Media companies went ‘all-in’ on streaming in 2020—but 2021 is the year of the streaming ‘rebrand’.

Hulu got a new look and sound. CBS All Access became Paramount+. HBO Max launched its ad-supported tier yesterday.

Companies are distinguishing themselves by bringing back their original content, releasing new hits and by making streaming simpler or more affordable.

The hope is that by making the complicated world of streaming more enjoyable, companies will attract more viewers and ultimately more ad dollars. And as they do this, they spend ad dollars themselves—mostly programmatically.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Streaming services use new strategies to gain subscribers

It wasn’t long ago when viewers just had a few options to choose from if they wanted to stream video online. The go-to platforms were Hulu and Netflix.

Now consumers have over 200 options, with at least 15 of those you could consider ‘major’ services in the U.S.

As the playing field got more crowded, streaming services needed to distinguish themselves through their content and user experience.

During the pandemic, newly launched streaming services capitalized on people staying at home all day. Disney+ exceeded expectations and gained 100 million subscribers in 16 months. In comparison, it took Netflix 10 years to hit this milestone.

“The enormous success of Disney Plus, which has surpassed 100 million subscribers, has inspired us to be even more ambitious, and to significantly increase our investment in the development of high-quality content,” said Disney’s CEO, Bob Chapek. The service plans on launching more than 100 titles each year.

Some of these titles will include feature films simultaneously launching in theaters, like the recent Cruella.

With so much emphasis on releasing premium shows and movies, the struggle for consumers is not the lack of high-quality content—it’s too much, everywhere. And the tab on consumer subscriptions is adding up quickly.

That’s why more companies are rearranging their payment and advertising models to make content more affordable. HBO Max is the most recent to launch an ad-supported plan at $10 a month, adding that it’s the lowest “ad load in streaming.”

Each streaming service has its own branding strategy—niche content, kids programming, sports, live TV, ad-supported tiers and so on—but no matter the approach, each service needs to build awareness via advertising.

To stay top of mind with consumers, many are turning to programmatic advertising.

MediaRadar Insights

92% of all streaming buyers are buying programmatic ads in 2021. Their advertisements promote their service or their programming.

Streaming services total investment between January and April 2021 reached over $301 million. The large majority of this (86%) was placed programmatically.

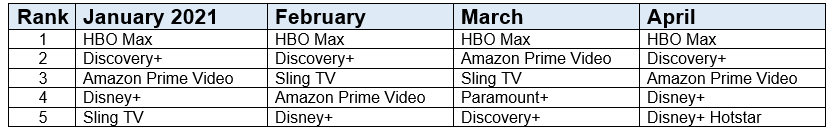

Top programmatic streaming spenders this year through April:

- HBO Max

- Discovery+

- Amazon Prime Video

- Disney+

- SlingTV

Together, the top five represent over 159 million in programmatic investment—62% of programmatic investment from streaming companies.

Even though there were several new streaming service launches last year, advertising is up this year as the competition is tight.

Programmatic streaming is up over 120% every month January – April compared to last year. By month spending is up YoY as follows:

- January – 174%

- February – 128%

- March – 138%

- April – 124%

HBO Max is consistently the top programmatic spender each month. The other companies that remain in the top five from month to month are Discovery+ and Amazon Prime Video.

*Updated June 2021

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.