As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

Over the last decade, the demand for exceptional beer has exploded.

The number of breweries in the U.S. has grown over 400%. The market is more alive and competitive than at any point in history. And even without live events and fewer social gatherings, the beer industry didn’t falter.

“It’s always been said that beer is recession-proof, and now we’ve proven that it’s pandemic-proof,” says Ryan Bandy, sales director for Indeed Brewing in Minneapolis.

Beer companies have innovated a tremendously during the pandemic. How has that impacted their advertising strategies?

But first, a note on the shift to eCommerce

Between the reduced indoor capacity at taprooms and the lack of events, beer companies had to figure out how to get their products into the hands of customers.

Breweries that were not packaging prior to the pandemic began to sell their beer in cans and bottles. National brands started investing more in niche-markets, like non-alcoholic beer. And smaller companies made digital ordering easier for companies.

Tavour, a platform that delivers craft beer to consumers, ran a survey among breweries and found that on average, respondents had shifted 25% of their business to online channels by March of this year.

With this shift to eCommerce, it’s not surprising that we’ve also seen media budgets shift to digital.

MediaRadar Insights

Changes Across Format

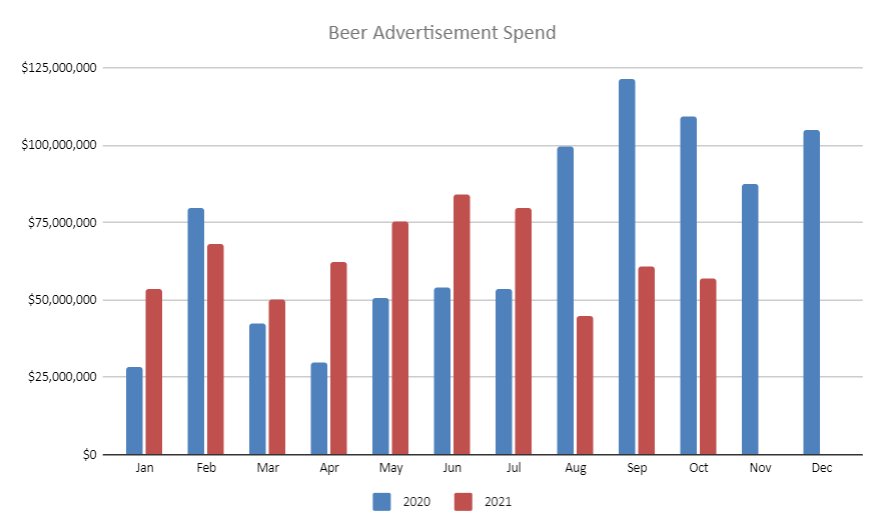

Though spend in the beer category is down 5% year-over-year, digital advertising and print both saw significant increases.

Digital advertising investment in this category increased 74%, indicating that legacy beer brands, like Modelo, Corona, Miller Lite and Bud Lite shifted spending to where buyers were shopping.

Beer brands have traditionally invested heavily in TV, but as viewership shifted to over-the-top (OTT) streaming, they started to shift their budgets. TV spending was down 12%.

That being said, TV is still the biggest channel for these brands. In 2021, brands spent roughly $97 million on digital advertising, while they spent $534 million on TV.

Number of Advertisers

The beer category saw a 15% increase in the number of advertisers.

237 advertisers spent $636 million in 2021, compared to the 206 advertisers who spent $669 million in 2020.

Retention and Shift in Top Advertisers

Of the top 22 advertisers from 2020, 16 advertisers maintained their dominance in the category, which is a retention rate of 73%.

Of all beer advertisers, the category saw a 55% retention rate between 2020 and 2021 (through October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Constellation Brands, Inc.

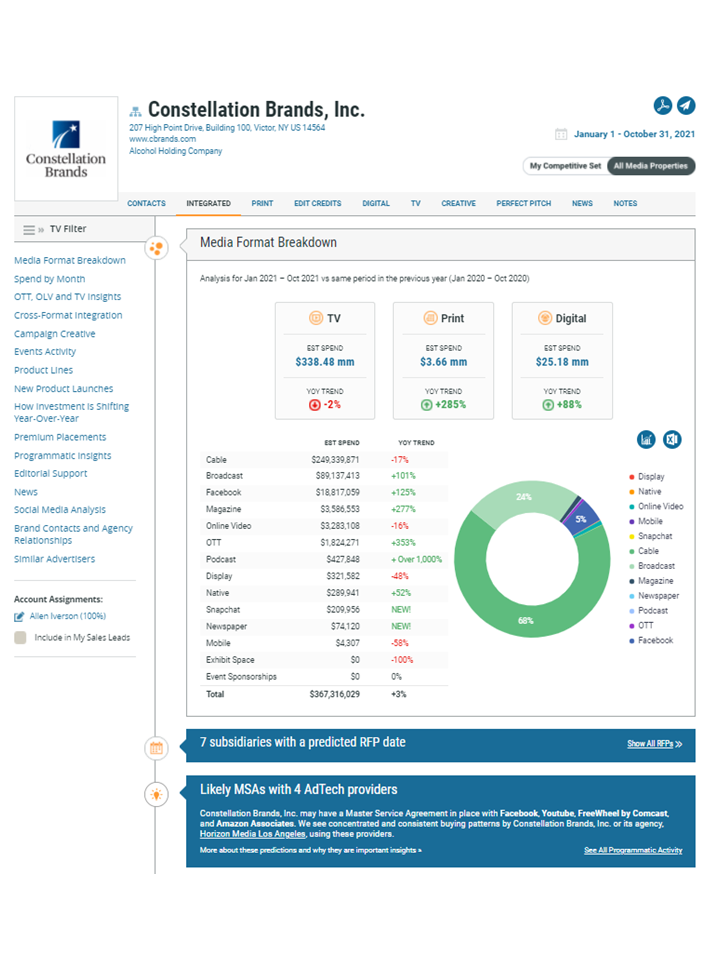

Constellation Brands Inc. an American producer and marketer of beer, wine, and spirits is a top advertiser in this category, dedicating 80% of their overall budget to ads promoting their beer. Overall, Constellation Brand’s ad spend is up 3% in comparison to last year with their investment in digital up 285% YoY.

They have made significant investments in OTT and podcast ads. OTT is up over 350% and podcasts are up over 1000%. Snapchat and newspapers advertising are both new this year for Constellation Brands.

Below is a breakdown of Constellation Brands’ ad spend thus far in 2021. We predict they will likely have four upcoming RFPs issued, MediaRadar can help you connect with 42 key contacts at Constellation Brands.

Make sure you are prepared to pitch. It will be interesting to see if and how their advertising shifts and what formats they focus on in 2022.

2. Anheuser-Busch InBev SA/NV

Anheuser-Busch InBev SA/NV is another big spender within the Beer category. Seventy-four percent of their budget is allocated to their beer product lines.

Anheuser-Busch InBev SA/NV has increased investment across digital, print and national TV in comparison to last year. Their biggest increase in advertising has come from cable TV, where they are investing over $15mm. This is up 408% compared to last year.

We see significant growth across video platforms. Online video is up 573% YoY, broadcast is up 149% and OTT is up over 1000% YoY.

Will they continue this strategy into 2022? Only time will tell, but make sure you are prepared to pitch Anheuser-Busch InBev SA/NV. MediaRadar can connect you with 8 key media buyers from Anheuser-Busch InBev SA/NV and their agencies.

3. Molson Coors Beverage Company

Molson Coors Beverage Company is one of the top spenders in beer advertising. They saw their largest growth in advertising in digital with 51% growth YoY. Print spend is also up 46%.

The formats considerably increasing spend are podcasts and OTT. Also of note, overall ad spending is up 15% YoY despite a 3% drop in TV ad spend.

Below, you’ll see a detailed breakdown of Molson Coors Beverage Company’s spending We predict that it’s likely that Molson Coors Beverage Company will have 7 RFPs coming up in the near future. Be ready to pitch! MediaRadar can connect you with 49 key contacts at Molson Coors Beverage Company and their agencies.

4. The Boston Beer Company

The Boston Beer Company is another big spender within the beer industry. 52% of their budget is allocated to their beer product lines. The Boston Beer Company has increased investment across all advertising formats —digital, print and national TV – with a marked push coming in digital. This is up 274% compared to last year.

More specifically this digital push has been in Facebook, OTT, and Snapchat. With Facebook and OTT both being up 368% and Snapchat up over 1,000%!

Will they continue this strategy into 2022? One can only presume so as we continue to interact most directly with our small screens working from home—phones, laptops and computers become the new normal.

MediaRadar can connect you with 19 key media buyers from The Boston Beer Company and their agencies and we predict they will likely issue 1 RFP. We’ll be watching the Boston Beer Company’s ad spend closely to see if they continue their investment across print, digital and TV.

5. Heineken Holding NV

Heineken Holding NV is our final of the five top advertisers in the beer industry.

They spend 72% of their budget on advertising beer products. Their spend is slightly down at -19%, but they’ve increased their spend on digital advertising by 87%, with their investments in OTT growing by over 1000%.

Will they continue their investments in digital spaces? Be ready to pitch Heineken. We predict one upcoming RPF. MediaRadar can connect you with 22 contacts at Heineken Holding NV.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.