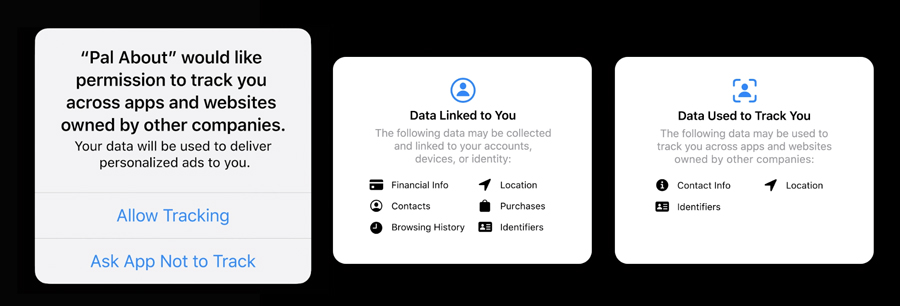

At WWDC 2020 conference, Apple announced a big change was coming with iOS 14: App Tracking Transparency, which requires “app developers to self-report their privacy practices, clearly summarize their privacy info in the App Store so users can see it before they download an app and make it easier for users to see and control what data an app is collecting about them.”

Katie Skinner, a manager for user privacy software at Apple, said, “We believe tracking should always be transparent and under your control. So, moving forward, App Store policy will require apps to ask before tracking you across apps and websites owned by other companies.”

The news made headlines.

At the time, there were more than 100mm iPhone users in the U.S. It was expected that most of them would “Ask App Not to Track,” which would make targeted advertising on iPhones—and any apps installed on them—next to impossible.

Let’s explore the new protection and how advertisers are steadying themselves on the shifting sands.

What Exactly Is Apple’s App Tracking Transparency?

In 2017, Apple released Intelligent Tracking Prevention (1.0) to limit the use of cookies on Safari (the Apple-owned browser) by tracking service providers through a setting called “Prevent Cross-Site Tracking.”

Since then, Apple has updated the technology and intensified its stance on privacy.

With iOS 15 in 2021, Intelligent Tracking Prevention got even stronger—this time by hiding the user’s IP address from trackers, which meant advertisers can’t use the user’s IP address as a unique identifier to connect their activity online.

Apple’s App Tracking Transparency feature, which launched with iOS 14, is essentially the mobile-app version.

With the update, Apple effectively sacked its IDFA—Identifier for Advertisers—which helps mobile marketers attribute ad spend. The company did this by giving iPhone users the ability to opt-in or out of data tracking.

If a user opts out, advertisers can’t use IDFA to deliver targeted campaigns.

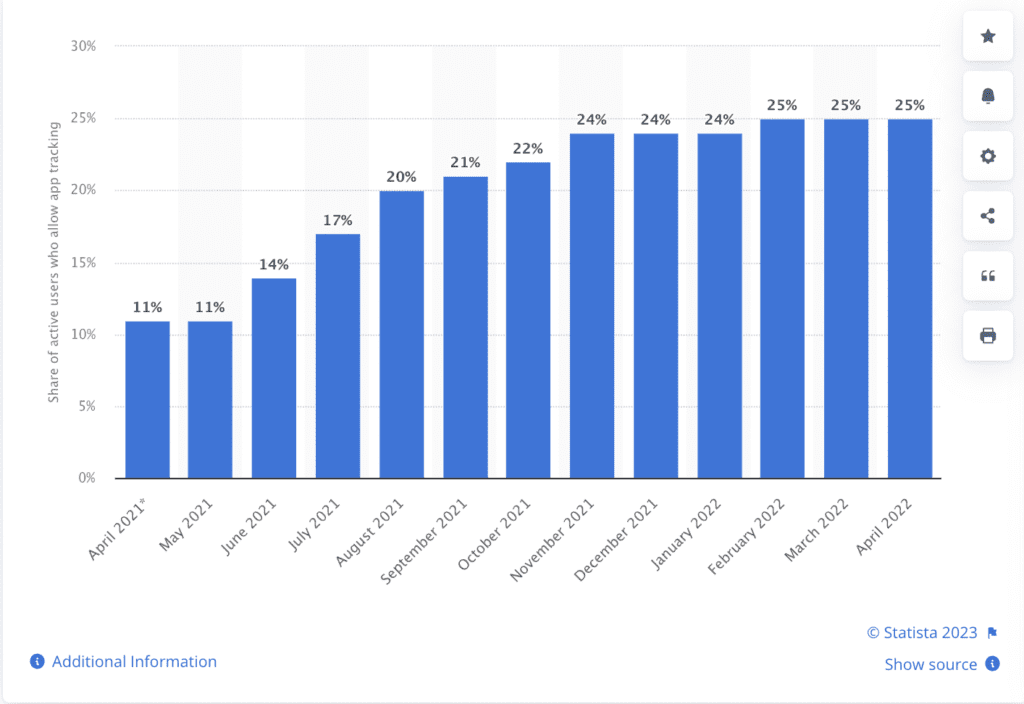

This opt-in feature will be used across all iOS devices, including Apple TVs. While advertisers didn’t know the opt-in rate then—it was estimated to be as low as 5%—they do now.

According to Statista, the opt-in rate among those who have downloaded iOS 14.5 is around 25%. Said another way, only 25% of iPhone users allow advertisers to track them.

With so many users concerned about tracking, the low opt-in rate was expected and is likely to increase.

Remember: All of this happened against the backdrop of advertisers bracing for a world where Google Chrome drops third-party cookies. Currently, advertisers will have to have a cookie alternative ready by 2024.

How Are Advertisers Responding?

In 2020, many leaders said that Apple killed the IDFA.

“The IDFA is dead,” said CEO of Branch Alex Austin to AdExchanger. “There is no other way to interpret this.”

Others simply didn’t know what to expect.

“It’s very hard for us to extrapolate what [the IDFA changes] will do given that there is no precedent to this,” said Criteo CEO Megan Clarken. The ad-targeting technology company predicts that the update will cut their earnings by at least $3 million in the proceeding quarter.

Facebook was on the fence as well.

The social media giant even took aim at Apple with a full-page newspaper ad. Without IDFA, advertisers would have no effective way to deliver ads to Facebook users on iPhones.

The ripple effect continues to impact Facebook, with analysts saying the change would cost the company at least $12 billion.

Given the compounding impact of Apple’s decision to put IDFA on the chopping block, it’s no surprise that the industry has acted fast to find an alternative.

The Trade Desk (TTD) is working on an open-form tool—Unified ID 2.0—to help the industry work in a post-cookie world. The tool will give consumers an open ID that replaces cookies and gives controls to consumers while also enabling personalized advertising.

Where Does Programmatic Advertising Stand?

Programmatic has fared better than most other forms of advertising during the COVID-19 pandemic.

MediaRadar data shows that the number of advertisers running programmatic ads increased by 26% between January and May 2020.

In June, spending levels hit their highest point since the beginning of the year. In fact, spending levels in June were down just 3% compared to January.

The types of companies buying programmatic ads shifted in Q2.

Most noticeably, travel brands drastically cut spending. Meanwhile, other categories—media, home furnishings, and education/training—increased spending.

Clearly, programmatic advertising was largely unaffected by Apple’s announcement.

But what about now?

How has programmatic spending fared in 2022, and what’s in store for 2023?

Consider this: The programmatic advertising market is expected to grow by $314.27 billion between 2022-2026, accelerating at a CAGR of 26.66%.

So, has programmatic advertising been impacted by Apple’s announcement in 2022?

Not really.

Now it’s time to see how programmatic advertising fares following Google’s official sunset of third-party cookies next year.

For more insights, sign up for MediaRadar’s blog here.