As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Winemakers began picking early this season and are reporting outstanding grape quality.

Winemakers in California—where 80% of the nation’s wine is grown and processed—expect this year’s vintage to be “one of the best in recent history.”

And it’s not just in California and the West Coast. Over in Texas, the wine industry market is exploding. “They’re starting to realize that we’re, we’re a powerhouse; we’re somebody that is making great wine and we have a really good experience and lots of really unique geography, especially out in the Hill Country here, for different wine settings,” said Nate Pruitt, the owner of Bell Springs Winery in Dripping Springs.

But even though the harvest is great and wineries are growing, the industry isn’t escaping the ubiquitous supply chain issues and increased prices for shipping costs. We will likely see a champagne shortage during the holidays. And it’s unclear when all the bottlenecks in shipping and delivery will clear.

“Supply constraints are always popping up—but never to the extent and scope that we’re seeing now,” said Nima Ansari, spirits buyer at Astor Wines & Spirits in Manhattan.

Though supply chain issues are a real challenge, current demand for wine is high and companies have a great harvest on their hands. Under these conditions, we’ve seen advertising spend increase.

MediaRadar Insights

Overall Spending and Breakdown Across Formats

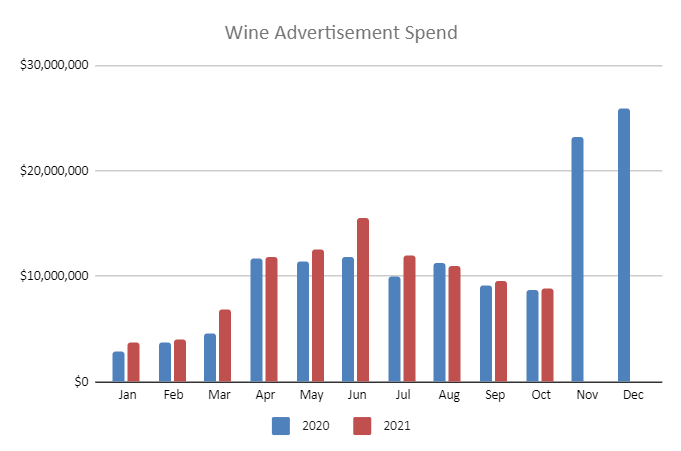

Wine marketing teams have increased their investments by 13% year-over-year in 2021 (through October.)

The wine industry is unique. Print makes up the largest share of spending at $41.6 million, but more importantly, this format grew significantly. Spending in this format increased 21% in 2021. Unlike many industries that have decreased their print investments, wineries are upping their spend.

But we’ll be honest. Digital grew at a faster pace, just as it did across most industries.

Digital grew 35% year-over-year, reaching up to $27.7 million.

TV was the only format to shrink. Wine advertisers spent $11 million over the last year (through October), which is 11% less than last year.

Number of Advertisers

1.3 thousand advertisers spent $95.9 million in 2021 compared to 1.3 thousand advertisers spending $84.7 million in 2020.

Advertiser Retention

In the overall category, wine advertisers had a 44% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Constellation Brands, Inc.

Constellation Brands, Inc. is the top advertiser in this category, dedicating 7% of their overall budget to ads promoting their wines. Constellation Brands, Inc. ad spend is up 3% in comparison to last year

Their investment in print is up 285% year-over-year, reaching up to $3.66 million.

Digital also grew significantly at 88%, with growing investments in OTT and Podcasting. Podcasting grew over 1,000%.

Below is a breakdown of Constellation Brands Inc. spend thus far in 2021. We predict they will likely have 4 upcoming RFPs issued, MediaRadar can help you connect with 42 key contacts at Constellation Brands.

2. E & J Gallo Winery

E & J Gallo Winery is another top advertiser in the wine category, with 42% of their budget dedicated to advertising their wine products.

While E & J Gallo’s spending on advertising is down 9%, they are increasing their investments in TV and print ads.

Cable ads saw a growth of 32% and spending on broadcast ads increased by 189%. Magazine advertisements accounted for 30% of their total spend, at over $6 million.They also began advertising with Snapchat this year and they increased their spending on OTT ads by over 1000%.

Below is a breakdown of E & J Gallo Winery’s spend thus far in 2021. We predict they will likely have 3 upcoming RFPs issued. MediaRadar can help you connect with 31 key contacts at E & J Gallo Winery.

3. LVMH Moet Hennessy Louis Vuitton SA

LVMH Moet Hennessy Louis Vuitton SA is a big spender in the wine category, spending over $305 million on advertising their wine products. They increased their ad spend 63% since last year.

70% of their overall advertising budget goes to print ads, with over $190 million allocated to magazine ads and nearly $24mm to newspaper ads.

They have also increased their digital spend 284% year-over-year. They increased investment in Snapchat by over 1000%, Display ads by 835%, Online Video ads by 310%, and Facebook ads by 70%. LVMH also began running OTT ads this year.

Below is a breakdown of LVMH Moet Hennessy Louis Vuitton SA’s spend thus far in 2021. We predict they will likely have 26 upcoming RFPs issued. MediaRadar can help you connect with 90 key contacts at LVMH Moet Hennessy Louis Vuitton SA.

4. Kayco

Kayco is another top advertiser in the wine industry, with 82% of their overall budget going to promoting their wine products. Their advertising spend has gone up 57% since last year.

Kayco’s digital spending increased by over 1000%. New to the formats, they invested $1.3 million into native advertising and $21,610 into Facebook ads.

82% of their overall ad spend, $6 magazine goes to magazine ads.

Will Kayco continue to increase their advertising investments? Below is a breakdown of Kayco’s spending thus far in 2021. MediaRadar can help you connect with a key contact at Kayco.

5. Treasury Wine Estates Limited

Treasury Wine Estates Limited is another top advertiser in wine, and has increased their overall spending by over 1000% this year.

They are new to investing in TV and other forms of digital advertising. Snapchat, Broadcast, Cable, OTT and exhibit space advertising were all new for this brand. Nearly every category saw an increase of spending.

Treasury Wine Estates Limited has shifted money into new formats and might be open to continuing this trend in 2022. We predict they will likely have 3 upcoming RFPs issued. MediaRadar can help you connect with 7 key contacts at Treasury Wine Estates Limited.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.