Luxury brands are rumored to have a grudging relationship with online advertising, fearing brand damage.

Online advertising can feel cheap: digital ads appear to reach everybody, rather than the select few.

Despite valid hesitations, luxury brands have had to adapt to changing customer demands and patterns. There is too much to lose if brands don’t adapt with online shopping behavior.

The challenge is that luxury customers want to feel like their shopping habits are exclusive, even when they are buying from otherwise mainstream channels.

Luxury brands have skirted around this problem by using programmatic advertising.

Programmatic advertising allows luxury brands to get ads in front of the right people based on behavioral and contextual factors.

Luxury brands forced to modify their methods

Luxury brands are facing steep online competition from resellers and wholesale stores.

Online marketplaces that sell luxury goods, like Net-a-Porter, The RealReal, Farfetch and StockX all have driven luxury brands to be more creative and adaptive with digital marketing strategies.

While luxury brands have embraced new digital strategies involving keyword search, social and email, marketing to luxury customers is still evolving.

Programmatic advertisements can help ease the tension between advertising to a very niche audience, through overtly public channels.

Programmatic advertisements allow marketers to place targeted ads based on contextual and behavioral information.

Contextual information allows marketers to place relevant ads on the websites that elite shoppers spend their time.

But programmatic advertising based on behavioral methods might be more effective. This type of advertising allows marketers to deliver ads based on income and wealth-related data for consumers with exclusive taste.

“A luxury airline can not only target high-net-worth individuals over a certain threshold, but also use programmatic to reach high-income users who have recently researched travel destinations included in the airline’s travel destinations,” says adtech executive Joanne Joynson-Hewlett. The same goes for targeting affluent people who are searching for new furniture, yachts or even high-end real estate.

A blend of these two tactics is important for advertisers who are seeking to reach a group of shoppers that quickly distinguishes exceptional quality from the mainstream.

MediaRadar Insights: Programmatic advertising in luxury markets rising

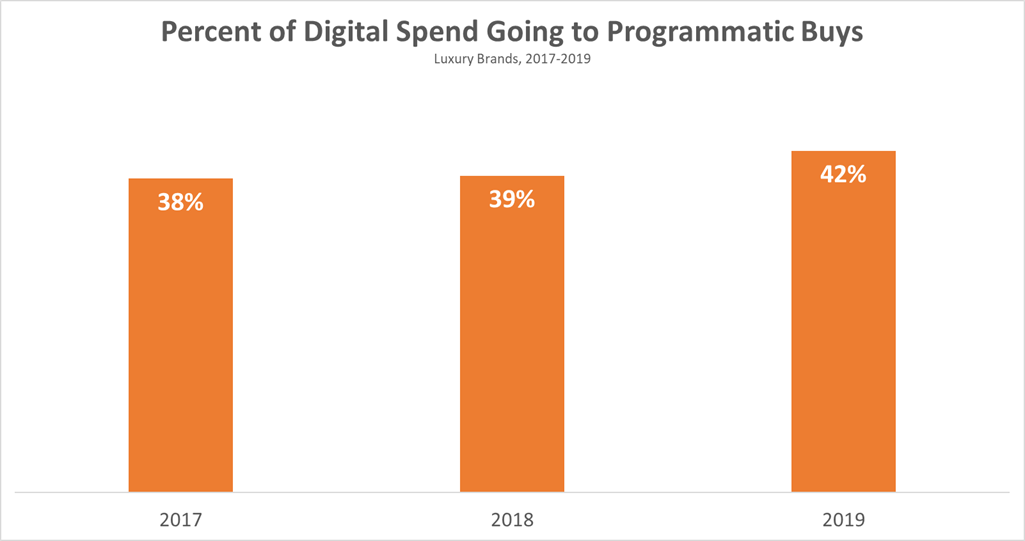

Facing a demand to capture elite online shoppers, luxury brands have increasingly spent money on programmatic advertising.

In 2017, 38% of luxury digital ad spend was going through programmatic channels. In 2019, luxury brand programmatic spending increased to 42% of online ad spend.

That is almost half of online advertisements from elite brands.

Top programmatic luxury advertisers in 2019 were:

- BMW

- Lexus

- Mercedes

- Swatch

- Kering (Gucci, Saint Laurent, etc.)

Car brands were the top advertisers to take advantage of this tactic. This is interesting because auto ad spending has been down by other accounts.

While car makers came in on top, what categories followed behind them in programmatic ad spend?

Top luxury categories advertising programmatically in 2019 were:

- Imported luxury cars

- Women’s Fashion

- Fine Jewelry

- Fine Watches

This suggests that products that are at the high-end of this side of the shopping spectrum, like yachts or travel experiences, still may be promoted through word-of-mouth or personal relationships.

This may be favorable for luxury brands because changes are always on the horizon.

Programmatic advertising has advanced in a number of ways across industries, but Google recently announced it is putting an end to its third-party cookies and new legislation is now in place to protect consumer privacy in stricter ways.

Changes like this will continue to force every industry, including luxury, to stay on their toes.