September is underway, which means Q4 is quickly approaching. In the B2B advertising market, Q4 is typically the second most active quarter of the year, just behind Q2.

But this year is no ordinary year. Here, we share B2B advertising insights that offer context for the spending levels and trends we may see as we enter the final quarter of 2020.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

B2B digital advertising grew amid the pandemic

Without events, B2B marketers reallocated their event dollars to digital channels, including advertising.

According to eMarketer, B2B companies in the U.S. will spend 22.6% more on digital ads this year than in 2019—spending a total of $8.14 billion. In recent years, B2B digital ad spending grew faster than other forms of US digital advertising—but growth began to slow. The pandemic, however, caused it to reaccelerate.

This surge in digital advertising is significant considering that more than half of US B2B companies made cuts to their overall advertising budgets—but it’s not surprising. People are online more and B2B print is facing a crisis, making it a less viable alternative for advertisers.

B2B advertisements are used to promote webinars, virtual events and the many new content assets created by B2B brands.

Towards the beginning of the pandemic, marketers planned to reallocate dollars to virtual events and content. “Marketing budget dollars originally slated for events are being shifted to content marketing and social media,” said Tom Pick, founder and chief digital marketing consultant at Webbiquity LLC.

These dollars and content creation efforts paid off. Recent research from Pathfactory found that B2B digital content asset views increased by 40% during the pandemic. Executive summary engagement alone increased by nearly 260% and landing pages increased by 140%.

While a portion of this content is found organically, the internet is saturated with reports, blogs and other content. To make this content stand out and get in front of their ideal audiences, many B2B brands promoted their new assets using advertisements.

MediaRadar Insights

B2B brands quickly pivoted their strategies this year—but how will they finish it out? As mentioned above, Q4 is an active time of the year for B2B advertisers. Last year in Q4 over seventy thousand advertisers bought B2B ad space.

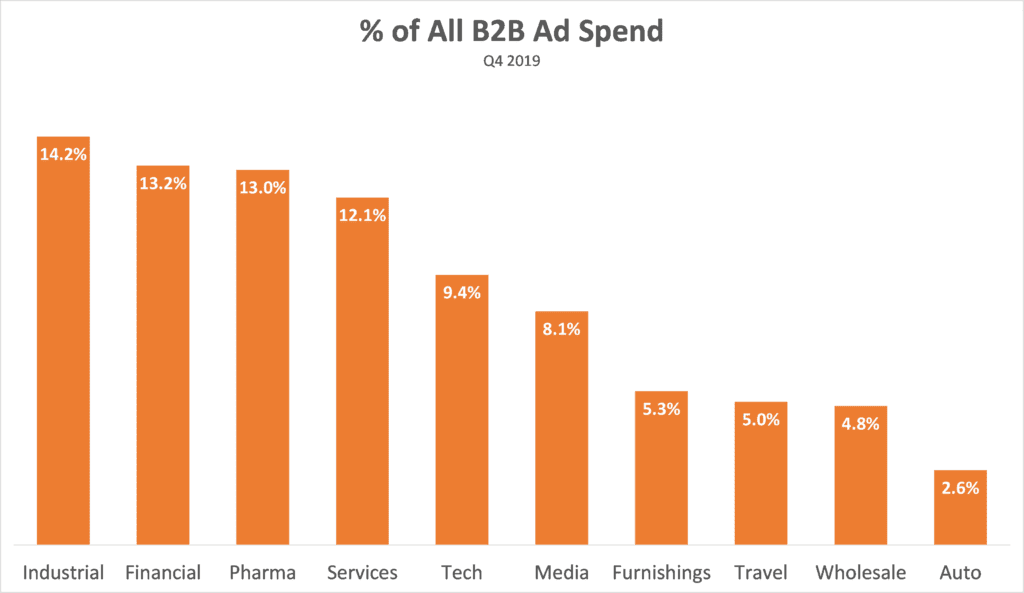

We can see who the biggest spenders are broken down by category below:

The top three categories that bought B2B advertisements in Q4 are Industrial, Financial, and Pharma. Collectively they accounted for just over 40% of all B2B ad spending.

While industrial supply chains experienced disruption at the height of the pandemic, they were performing ‘better than expected’ by July. Some analysts are now predicting that manufacturing will even come out stronger post-COVID.

However, to reach a stronger position, the industry will go through many changes—like increased automation and potentially moving parts of their supply chains back to the U.S. It is unclear how this will impact their advertising at the end of this year.

Financial services and pharmaceuticals are experiencing a strong year. They both increased their digital advertising dollars significantly between January and July. It is unlikely that this would change in Q4.

Of all the industries, travel is struggling the most. American Airlines recently announced it would layoff 19,000 employees starting October 1st. Due to these challenges, we don’t expect travel advertisements to return to their 2019 levels, which in Q4 of 2019 made up 5% of all B2B ad spending.

While industrial, financial, and pharma may continue to dominate the share of B2B advertisements, other smaller players like furnishings and wholesale may make up a larger portion without travel’s typical presence. As spending unfolds, we’ll share our findings here.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.