Despite the postponement of the Summer Olympics, NBCUniversal will release Peacock as scheduled on July 15th.

As the latest company to enter the streaming market, Peacock has taken a unique approach by offering three subscription tiers, including a free ad-supported option for consumers. Peacock will feature many adored TV shows—and is spending aggressively on advertising to make sure consumers know about its release.

Here, we share what you need to know about Peacock’s strategy prior to launch.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Its AVOD approach may pull viewers from other services

Slow to enter the streaming wars, the service has a different go-to-market strategy than other companies. In addition to a subscription service, it will offer free ad-supported video on demand (AVOD) services.

“This is the only strategy that NBCU can really have,” senior media analyst at Needham & Co Laura Martin said. “To launch as the tenth subscription service was not as good an idea as trying something different.” Consumers will get to access more than 7,500 hours of content, with ads limited to five minutes per hour.

There are two paid tiers that consumers can choose from:

- Peacock premium: Users pay $4.99/month to access 15,000 hours of content. Viewers will still see five minutes of advertisements per hour of TV.

- Peacock premium without ads: For $9.99/month, users access 15,000 hours of content without ads.

Commercials will not be constantly repeated like on linear TV. Peacock offers “frequency capping”—technology that prevents a single brand from dominating the ad spots.

Consumers may gladly welcome this AVOD option when they are already paying for a number of streaming services. Five minutes of ads in exchange for free, high-quality content will be worth it for many families, especially in times where money is tight.

Peacock offers relished content, but is trailing behind in consumer awareness

NBC may be slow to enter the streaming market, but it doesn’t mean it’s entering without ammo.

NBC has a history of creating “premium” content that fans devour. Peacock will have rights to “Parks and Recreation,” “The Office” (coming off of Netflix in 2021), “30 Rock” “Law & Order: SVU,” “Downton Abbey,” “Friday Night Lights” and “House.”

Universal’s movie franchises will also be available, including “Jurassic Park”, “Shrek”, “The Bourne Trilogy”, “Fast & Furious” and more.

Top kids content includes: “Where’s Waldo?,” “Cleopatra in Space,” “Curious George.”

Sports fans will also be drawn to Peacock—it will start showing live soccer next month.

Despite its high-quality content, a survey by YouGov found that Peacock trailed behind other streaming competitors in interest level among consumers (only 6% or respondents would be “interested in watching a new show on the platform).

Even though NBC’s classic shows are drawing audience’s interest, Peacock has catching up to do. How does it plan to compete with Netflix, Disney+, Amazon Prime, Hulu and others?

A peak at its advertising efforts gives us some insight.

MediaRadar Insights

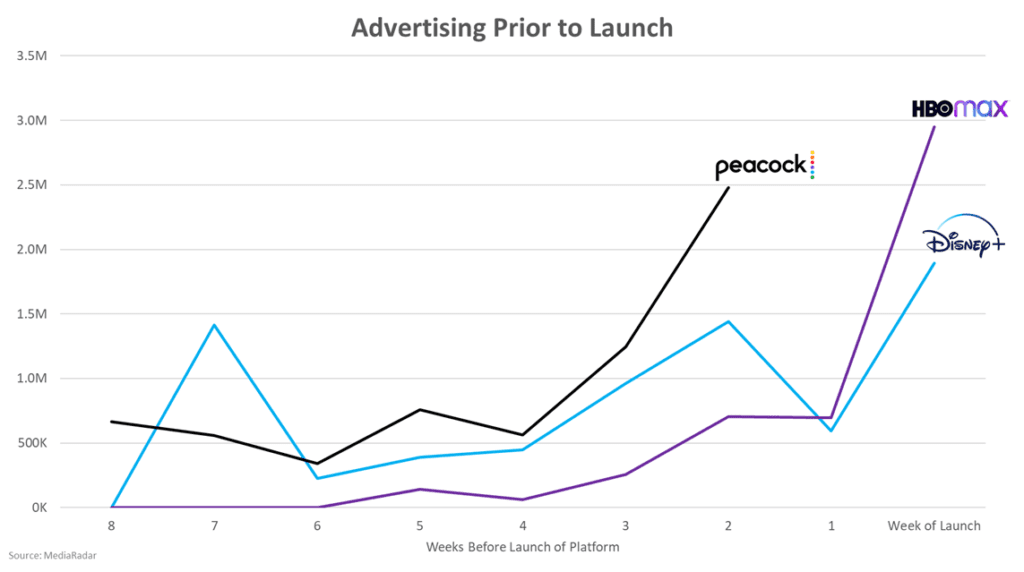

Compared to the recent launches of Disney+ and HBOMax, Peacock had a strategy that mirrored Disney+ — gradually building interest in the weeks leading up to launch. However, the real difference emerged in the most recent data when Peacock began making a large push.

Two weeks prior to release, Peacock’s advertising was up 71% compared to where Disney+’s spend was at the same time.

One potential reason for Peacock’s earlier push could be that the company has already opened up the platform for Xfinity customers, allowing them to start getting viewers before the national launch date.

Another potential reason for this push is that Peacock is fighting an uphill battle on brand awareness, as shown in the YouGov survey mentioned above.

HBO Max, as we can see, went with a different strategy, running most of its advertising just prior to the product launch.

It is worth noting that Disney+ also marketed aggressively for weeks after the launch of the platform to continue encouraging subscribers to sign up. For example, more advertising was done for Disney+ in the four weeks after launch than in the four weeks prior to it.

Peacock is entering a crowded market, not just in terms of streaming services available, but also in the marketing fight among those streaming services. In June alone, over $45M was spent on advertising by streaming services, and Peacock was the third largest spender, behind Amazon Prime and Disney (Disney+ & Hulu), but ahead of AppleTV+ and Netflix.

Even though consumers are watching more content amid the pandemic, there is a cap on how many services they are willing to pay for. Peacock can use this to market itself as a more accessible option for viewers.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.