Week of January 9, 2023

This week MediaRadar reviewed ad buys from the week of December 26, 2022 and compared them to ads that ran the week of December 19, 2022. The last week of the year is when everyone has a little fun before their 2023 resolutions begin in January.

While we highlighted four categories in this article, you can see the shifts in ad spend among all categories here. We look at Quarter-Over-Quarter (QoQ), Month-Over-Month (MoM) and Week-Over-Week (WoW).

Here is a full list of advertising changes by category. (Don’t worry, it’s ungated)

Here are some key weekly takeaways from advertising shifts that took place.

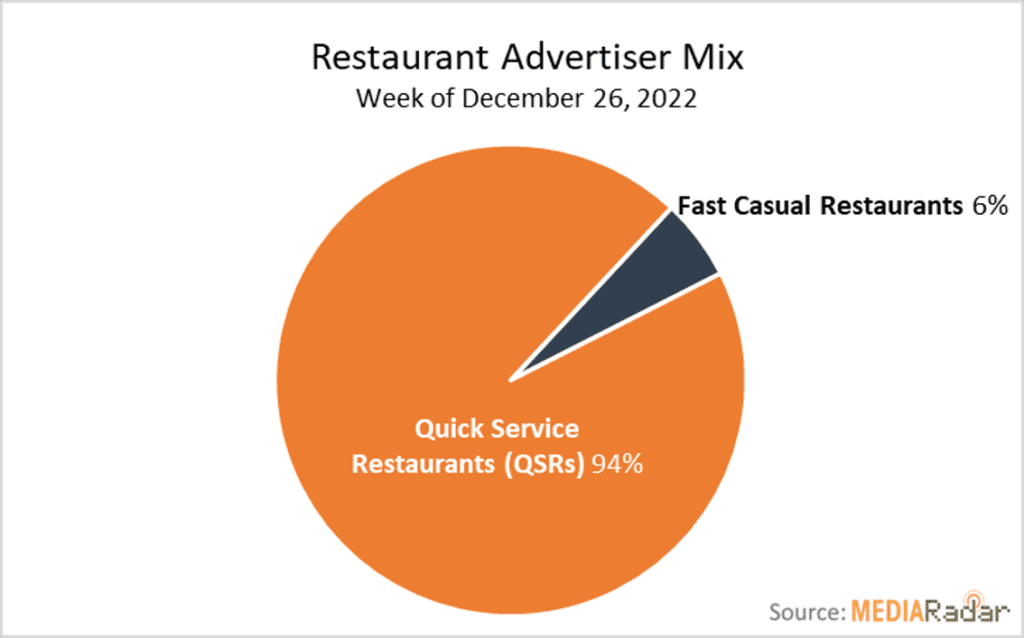

As consumers do their post-holiday returns, MediaRadar saw Restaurant advertising spike nearly 400% WoW. This was driven by an increase in advertising investment of over 1000% from Quick Service Restaurants (QSRs). Fast Casual Restaurants also advertising this week, but investment was 25% lower than the prior week.

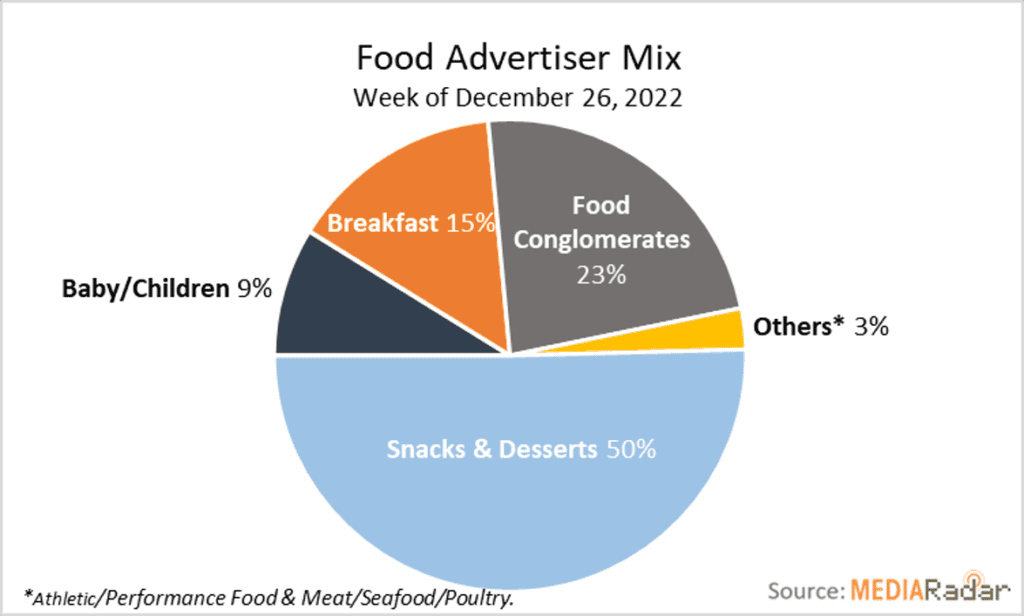

We observed a 50% WoW decrease in Food advertisers. This decrease was observed across the category. Snacks & Desserts, which represented the largest segment of advertisers in this category, was down over 50% WoW. As the hearty holiday meals are now over, Meat/Seafood/Poultry advertisers decreased ad investment nearly 100% WoW.

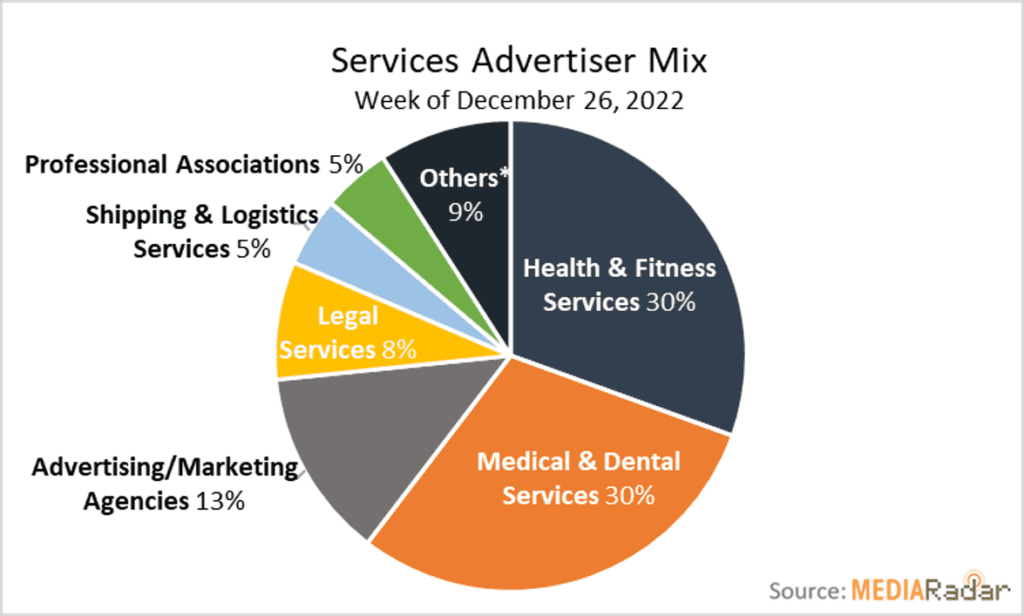

This week, we saw an over 50% uptick in ad sales from key Service Categories. Health & Fitness Services, such as gyms, fitness classes, and weight loss services, increased ad spend by over 400% WoW. These advertisers want to make sure they are top-of-mind as people set goals surrounding a healthier lifestyle for 2023. Separately, Medical & Dental Services also increased their advertising by over 5% this week.

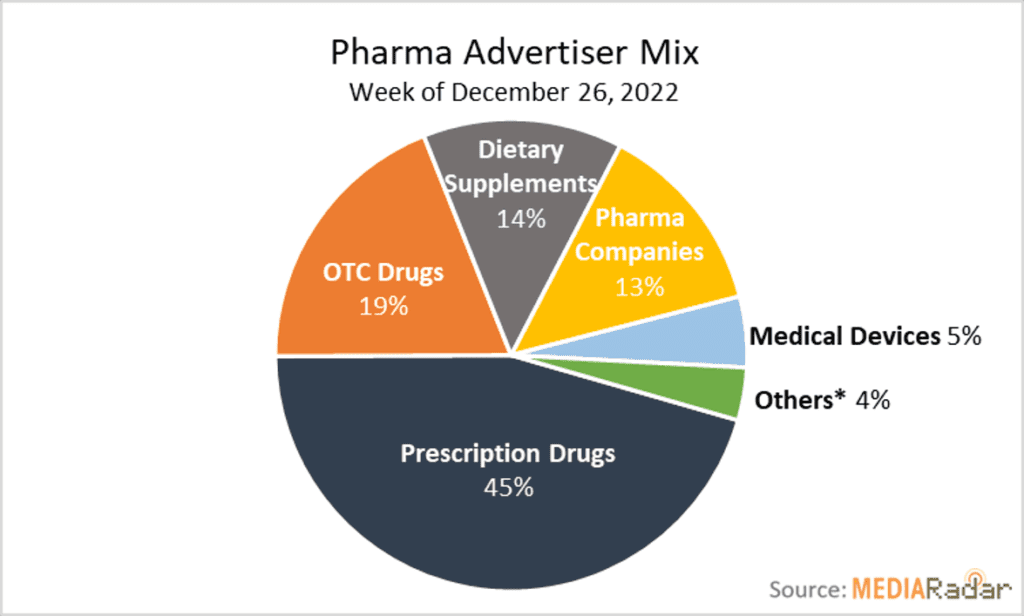

Pharmaceutical advertising decreased ad spend for the 4 consecutive weeks. We saw a 25% WoW decrease during the last week of the year from these advertisers. Among the largest Pharma companies, we saw a decrease of 75% WoW. We did see Prescription Drugs like GSK’s Nucala increase their advertising over 100% WoW and Amgen’s Evenity was up 200+% WoW.

For a full breakdown of which product categories are buying ads now, click here. The list is updated each week – you can subscribe to receive it in your inbox.