This year’s back-to-school season is strange.

Some students returned to school with masks and hand sanitizer, while others joined Zoom calls. Another 20-30% of students are experimenting with “hybrid schooling.”

This rearrangement of schooling options forced parents to switch up their back-to-school shopping lists.

A couple of weeks ago we shared how this odd back-to-school season impacted advertising. Now we take a look at how those advertisers specifically utilized programmatic as part of their campaigns.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Back-to-school buying goes in a new direction

With many students doing virtual or hybrid schooling, traditional back-to-school sales are suffering.

The Children’s Place—the only pure play children’s retailer growing in market share—predicted that its Q3 revenue would drop about 25-30%.

“We don’t anticipate that there will be a catalyst to drive any back-to-school meaningful business until Spring ’21 at earliest,” said President and CEO Jane Elfers. “We’re not looking for anything to happen in the later half of the year or in the fourth quarter to drive back to school sales.”

The lack of returning to school and seeing friends curbed the excitement of buying new clothes this year. Plus, there are more expensive items on the shopping list, forcing parents to reexamine their budgets.

Back-to-school budgets reallocated to tech and office furniture

Even though parents aren’t spending the normal amount on clothes or school supplies, it doesn’t mean 2020 will be a frugal back-to-school year. Actually, it’s the opposite: It’s likely that spending will reach record highs according to the National Retail Federation.

Why will spending be up? Many parents will buy new tech, office furniture, and supplies to set up a homeschooling space for their children.

Parents with children in grades K-12 are expected to spend an average of $789.49 this year, which is up from $696.70 last year. 63% of these families will buy computers or other electronics.

In addition to tech, parents are buying desks and office furniture. Between mid-July and August, the term “kids desk” rose 3783% and “computer desk” increased 257% on Amazon, according to Profitero. However, unfortunately for parents, there is a shortage of furniture and many items are backordered.

College students will likely be needing non-traditional items as well. Bed Bath & Beyond launched a college-at-home program to help students revamp their childhood bedrooms.

Likewise, Kohl’s back to school headline is “Heading back or logging in, the new year starts here.” It’s important to note that hand sanitizer and facemasks are featured heavily—pointing to the fact that college life will not yet be fully normal.

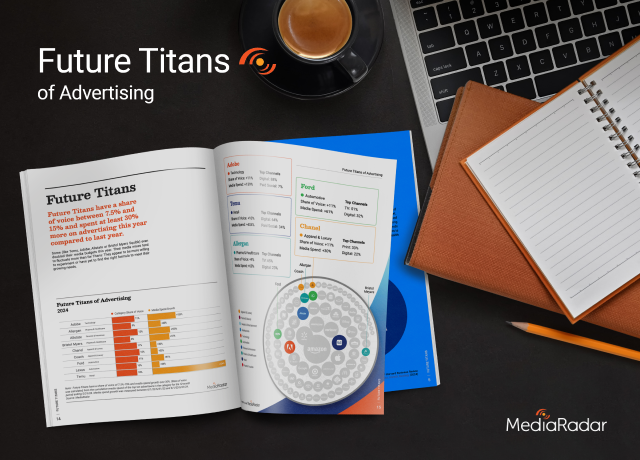

MediaRadar Insights

Methodology

We analyzed programmatic ad spend in July and August year-over-year (YoY).

Findings

Overall, programmatic retail ad spend during the back to school season decreased 7% YoY, which is much better than the -31% felt across all ad formats. Print felt the worst impact from slow back-to-school ad spending.

Unlike the overall market, programmatic back-to-school advertising is not as concentrated, with the top ten spenders making up 44% of all programmatic spending.

Of the top ten back-to-school advertisers, only three raised their programmatic budgets YoY:

- Amazon: +117%

- Walmart (+12%)

- Kohl’s (+17%)

Others—Best Buy, Target, and Office Depot—cut their programmatic ad spending amid this odd back to school season.

Advertisers were forced to adjust their messaging. Walmart is running a campaign acknowledging both kids going back to school and kids staying home. Meanwhile, Target’s commercial is focused on schooling from home, with tech playing a heavier role.

This is just the beginning to an uncertain end of the year. As the holiday season approaches, we’ll be tracking advertising trends as advertisers finish out 2020.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.