The coronavirus crisis carries on, but restrictions are getting lighter.

After 100 days of a health crisis and 12 days of protests, New York City is beginning to reopen. 400,000 workers could be returning to work today.

While the economy will not snap back to normal immediately, there is hope.

If this epicenter of the crisis can get rolling again, advertisers and publishers can prepare for their next phase in transitioning to normal.

Which consumer facing ads have already upped their spend?

We encourage you to subscribe to our Blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

How are Consumers Adjusting to the New Normal?

When COVID-19 first hit, it was hard to believe that we would spend months sheltered-in-place, uncertain of when things would return to normal. It was hard to imagine what it’d mean for our productivity at work, exercise routines, social activity and shopping habits.

Now, it’s June and we’ve settled into a groove. Things are re-opening at different paces across the country and the world.

IBM polled 25,000 people across the States in April to see what consumers thought about transitioning back to ‘normal.’ For the most part, the impacts of COVID-19 on consumer behavior will be long term. In order to survive, organizations will need to quickly adapt.

How do business models need to adapt?

McKinsey research can point businesses in the right direction. For one, more than half of consumers in most countries believe their finances will be impacted for at least four months, leading most consumers to prioritize essentials.

McKinsey also points out that even though economies are opening in pockets, we will still see a “homebody” economy. People will be spending most of their money on essentials, but they also will spend money on what makes the “homebody” life a little more comfortable.

For many consumers, this means health and wellness products.

“Health is the new wealth,” according to CMO of Gelmart International Caroline Levy-Limpert. As consumers feel vulnerable and limited in the ways they can treat themselves, health and wellness products have become one of the big areas in which they are willing to spend discretionary income.

Even though many Americans want to go on a road trip this summer, most consumers are still about travel and events. Many will instead use their discretionary money to buy ‘sanity products,’ whether that’s books, apps or a new puppy.

As restrictions ease, we expect to see more advertisements for products that support a comfortable homebody lifestyle.

MediaRadar Insights

As we’ve transitioned to a new normal, what we’re interested in buying has changed.

Eyewear

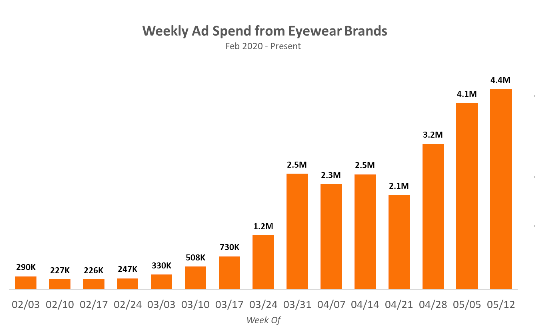

For example, ad spend by eyewear brands has seen dramatic spend that began mid-March.

Since March 8th, spend was up 208% YoY. Spring 2019 sunglass spending was about the same as what prescription glasses are at today.

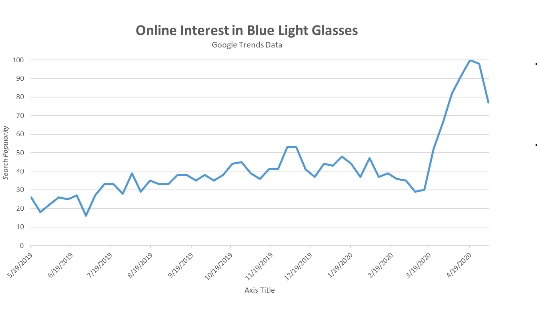

Amid increased screen-time, consumer interest in blue light glasses has seen a dramatic spike. Many of the ads promote blue light glasses or lenses.

Skincare

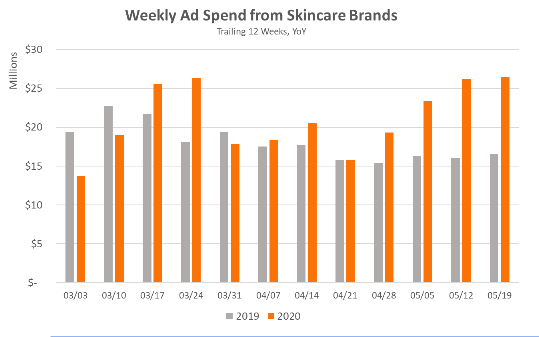

Since March 8th, skincare ad spend has been up 21% YoY.

Attention to skincare has increased as masks cause itchiness or redness. People also see themselves on Zoom in meetings and want to feel better about their appearance.

Pets

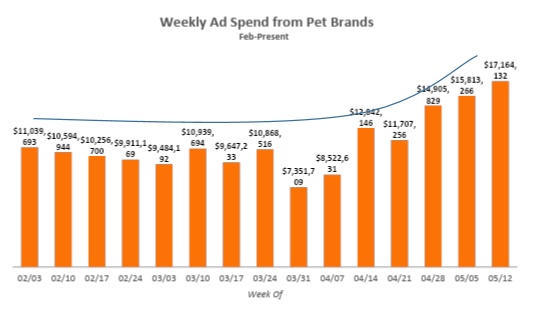

The Humane Society said that in March and April there was a 34% YoY increase in the number of pet adoptions. Pet brands, mostly made up of by food products have responded by upping their ad spend 51% YoY since March 8th.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.