It’s no secret that B2B marketing was hard hit by the COVID-19 pandemic. Business that relies on in-person connection simply couldn’t remain unaffected by social distancing regulations.

But while industries looked different this year, they certainly didn’t stop moving. B2B marketers have adapted and thrived with a full docket of virtual events and digital advertising.

How have these changes impacted B2B spending across event sponsorships, digital ads, and print? Keep reading to find out.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

B2B Marketers Get Creative With Virtual Gatherings

Virtual events weren’t unheard of before stay-at-home orders, but as limits on crowds became widespread, the B2B industry began to rely on them more heavily.

Advertisers moved past traditional webinars and began hosting “Ask Me Anything” events and virtual coffee hours—any number of online get togethers designed to provide face time without being together in person.

Industry leaders quickly experienced new benefits using virtual events, such as:

- High cost effectiveness

- Global reach

- Easy and instant insight and analytics

The flexibility of virtual events allowed marketers to show off their creativity and truly engage attendees in ways that aren’t always feasible in person. Online and remote events allow organizers and hosts to cater to individuals and provide feedback in real time in an organized way.

In the long run, virtual events likely aren’t going anywhere and will instead simply grow in popularity, effectiveness, and adaptability as both organizers and audiences become more accustomed to the new format and increased possibilities.

B2B Ad Spend Grows

As the year’s gone on, B2B ad spend has been heavily directed at digital advertising.

“The conditions of Covid-19 are really forcing B2B marketers to realize that they need to accelerate their transformation into digital,” says Jillian Ryan, eMarketer principal analyst. B2B digital ad spend is expected to grow 22.6% YoY by the end of the year

Ryan points out that this digital ad spend has been on track to increase for several years, though 2020 brought about an unexpected shift: audiences were spending more time on laptop and desktop computers, and less on mobile phones.

Working from home changed the devices that audiences used, so advertisers had to make quick decisions to target them where they found them: on the larger work devices that they used for Zoom calls, rather than the cell phones they formerly scrolled on their commute.

Of course, the increase in digital spend wasn’t visible across the board. Industries such as healthcare increased digital ad spend by 41.2% YoY, while harder-hit industries such as travel decreased by 44.5%.

MediaRadar Insights

With virtual events on the rise, it would make sense to assume that the same sponsors of in-person events would simply shift their attention to webinars and online conferences. This isn’t necessarily the case.

Of all event sponsors and exhibitors who attended B2B events in April through September of 2019, only 43% sponsored virtual events in the same time frame in 2020. Those who did return were big spenders, who made up about 50% of total spend.

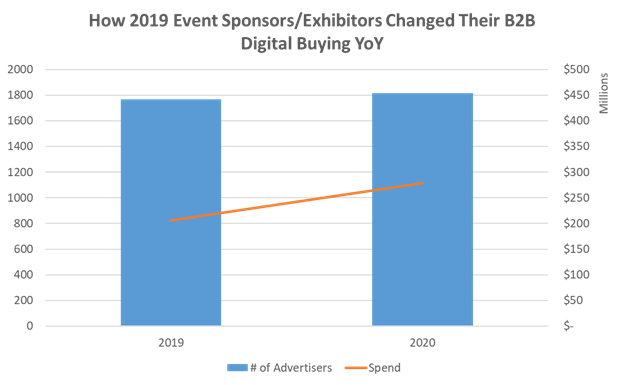

Even though the majority of event sponsors didn’t make a direct switch to virtual events, they began to invest more in digital ads across websites. Between April and September, event sponsors and exhibitors from 2019 spent 35% more YoY on digital ads, even as the total number of digital advertisers only increased slightly.

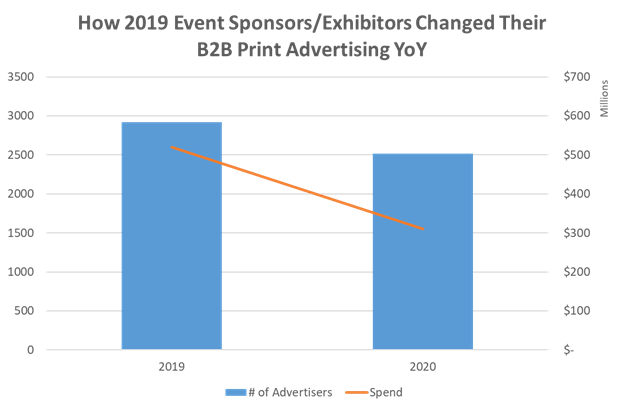

The same can’t be said about print, however.

When advertisers left events behind, they didn’t flock to print options. Overall spend on print advertising options from this group decreased by 40% YoY. This constitutes more stability than the print industry’s 45% drop overall, but still doesn’t look bright.

As face-to-face events remain limited, big companies shifted sponsorships to virtual events, while many others reallocated their budgets to advertisements across B2B websites. Digital buying is up and print buying is significantly down.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.