Ad tech is constantly evolving—and 2020 made industry leaders hustle faster than any other year.

On top of changing privacy legislation and an economic recession, consumers and businesses were forced to massively change their behaviors. This forced ad tech leaders to keep up, responding to the urgent needs of their clients.

Here we highlight three key trends in ad tech from 2020.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Ad Tech Forced to Deal with Change: Before and During COVID

The Push Towards Privacy Continued

Remember when the biggest news in ad tech was the California Consumer Privacy Act (CCPA) going into effect and Google removing cookies? It’s hard to believe, but that was this year, pre-COVID.

Even though our attention was diverted to how ad tech leaders were responding to a global pandemic, media leaders still needed to continue preparing for an internet largely without third-party cookies.

Leaders formed the Partnership for Responsible Addressable Media to reshape the ad tech ecosystem together. “The Partnership was created to serve as a collaborative forum for our industry to ensure addressability standards that preserve privacy, provide a consistent and effective framework for advertisers, and enrich the consumer experience,” stated Executive Director Bill Tucker.

In addition to this collaborative, ad tech vendors LiveRamp and The Trade Desk developed new targeting technology based on user authentication and identity resolution technology.

Programmatic Proved Resilient Amid the Pandemic

Brands needed to get the most out of their advertising dollars this year, driving many new brands to experiment with programmatic buying. The flexibility, hyper-targeting and accurate metrics made programmatic a clear winner when marketing budgets were slashed.

Plus, CPM prices dropped initially amid the pandemic—offering better return for brands who were prepared to take advantage of lower prices and surging traffic. New artificial intelligence solutions, like IBM Watson, also made CPC prices drop significantly for users. According to IBM, CPC prices on average drop 31%, but some clients saw CPC prices decrease by 71%.

Programmatic Expanded Into New Channels

Digital out of home, voice activated, podcasts, and audio programmatic ads are just getting started. As eCommerce exploded during the pandemic, voice activated shopping is only expected to accelerate.

In a pre-COVID survey from VoiceBot.AI, 25% of respondents said everyday household items are the most ordered through voice-assistants, followed by apparel and then entertainment and games. Amid the pandemic, daily use of voice-assistants increased.

2020 caused people to change their technology and consumption habits, and though it is still uncertain, it’s highly likely that some of these new habits will stick around in our next normal. This will shape the channels that programmatic plays a significant part in as we head into 2021.

MediaRadar Insights

Methodology

This analysis looks at the behaviors and trends of the top programmatic advertisers in 2020.

Findings

In 2020, there have been 173 thousand native programmatic advertisers spending $2.75B so far. In that same period of 2019, there were 77 thousand advertisers spending $2.3B. This significant jump in advertisers, but relatively small uptick in dollars spent suggests that ad buys are relatively small.

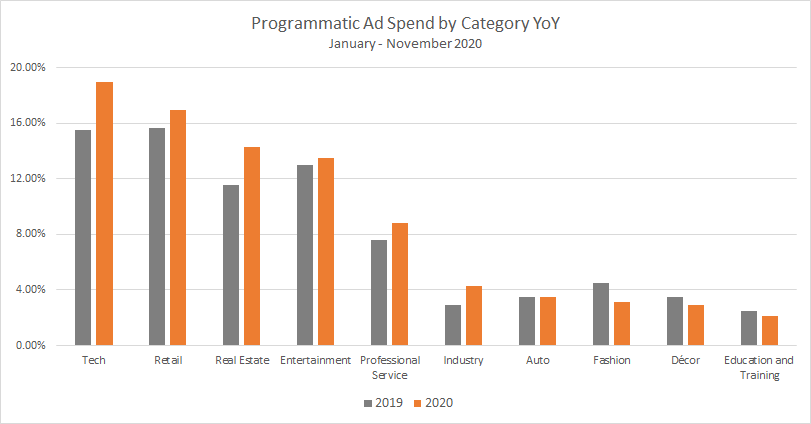

The top category in 2020 is technology, which saw a 4.5% increase, which translates to $124mm. The Real Estate category also had a strong uptick in spend, jumping up 2.5% YoY. Across other categories, spend remained consistent.

Many advertisers are exploring programmatic for the first time, but don’t make up the majority of the spend. Of the top 1000 spending programmatic brands of 2020, 236 of them didn’t buy programmatically in 2019. These brands who were new, and willing to spend more than other newcomers, spent $1.3MM collectively.

The top five brands placing native programmatic ads in 2019 were:

- Squarespace

- TD Ameritrade

- BestBuy

- Amazon

- CompareCards

Together, their ad spend made up just 3% of total ad buy.

Interestingly, Amazon lowered their programmatic ad spend by 32% in 2020, dropping out of the top ten brands. This may not be a huge surprise, considering how well they’ve done during the pandemic. Amazon may not feel the need to advertise during this time.

By looking at how the top programmatic buyers changed this year, we clearly see the impact of the pandemic. The top five brands spending in 2020 are:

- Lending Tree

- The CDC

- EditorX (a web design/editor service)

- Geico Insurance

- BestBuy

The only company to stay on this top list was BestBuy, and in 2019, we wouldn’t be thinking about the CDC as a major ad buyer.

These top five brands spent $92 million, but only accounted for 3% of total ad spend YTD, reinforcing the idea that though there were more dollars spent in programmatic ad spending in 2020, the ad buys were small.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.