In our recent trend report, we dove into the shape of B2B advertising in both Canada and the US. These are the main takeaways from MediaRadar’s research.

At first blush, the advertising industries in Canada and the US don’t appear to be all that different. The two countries share a border, the industries share plenty of advertisers and publications, and brands don’t typically need distinct creative for each market.

But there are some important differences in B2B advertising across the two countries, in particular.

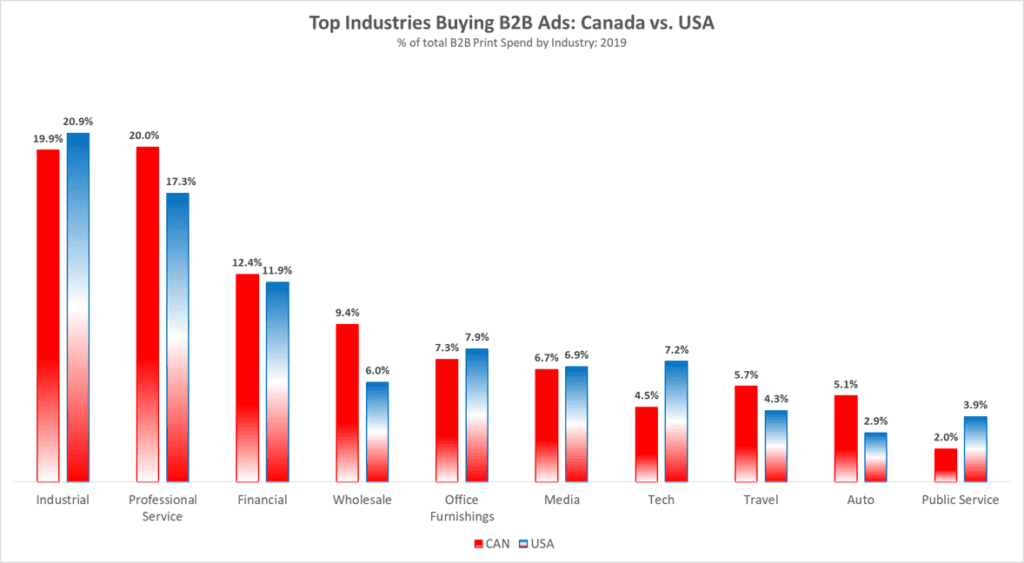

For starters, the B2B ad markets are made up of similar top industries, but there are differences in how those industries account for spend.

The graph shows that:

- In Canadian B2B publications, four industries account for a larger share of spend than in the US: Professional Services, Wholesalers, Travel, and Auto. The biggest gulf is for the wholesale industry; wholesalers account for nearly 10 percent of ad spend in Canada and just 6 percent in the US.

- In US B2B publications, Industrial, Tech, & Public Service companies account for a higher share of spend than in Canada. The tech industry sees the biggest gap in advertising spend: it accounts for 4.5 percent for Canada and 7.2 percent for the US.

- Getting back to the similarities, these top 10 industries account for roughly 90% of all B2B print ad spend in both countries.

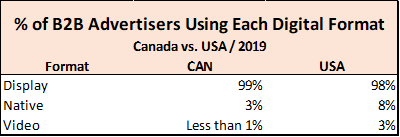

What about how B2B advertisers are using the power of digital advertising?

In both the US and Canada, nearly all online B2B advertisers utilize display advertising. The format takes the largest share of digital ad dollars, and will likely continue to for the near future.

However, where we see a key difference between the two countries is the up-and-coming formats: native and video. US companies are more than twice as likely to use native ads and three times as likely to use video ads.

At the same time, both B2B markets have huge potential for growth within these formats. In the US, fewer than 1 out of 10 B2B companies are utilizing native ads, a critical format as B2B publications go digital.

B2B advertisers in both the US and Canada have the opportunity to grow their investments in these relatively new formats.