Sports are back—but they are far from normal. While many consumers are eager to sit back and watch a televised game, others aren’t as eager to jump into the distraction yet.

How are consumers responding and what does that mean for advertising?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Mixed predictions: A complicated return of sports and advertising

Sports are a boon for networks. The NFL alone created $4.6 billion in national TV ad revenue in 2019. But this year is unlike any other—and it’s difficult to say with confidence if scheduled games will fully pull through, how fans will engage, and which advertisers will come back.

For many fans, it’s strange—if not disturbing—to watch a game with fake cardboard or virtual fans in the stadium, or seats covered in a blue backdrop with the Delta logo, reminding them of times when they travelled by plane. The consumer response will largely impact TV networks and their sponsors.

According to some analysts, the return of sports will be great for networks.

“We believe that the return of seven pro sports in July and August plus the NFL in September suggests higher linear TV sub ads in the second half, including by cord-nevers, and higher subscriber churn for streaming services,” explained Needham & Co. analyst Laura Martin.

However, it might not be that simple. Others say that ratings have been all over the place—and for many reasons. The lack of real human emotion in the stadiums, the strange timing of the seasons, political advocacy at the forefront of the games, all amid a pandemic don’t make an environment where sports feel as fun or relaxing as they normally do.

It gets even more complicated for college sports. For example, the University of North Carolina moved all classes online for undergraduate students, but planned to continue football, raising questions asking which comes first: “student” or “athlete.”

College football generated $1.2 billion in ad revenue for U.S. television networks last year, and if the season gets cut, networks would experience big losses.

The cancellation of the season would have bigger implications than football advertising itself. 14% of cable-TV customers in a UBS Securities survey said they’d cancel their service if college football didn’t happen. If the seasons are cut short or don’t continue, networks will have less value to offer advertisers.

MediaRadar Insights: Most, but not all, advertisers returned to sports networks

In response to these different concerns and predictions, we took a look at our data to understand how advertisers are actually spending.

Methodology

For the three major sports that already returned (NBA, MLB, NHL), we compared the advertisers running ads during the game Pre-COVID* to the advertisers running ads after games returned.

*Notes:

- For the NBA and NHL Pre-COVID is considered the entire regular season prior to the pause, for the MLB we used the 2019 regular season

- To account for the large difference in the number of games played between the sample sets, most data figures will refer to % of total spend.

- Return to play is defined as July 23rd (opening day for the MLB) to August 15th (latest data)

Findings

Since sports came back to national TV, 527 companies have spent nearly $100M on TV ads during games. Looking at the top 100 advertisers across all three sports prior to COVID-19, 83% returned to advertising during the return to play.

Of the 17 companies who haven’t yet returned to advertising, only 5 come from the top 50 prior to COVID-19. Notable companies that didn’t return include:

- Microsoft

- LVMH

- Expedia

- Sprint

Brands that are running ads during the return to play, but did not pre-COVID include:

- Quibi

- Biden for President

- Slack

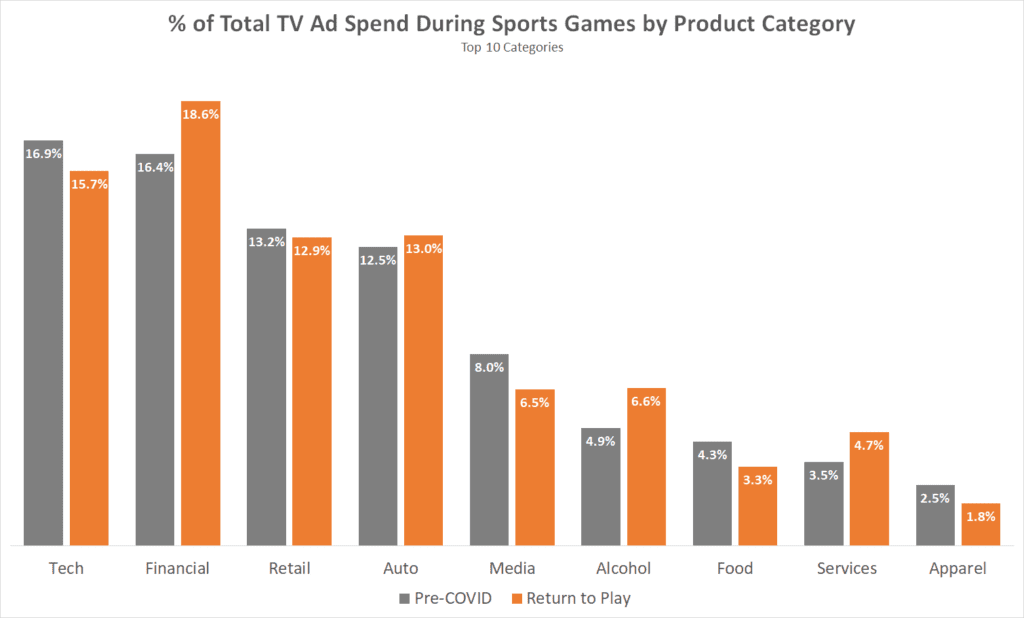

There have been changes in the makeup of advertisers who are buying the ads. For example, financial firms and alcohol brands are making up a larger share of the spend during return to play.

One category not pictured above (because they were not in the top 10) is travel companies. Prior to COVID-19, across the three major sports, travel companies accounted for 2.1% of ad spending. Since the return to play, they account for only 0.2%, as companies like Expedia and Marriott have not returned their advertising.

Networks have done a good job retaining their top sports advertisers. Looking at the top twenty-five advertisers pre-COVID across each league, both the MLB & NBA have seen twenty-three return, while the NHL saw twenty-four return.

While the loss of live sports during summer was a hit for networks, advertisers are coming back. This is good news—especially as the NFL prepares for its Kickoff game on September 10th and a regular (as can be) season to follow. There may be many questions lingering, but based on the data, it seems that brands are ready to place ads.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.