Like much of the economy, manufacturing was forced to come to a halt due to COVID-19.

From chemical products to machinery to plastics, manufacturing companies provide the supplies and parts that other businesses need to carry on. Without these companies, it is difficult for workflows in other sectors to get rolling again.

Major enterprises are eager to get their supply chains back in order — and the 12.8 million employees who work in manufacturing want to get back to work. For these reasons, manufacturing is one of the first industries to start reopening.

What does this mean for B2B advertising?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Factories Are Reopening, But Not Without Challenges

While manufacturing experienced contraction, the drop was not as bad as expected.

The ISM Manufacturing Index fell to 41.5 in April, which was better than Wall Street’s prediction of 31.5. Even though the drop was better than anticipated, leaders still feel the weight of the crisis.

“COVID-19 has destroyed our market and our company,” said one respondent to the ISM survey. “Without a full recovery very soon, and some assistance, I fear for our ability to continue operations.” This respondent works in the nonmetallic products industry.

Manufacturing plays a big part in regional economies. Governors in these regions are allowing some manufacturers to reopen, with specific measures in place, in order to get employees working again.

Michigan Governor Gretchen Whitmer, who faced highly charged protests, said factories can reopen May 11, while stay-at-home orders would last until May 28 (now June 12).

“It’s a major step forward … to re-engage our economy safely and responsibly,” Whitmer said at a news conference. “Manufacturing is an important part of our economy.” While some factories are opening, production will still be slower than normal with safety measures in place and supply chains disrupted.

For example, auto production is dependent on factories in Mexico gearing up, and without these partners at work, things will be slow moving. Likewise, supply chains in China that provide the basic necessities and raw materials for companies need to be in place.

“There are three things that have to all come together. You have to have a healthy workforce, a healthy supply chain and healthy demand,” said Vice President of Industry, Labor & Economics at the Center for Automotive Research Kristin Dziczek. “It’s not just flip a switch and everything is as it was. It’s very complicated.” In fact, Ford had to shut down its factories, just two days after reopening when two workers tested positive for COVID-19.

In response to these struggles, McKinsey has outlined in detail three core areas of focus for re-opening factories:

- Protecting the workforce

- Managing risks to ensure business continuity

- Driving productivity at a distance

As manufacturers slowly reopen, we have seen some shifts in advertising.

MediaRadar Insights

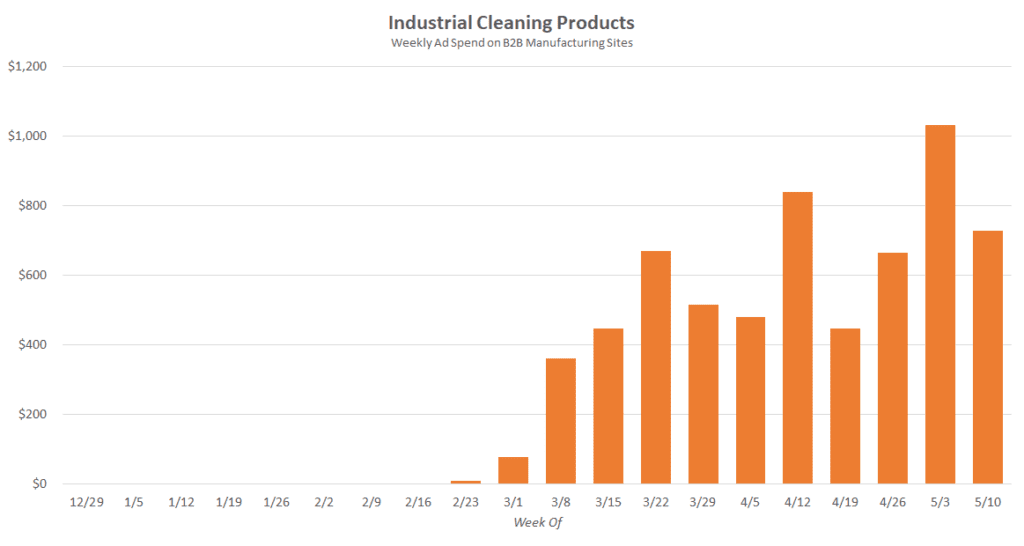

Our analysis looks at B2B website advertising from manufacturing companies.

When we compare the average weekly spend in the beginning of April to the first three months of the year, spending has contracted 39% on these websites. However, there have been signs of a recovery.

When we compare spending from the first week of May to just two weeks earlier (week of 4/19), spend was up 9%.

There has been an increase in spend among specific sub-categories. One of the most dramatic is industrial cleaning. The category went from spending basically nothing to quickly ramping up spend as COVID-19 began to impact the US.

Manufacturers have had to keep their factories extremely clean, so this increase is fitting.

Similar categories that increased their spend include:

- Factory automation

- Packaging products

- Products meant to help 18 wheelers move supplies more efficiently

COVID-19 has forced manufacturers to ask questions about their supply chains, automation and risk management for future crises. It will be years before we see the long-term impacts, but for now, we see signs of recuperation.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.