The COVID‐19 pandemic led to an economic recession in many parts of the world, and the U.S. was no different. But even as the economy faltered, the residential housing market stayed strong in many places, only improving as time went on.

Many aspects of the real estate landscape changed as the pandemic ran its course. Read more to learn about these changes and how this impacted advertising.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

The 2020 Real Estate Scene Responds to Stay-At-Home Life

As families adjusted to staying at home most of their days, life started to feel squished. Online classes, Zoom meetings, and chasing restless kids around small spaces pushed parents to the limits. Many families started looking for more rooms and outside space.

“The home sales are quite remarkable, given that we are still in the midst of the global pandemic,” says Lawrence Yun, chief economist for the National Association of Realtors. Despite the economic difficulties for Americans, many families say that they’ve sped up their timeline for buying a home based on the family’s changing needs.

“Where are you going to take your Zoom calls where you don’t interfere with one another?” said Kevin Tidwell, an agent with Rodeo Realty, sharing the thoughts of families who are struggling to balance childcare and distance learning while working from home.

The draw to newer homes with more space is so strong that the pace of home sales has increased by 9% year over year, and the sales rates in June, July, and August broke previously‐held records.

This rapid increase in home sales results in two major trends: a higher demand for homes than there is a supply and a widening gap of homeownership between socioeconomic classes.

Low Mortgage Rates Drive High Demand, But COVID Means Low Supply

Mortgage application rates are higher now than any year since 2008, and it’s no surprise—the average national mortgage rate dropped from 3.75% to 3% in a matter of weeks after COVID‐19 arrived in the US.

“A 0.75 percentage point drop may not seem like a lot, but it’s like handing $40,000 to a buyer of a $475,000 home,” said Taylor Marr, senior economist at Redfin. This means that there’s no time like the present for buyers, who may find interest rates affordable right when they need it.

Unfortunately, the supply hasn’t risen to meet the demand.

“We have had houses with 40 to 50 offers,” said Syd Leibovitch, president of Rodeo Realty. “It’s just bizarre.”

Other sources report homes selling for prices far above the asking price, with the high volume of buyers driving intense pricing competition.

Sellers, on the other hand, are few and far between as they wait for a safer environment in which to let strangers into their homes. The number of homes for sale is decreasing faster than it has since 1963.

Changes In Residential Real Estate Disproportionately Affecting Lower Socioeconomic Classes

Even with lower mortgages, buying houses during the pandemic isn’t for everyone.

“When you look at how prices have gone up, that creates a big barrier for down payments because you still have to put down 20%, if you’re going with a conventional loan,” said Daryl Fairweather, chief economist at Redfin.

Those who have the financial ability to buy their own homes have, in general, been less likely to lose their jobs. Those who fall in lower socioeconomic brackets are more often renters and more likely to have lost their jobs, putting them at high risk of eviction.

In May, the average home price rose 4.2% nationally compared to the previous year. However, the prices for the cheapest third of available homes—those most likely to be accessible to former renters and others in low socioeconomic classes—rose 6.2%. This placed affordable housing even farther out of reach for those in lower income brackets.

MediaRadar Insights: Advertising Trends In Real Estate

Methodology

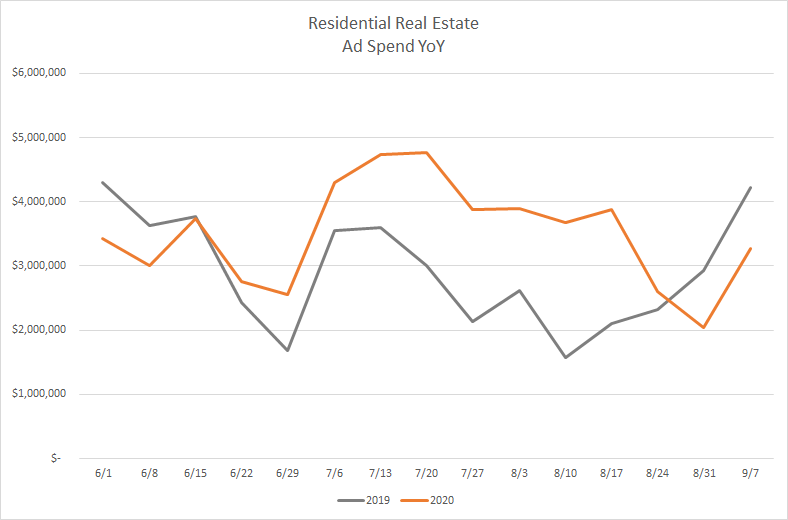

We analyzed retail ad spend from the beginning of June through the first week of September (September 3rd) in an attempt to see how these real estate trends have affected real estate advertising. This analysis includes data from TV, digital, and print ad spend.

Our Findings

Since June, residential real estate ad spend has increased by 30% on average. This growth is largely due to large spend weeks in July and August, where ad spend increased by as much as 134% (mostly digital and television campaigns).

Ad spend in residential real estate reached $4.5 million in the last eight weeks, which is a 28% increase over the same period in 2019. Levels in the last two weeks are more consistent with levels in 2019.

Overall, ad spend in residential real estate is down 11% YoY. The largest deficit of 61% occurred at the end of April. This is likely because realtors are faced with a shortage of homes for sale.

Home prices are projected to fall slightly through the remainder of 2020. For now, potential buyers have few options to choose from and are placing competing bids. This competition inflates prices, which is easiest to see in the Midwest and California.

Real estate, like most industries, has seen its fair share of changes as the country responds to COVID‐19. As the pandemic dies down, we’ll continue to track advertising spending and trends across all of these industries as we finish out 2020.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.