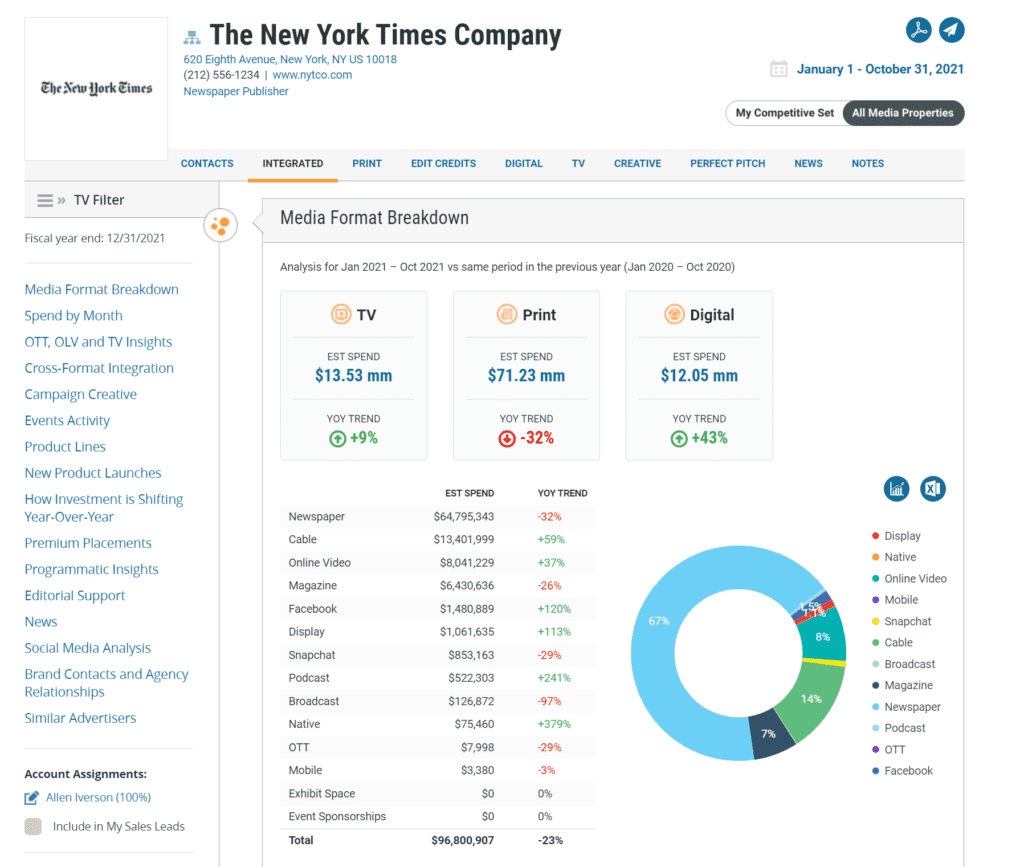

5. The New York Times Company

The New York Times Company is another big advertiser in the video game industry, with 4% of their budget devoted to promoting their games. While their overall ad spend was down by 23% since last year, digital advertisers saw an increase in spending of 43%.

Digital media such as Facebook, display ads, podcast spots, and native advertisements saw increased investments of 120%, 113%, 241%, and 379% respectively.

Below is a breakdown of The New York Times Company’s ad spend thus far in 2021. MediaRadar can help you connect with 5 key contacts at The New York Times Company.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.