Small businesses have cut and reallocated their advertising budgets—often funneling dollars from local channels to Google and Facebook.

“Ad spend piping into local channels will be significantly reduced for the long haul,” said Jed Williams, chief strategy officer at Local Media Association. Dollars that traditionally go to billboards, local TV and radio are now going to major digital platforms, as the return on investment is much easier to measure and justify.

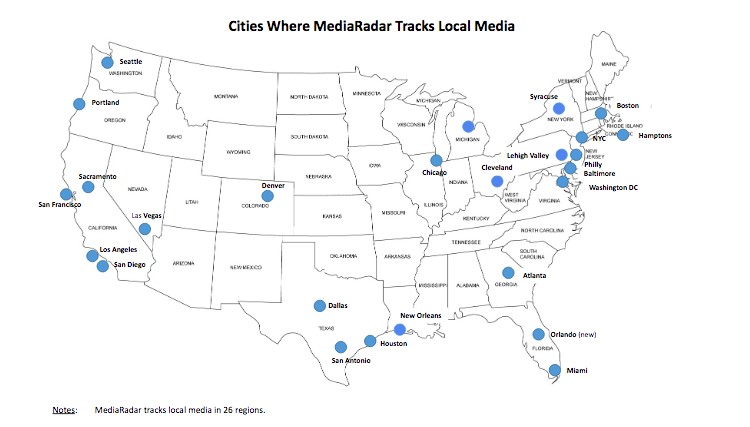

MediaRadar tracks local media in twenty-six regions across the United States. With our data, we can see how local advertisers are responding to COVID-19 across media formats and regions.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

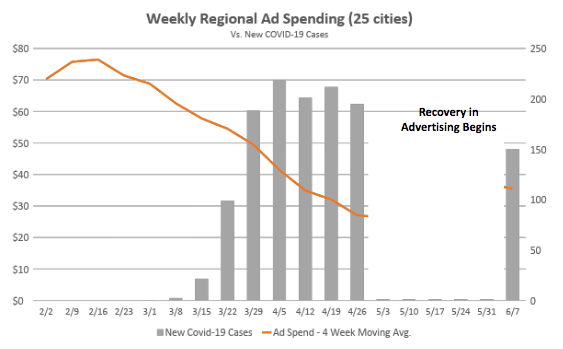

A bird’s eye view: Regional ad spend amid COVID-19

MediaRadar tracks local media in the following cities and identifies overall trends among small businesses.

Over the last few years, regional publications were already struggling against the digital revolution and a growing share of budgets were going to companies like Google and Facebook.

COVID-19 caused even deeper cuts.

Regional ad spending fell by more than 50% as COVID-19 spread across the nation.

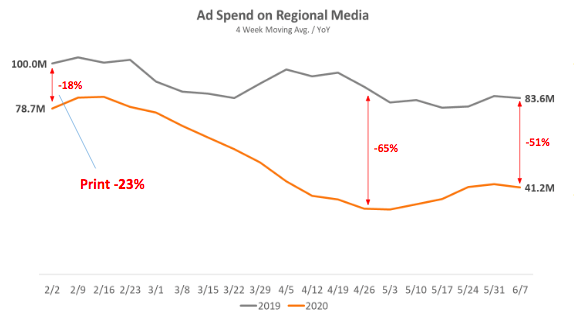

Regional ad spending was struggling at the beginning of 2020, pre-COVID. Spending in January and February was down 18% YoY. Spending is now down 51%.

The medium most impacted is print. During February, regional print was down 23%, while regional digital was down 11%.

Analyzing regional ad spend across formats

Is this the fall of regional print?

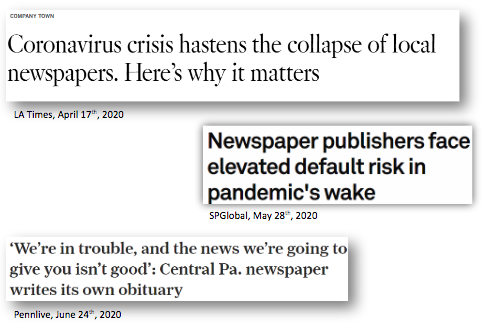

Much of regional spending is dedicated to print. In 2018, newspaper circulation reached its lowest levels since 1940. Furthermore, according to Pew Research, ad revenue for newspapers declined 62% between 2008 and 2018.

Further adding to the complications, McClatchy, the second largest newspaper group in the US, declared bankruptcy in February. In addition, the company said its Saturday print publications would be phased out from all of its thirty newspapers by the end of 2020.

There was already consolidation in the industry—and COVID-19 is putting more pressure on newspaper owners.

Spend on regional newspapers and publications was down 73% in early April.

Ad sales are improving, although slowly. In recent weeks, spend has been down by 50%.

“We’re 14 years past the peak of newspaper ad revenues,” explains Craig Forman, CEO of McClatchy, on the Digiday podcast. “Since 2006, more than $35 billion worth of ad dollars have left the newspaper business. We’re years into a digital revolution and there’s no going back.”

COVID-19 has only made trends that were already happening speed up.

Penelope Abernathy, a University of North Carolina professor who studies the news industry, says that this time period “could be an extinction-level event for newspapers.”

How has COVID-19 impacted radio’s revenue?

Radio broadcasters report that ad revenue has fallen 60-70% and don’t expect to see full recovery quickly.

“Even if the economy were restored tomorrow, it would take months to generate and invoice sponsor revenue, let alone receive it,” explains President & CEO of New Jersey Broadcasters Association Paul Rotella. People driving again will help, but it’s expected to be a slow rebound.

Sirius-XM noted that ad sales are improving as the country comes out of quarantine. The reopening of places like auto shops and barbershops are also good news for radio, as many of these businesses have their stations on constantly while at work.

On the other hand, IHeartRadio recently extended their furloughs by another 90 days. In a memo obtained by the press, they cite “restrictions lasting much longer than anticipated,” which are “having a significant impact on ad revenue”. Their stock price remains at below $10, after consistently trading in the $14-18 for the year prior to the pandemic.

Cumulus Media is in the middle of fighting off a hostile takeover effort. Recently their stock price rose as the board instituted a shareholder rights program. However, Wall Street isn’t loving the company right now. It’s being dumped by hedge fund managers, with 38% fewer hedge funds holding Cumulus stock QoQ.

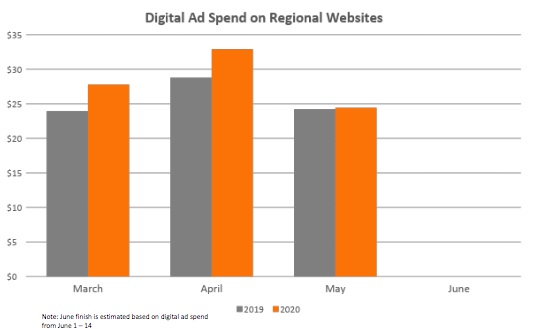

Digital shows resiliency

Digital has picked up some of the slack lost in other mediums. Since the beginning of March, digital spend is up 11% YoY.

A snapshot of regional advertisers by state

States are experiencing recovery at different paces:

New York (In Recovery):

- NY regional ad spend bottomed the last week of March with levels down 79% YoY.

- Recent figures show spending “only” down 42% YoY.

Colorado (Normal):

- Colorado ad spend bottomed the week of April 19th at -53% YoY.

- That same week was Colorado’s spike in new COVID-19 cases.

- With cases steadily going down, ad spend has returned, and even has turned positive YoY.

Massachusetts (Slow Recovery):

- Through March, average weekly ad spend for Boston regional publications was $3.2M

- In April and May, average weekly ad spend was $760 thousand.

Florida (Regression):

- Florida was on the way to recovery as new cases fell throughout May.

- With cases rising in early June, ad spend fell WoW for the first time in 5 weeks.

If your region is not mentioned above, feel free to contact us for more information. We also have information on regional spending broken down by industry. As the cases continue to rise and fall in different regions of the country, we’ll continue paying attention to advertisers’ responses.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.