It’s a busy time to work in software and IT.

Businesses are transitioning their business models rapidly — and aren’t looking back. With that, there have been changes in software advertising.

Cloud computing, network equipment and anti-virus/malware software were among the biggest B2B movers in May, with significant increases in spend.

Despite the high spend in those sub-categories, overall software and IT spend has come down to normal levels. Let’s see what’s going on.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

COVID-19 forced companies to adopt new software rapidly

When COVID first hit, companies sent office-workers home to work remotely, thinking this would be a temporary shift. Now, it’s looking like it might be long-term.

Many companies, especially in tech, are saying that they won’t have employees come back to the office until the end of the year or the beginning of next year. Others are using this time as a pilot project to test fully remote workforces.

“It’s hard to not see 20% to 40% of our workforce be remote,” said Slack CEO Stewart Butterfield to MarketWatch. To make that permanent shift, CEOs are urgently reexamining their digital transformation strategies.

Digital transformation was already taking place among most companies. Gartner had already predicted that 75% of databases would be deployed or migrated to the cloud by 2022, but COVID-19 made dilly-dallying unacceptable.

“Two months ago [a customer would] have said it’s a strategic question,” said IBM Cloud Chief Technology Officer Hillery Hunter. “Now it is an existential question.” Those who don’t accelerate their digital efforts simply won’t survive this crisis.

IT feels the weight of their business on their shoulders

Business survival has largely shifted to the IT department — and they certainly feel it.

In the recent Agents of Transformation Report created by Cisco Systems Inc.’s AppDynamics subsidiary, researchers surveyed 1,000 IT pros in large organizations. The report found that:

- 81% of respondents said COVID-19 has created unprecedented pressure on their organizations

- 61% feel that they’re under more work pressure than ever

- 71% point to digital transformation projects that have been implemented within weeks rather than the months or years it would have taken before the pandemic.

This time has forced organizations to rush the inevitable, often taking shortcuts or not putting the sustainable support mechanisms in place.

This has been a wake up call to many businesses to respect their IT team as valuable leaders and to put necessary digital systems in place.

Digital transformation can’t be done overnight. IT will have a huge influence in the years to come, and with that we’ll see changes in IT firm advertising.

MediaRadar Insights

The demand for new software a few months ago was directly correlated with a spike in digital advertising dollars. Even though businesses are still grappling with new digital efforts, that rise has come back down.

Software

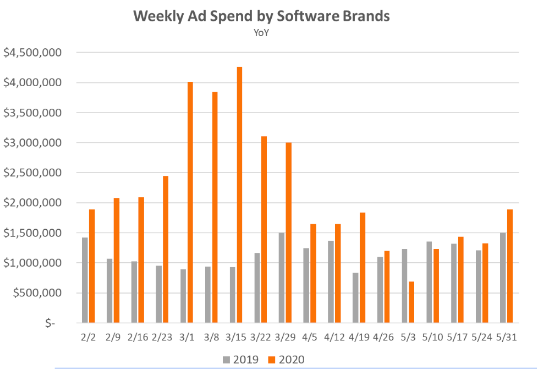

Despite higher levels than last year, the year-over-year increase is not nearly as high as it was in March.

Software will continue to help every industry function and adapt to the pandemic. Microsoft Teams, for example, has recently surpassed 75 million daily active users. Dynamics 365, is now being used to help businesses with contactless shopping and curbside pickup.

Likewise, Salesforce released Work.com to help businesses transition back to office work safely.

IT

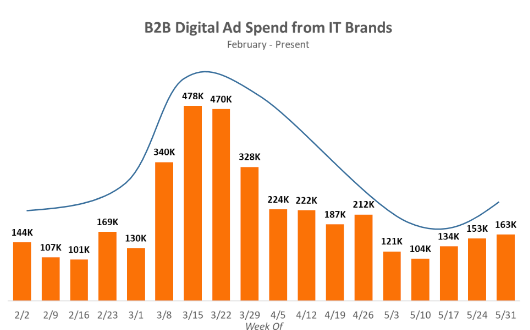

IT Companies quickly ramped up spending in mid-March to capture the needs of offices moving their workers to remote. The messaging was consistent across brands: “We’ll help your team go from working in an office to working remotely.”

However, after the spike, spending quickly dipped back down, even back to lower than last year.

Spend is now at levels comparable to last year. Similar to software at large, the numbers in May are higher than we saw in February, but the increase is not nearly as high.

It is important to remember that not every sub-category of this industry is faring so well. While cloud-products are booming, hardware products are experiencing a hit.

It appears that the initial shock to companies has subsided and many have probably chosen their new software partners. IT and emerging tech will continue to play a major role in forming a post-COVID society. We will continue monitoring any major changes and the biggest spenders in tech.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.