Amid the uncertainty in 2020, programmatic advertising via YouTube saw its share of ups and downs. In response, YouTube made changes to their monetization of videos.

How is programmatic faring with the adjustments?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

YouTube Makes Changes To Mid-Roll Ads

YouTube’s ad revenue slowed down in Q2. Shortly after, the platform adjusted its advertising model.

Ad revenue decreased in Q2 compared to Q1, but bounced back gradually

YouTube’s overall advertising revenue decreased to $3.8 billion in the second quarter of this year, compared to Q1, when it brought in just over $4 billion in ad revenue. However, total revenue was up YoY from $3.6 billion in Q2 of 2019.

Despite the slump in Q2, YouTube is on track to surpass all previous years’ revenues in 2020.

CFO Ruth Porat points to “ongoing substantial growth in direct response” ads as the primary driver behind YouTube’s year-over-year improvement.

However, Porat warns that “it’s premature to say that we are out of the woods, given the nature of the macro environment.” Revenue is increasing, but leaders are aware that this year is still full of uncertainty and are trying to not set expectations too high.

Changes in monetization took effect in July

In July, YouTube announced a change that increased revenue opportunities for creators and the platform.

Previously, creators could enable mid-roll ads for videos longer than ten minutes. These mid-roll ads bring in more money than skippable ads presented at the beginning of videos.

In July, YouTube shortened this requirement to eight minutes. Reducing the time length will make it easier for creators to make enjoyable content and probably have little impact on the viewer’s experience.

This change was likely in response to the wonky supply and demand issues caused by the pandemic—where there were more viewers than ever, but less brands willing to advertise. In the first half of the year, YouTube advertising rates dropped by nearly 50%.

This new model is likely designed to make up for some of its losses and boost revenue moving forward.

MediaRadar Insights

Methodology

To arrive at the findings below, we looked at programmatic ad spend on the 177 YouTube channels that MediaRadar tracks, analyzing spend and volume compared to 2019.

Findings

The year started off strong for programmatic, constituting 51% of total ad spend on YouTube in January and 48% in February. In March, when COVID‐19 was declared a national emergency, that spending dropped to just 10%.

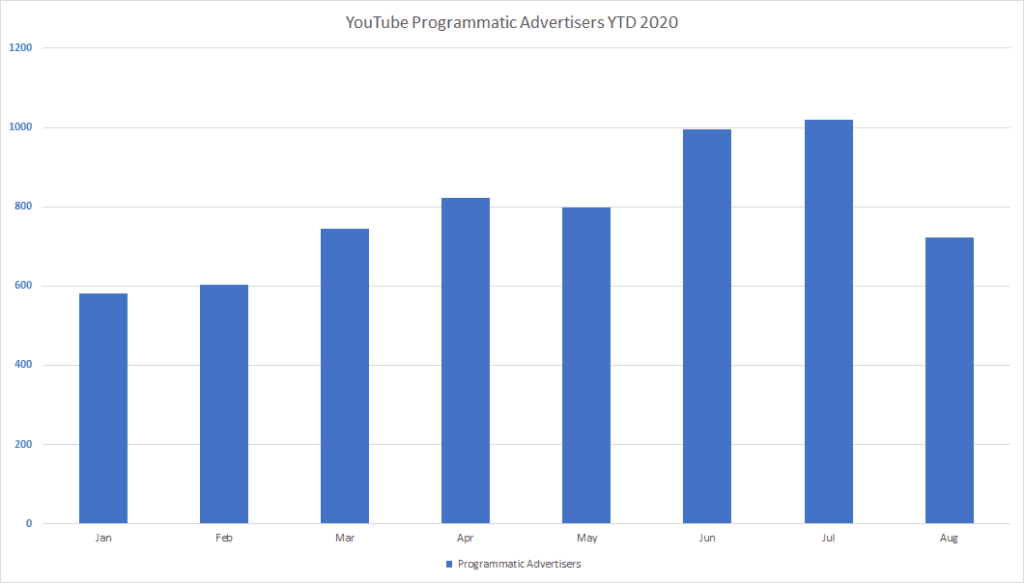

While spending plummeted, the number of programmatic advertisers increased. This suggests that brands invested in shorter and more “skippable” ads at this time. The largest spike in programmatic advertisers occurred in June, but then started to return to normal levels by August.

Programmatic advertisers made up 30% of all advertisers on the channels we track and were responsible for $28.2 million, or 25% of the total ad spend.

For the rest of the summer, trends recovered to normal levels and programmatic spend is continuing its upward trend.

In the months to come, the results of YouTube’s ad requirement changes will become more evident and we’ll share any noteworthy trends that appear in the data.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.