Leaders in the commercial real estate market are cautiously optimistic about recovery this year.

However, the return to occupancy will not be evenly distributed across business sectors or regions. What trends are shaping this market and what does they mean for ad sales reps?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Commercial real estate is coming back to life… but slowly

The shift to remote work left an overabundance of commercial real estate (CRE) on the market. Though many companies renewed their leases on a short-term basis, others cancelled their contracts.

For business leaders seeking to expand their business, the oversupply of office or warehouse space means that now is a good time to take advantage of good prices.

The industries that are best positioned to continue leasing or to expand their footprint are eCommerce warehouses, self-storage facilities, some grocery stores and medical or retail spaces, according to Owner of Commercial Professionals Galit Ventura-Rozen.

For example, New Jersey’s industrial market is going strong.

“New Jersey’s industrial market continues to be one of the few beneficiaries of the COVID-19 pandemic,” said Colliers’ senior director of research, John Obeid. “It has accelerated the shift in consumer buying habits toward online purchases, and has incentivized industrial occupiers to increase their surplus inventory, leading to significant occupancy gains over the last year.”

When it comes to traditional office spaces, however, the rebound has been slower. Business leaders are generally unclear about the organization of the post-pandemic work and how the return to the office should be executed.

According to the national VTS Office Demand Index, demand remains 38% lower than before the start of the pandemic. The bright side is that this is much improved from the low of 85% below pre-pandemic levels in May. New York, Seattle and Washington D.C. are seeing the strongest growth rates, while Chicago and Boston are lagging.

With recovery on the horizon, we should see ad numbers picking up soon. However, we’re not there yet.

MediaRadar Insights

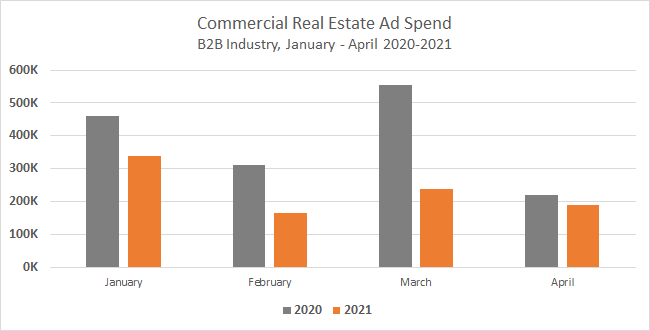

To date in 2021, 133 commercial real estate companies invested $845k into print and digital ad spend in the B2B space. Spend is down 45% from 2020, where 160 brands invested $1.5mm.

Though this industry is still actively recovering from the pandemic, projected April numbers for 2021 indicate that spend will be down 13% YoY, an improvement from March, where spend was down 57%.

Note: spending in April 2020 and April 2021 is a more telling comparison. Print spend in March 2020 was already allocated before COVID-19 was declared a pandemic.

CRE ad spending significantly dropped off in April 2020, and still has not reached the levels we saw at the beginning of the pandemic or in the early months of 2020. But the data indicates that it is inching closer to pre-pandemic levels.

Ad sales reps should be aware that CRE recovery is happening, but in pockets. Brands across different cities, like New York and Seattle, and sectors (i.e. eCommerce warehouses), will be experiencing more demand in the current climate than traditional office spaces.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.