The rapid ascent of digital advertising has made us immune to what should be head-turning statistics. This stat, however, still makes us do a double take: Between 2011 and 2024, healthcare and pharma digital ad spending is expected to increase by ~1,900%.

That increase paints a vivid picture: Healthcare advertisers are finally embracing digital channels after years of shunning them for traditional ones.

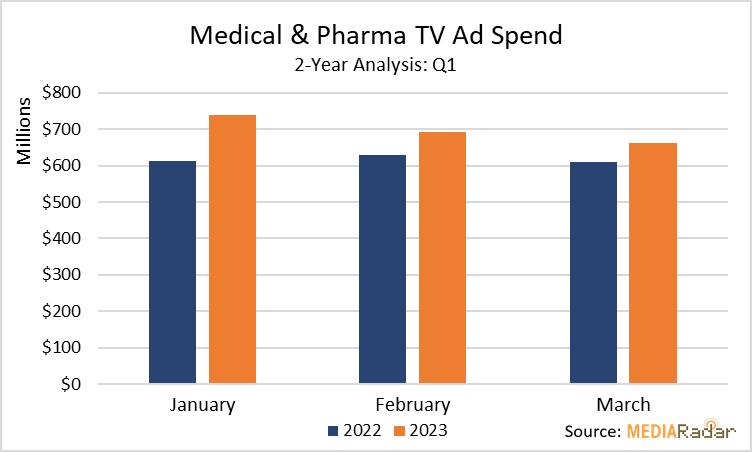

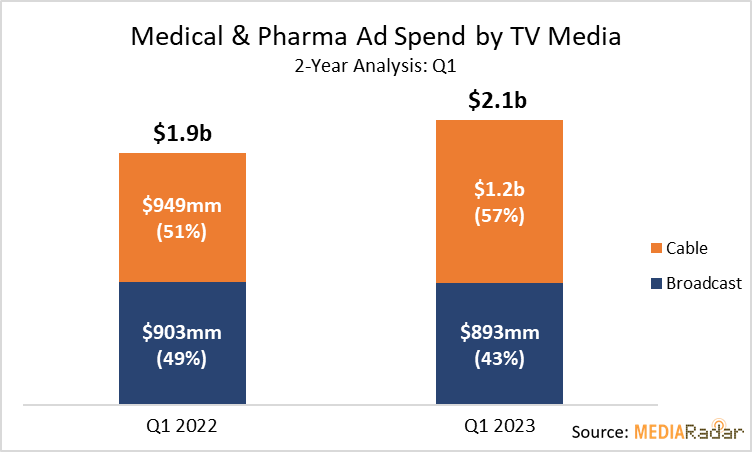

But medical and pharma advertisers still aren’t saying goodbye entirely to their long-time pals in the traditional advertising world. In Q1 2023, almost 190 medical & pharmaceutical companies spent more than $2b on broadcast and cable TV, up by 13% from Q1 2022.

Industry Titans Drive Ad Spending in Q1

The healthcare and pharma industries have always been dominated by a handful of titans, with companies such as Pfizer, AbbVie, and GlaxoSmithKline (GSK) among the most prominent. Unsurprisingly, these titans also have their hands deep into the cookie jar that is broadcast and cable TV advertising.

In Q1, AbbVie (up by 42%), GSK (up by ~80%), and Pfizer (up by 66%) all increased their investment in broadcast and cable TV, collectively spending more than $588mm. Overall, they accounted for 28% of the broadcast and cable TV investment from medical & pharmaceutical advertisers in the first quarter.

While spending was steady throughout the quarter—each month saw investments between $663mm and $738mm—January saw the biggest increase when ~170 advertisers collectively increased spending by 21% YoY to $738mm.

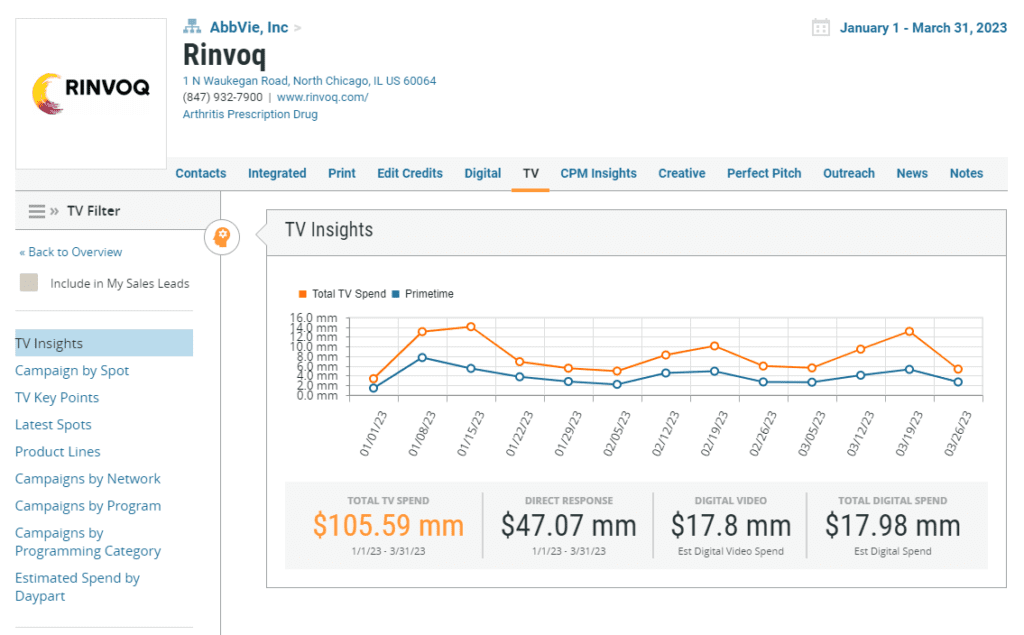

Much of that increase came from advertisers promoting dietary supplements and HIV/AIDs prescriptions but also from those at AbbVie who boosted their budget by more than 1,000% to promote their arthritis medication, Rinvoq.

The increase to promote Rinvoq comes as the company loses patent protection of their best-selling drug Humira, and at least eight biosimilars (nearly identical versions of the drug) hit the market in 2023, including Amjevita (Amgen), Cyltezo (Boehringer Ingelheim), and Hyrimoz (Sandoz).

Given the company’s historical reliance on Humira—AbbVie generated 37% of its revenue in 2021 from global sales of Humira—advertisers will dig deep this year to make up for the level playing field. That’ll mean more dollars to promote Rinvoq but also increased investments to drive sales of medications for other treatments, including psoriasis (Skyrizi), schizophrenia (Vraylar), and dry eye (Restasis).

Broadcast TV Advertising Falls As Viewership Declines

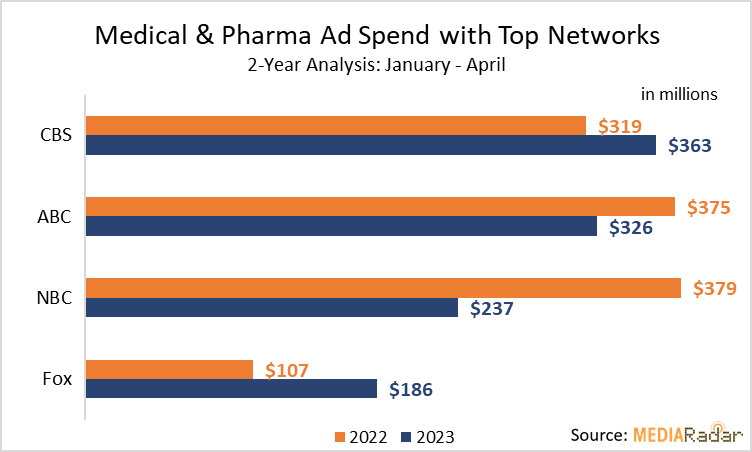

Not long ago, the trio of three-letter broadcast networks—ABC, NBC, and CBS—had a complete stranglehold on ad budgets.

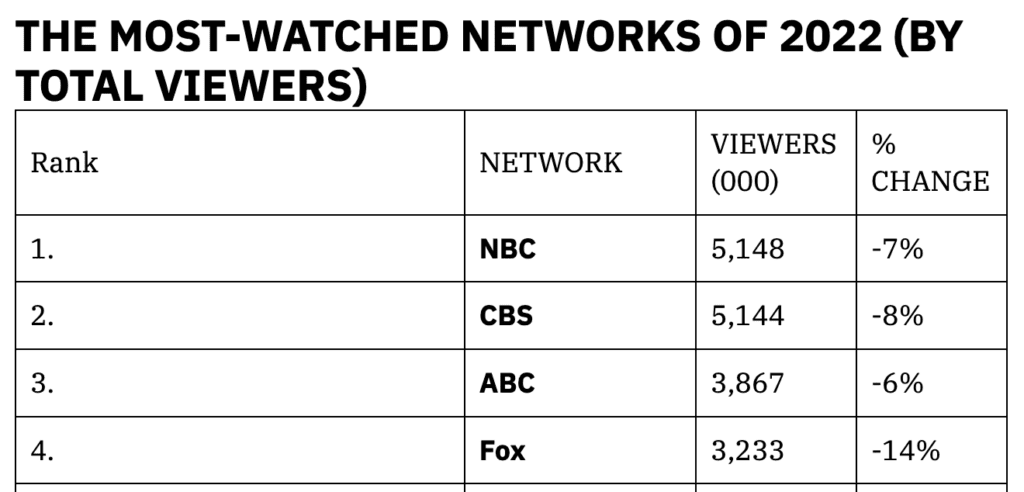

Declining viewership in broadcast TV, however, is loosening their grip. In Q1, medical & pharma advertisers decreased spending on broadcast TV by 1% following a year in which all major networks saw a drop in viewers by at least 6%.

That said, two networks—CBS and Fox—did see spending rise. For CBS, the increase comes following its 15th consecutive year as the most-watched network. Through May 14, CBS was averaging almost 6mm primetime viewers a night. And as of April 30, the network generated about 827b viewing minutes across its network, Paramount+, Pluto TV, and the CBS app, up by 2.2% from last year and 330b more viewing minutes than its closest broadcast competitor.

Overall, spending from medical & pharma on CBS increased by 23%, with top drivers coming from advertisers promoting psoriasis prescriptions. Advertisers for Pfizer and Sanofi also increased their investment, with the latter doing so by 90% YoY to promote Dupixent (asthma).

At the same time, advertisers, including those at AbbVie, Bristol-Myers Squibb Company, and Pfizer increased their investment in Fox by 120% YoY, but we can attribute much of that to the Super Bowl.

As spending on broadcast TV fell, spending on cable TV jumped by 27% to over $1.2b, thanks to big investments from companies like Merck & Co., Inc. (Gardasil, Keytruda, etc.), which increased its investment by over 100%. United We Stand also increased its investment by 53% YoY to promote Balance of Nature (dietary supplement).

Other companies that increased their investment in cable TV advertising include Merck & Co., GSK, and Johnson & Johnson.

Broadcast Networks Pivot into the Streaming Wars

A drop in ad revenue is never a good thing, and the broadcast networks are undoubtedly looking for ways to woo advertisers back. It would be far worse, however, if they were just sitting idly by as revenue declined.

They’re not.

Each of these major networks has a hand in the streaming wars, which have serious advertising implications.

Consider Peacock.

The NBC-owned streaming service has more than 22mm paid subscribers as of Q1 2023, up from 13mm in Q1 2022.

That growth has spurred advertising innovation. Last year at NewFronts, Peacock launched two new ad formats “to make marketers the star of the show with in-scene ads.”

At NewFronts this year, NBC announced something even grander: Integrating Peacock into its greater entertainment ecosystem.

According to Jenny Burke, EVP, of Advertising Strategy at NBCUniversal, “We are bringing the power of One Platform, which is the entire content and technology platform of NBC Universal, and supercharging those efforts cross-platform and then within Peacock.”

A big part of this innovation is Spotlight+, a full-brand takeover designed to reach viewers wherever they’re watching, whether that’s on Peacock or on primetime TV. According to Collette Winn, VP of Strategy and Operations for Creative Partnerships at NBCUniversal, Spotlight+ gives brands “total ownership of the day.”

The broadcast titan previously announced Must ShopTV to let consumers shop for products appearing in the content as they evolve their strategy to appeal to retailers and DTC brands.

Advertising innovation isn’t siloed to NBC, either. Hulu, which is owned by The Walt Disney Company (owned by ABC), drove more than $3b in ad revenue in 2022.

So, while it’s clear broadcast networks are losing ground to their counterparts in cable, they’re making up for it elsewhere, and advertisers will continue to take notice.

For more insights, sign up for MediaRadar’s blog here.