Week of February 20, 2023

This week, MediaRadar reviewed advertising from the week of February 6, 2023, and compared it to ads that ran the week of January 30, 2023. On March 1, 2023, MediaRadar will share a monthly advertising index.

This article discusses four categories, but we also share weekly, monthly, and quarterly ad shifts in investment among all segments here. (Don’t worry, it’s ungated)

Here are some key weekly takeaways from advertising shifts that took place.

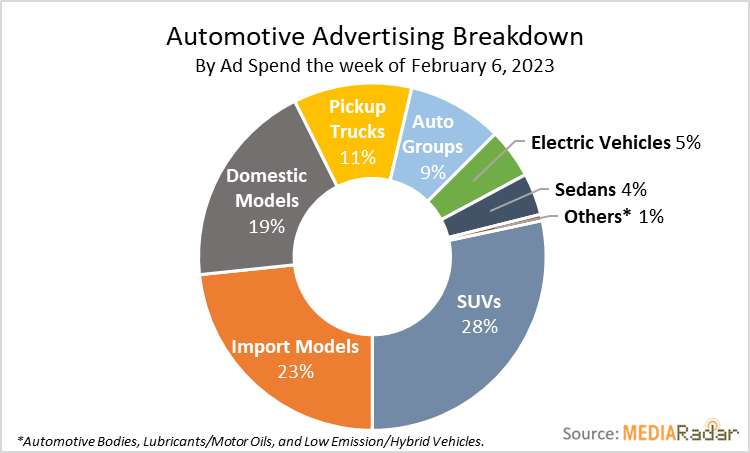

Automotive advertisers increased over 140% WoW to $175mm+ invested. This occurs after three consecutive weeks of ad spend declining. Automotive models were 91% of the total spend and spiked over 125% WoW. SUVs alone increased over 125% WoW to $50mm+ in ad spend. Automotive groups such as General Motors, Nissan Automotive Group, Volvo, etc.) invested $15mm+ the week of February th. That’s over 1000% WoW increase.

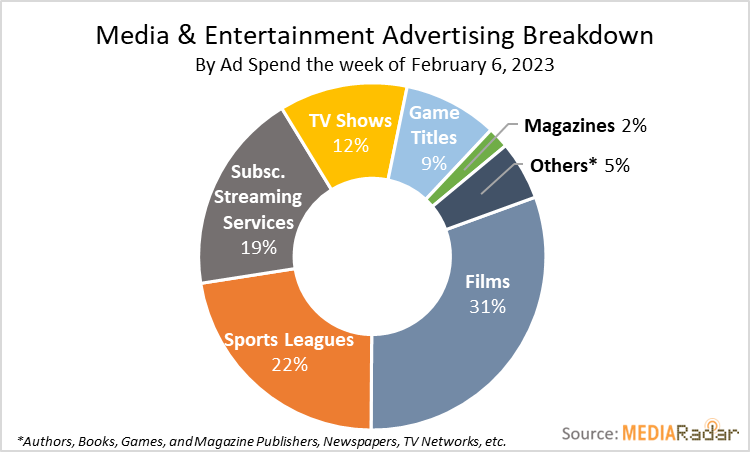

Media & Entertainment advertising increased over 50% WoW. This week MediaRadar observed over $100mm was invested to advertise movies. Ant-Man and the Wasp, Magic Mike’s Last Dance and The Flash were top ad spenders in this category. Sports leagues, like DraftKings, FanDuel and PrizePicks, increased ad investment 625% WoW to nearly $80mm in preparation for Super Bowl LVII. In addition, subscription streaming services invested over $65mm this week which was a 125% WoW increase.

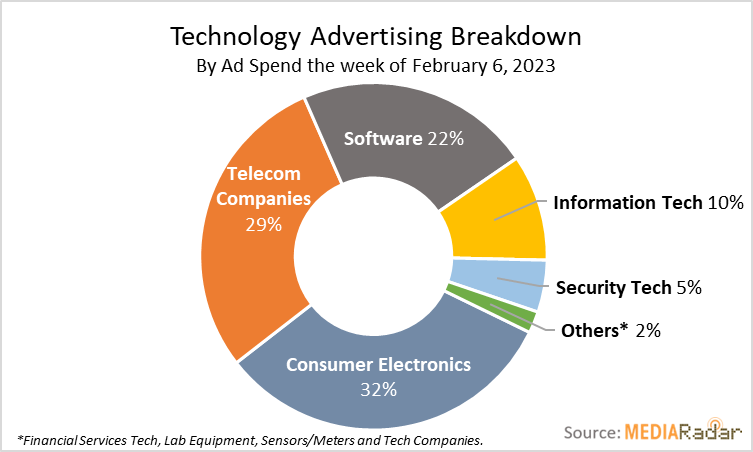

Technology advertisers increase investment over 25% WoW to $250mm. Consumer electronics advertising increased nearly 50% WoW to a little over $80mm+ in ad spend for the week. Biggest drivers within the consumer electronics category are cell phones and computers – both were up over 100% WoW. Telecommunication companies, like AT&T, T-Mobile, and Verizon, invested nearly $75mm this week which represents a 50%+ WoW increase in advertising. Software increased 25% WoW and security technology, which includes home security systems, increased advertising investment 100% WoW.

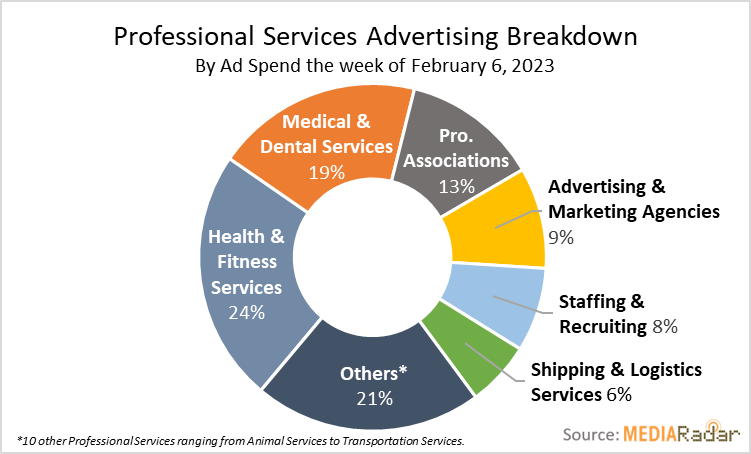

Advertisers within key Services categories saw a 25% WoW decrease. Health & fitness Services, like gyms and weight loss programs, were down over 30% WoW reducing ad spend to less than $15mm this week. Medical & Dental Services also reduced ad spend by nearly 40% WoW to less than $11.5mm. Separately, professional associations’ ad investment declined 45%+ WoW. Some top contributions to the decrease included medical & nursing associations, racing associations, and senior associations.

For a full breakdown of which product categories are buying ads now, click here. The list is updated weekly – you can subscribe to receive it in your inbox.