Last year shook the cosmetics industry. While staying at home, people took to DIY beauty products, skin care, and hair coloring. McKinsey predicted that revenues would be cut by 20-30% by the end of 2020.

However, makeup and self-care products are traditionally resilient during times of crises, as many people see these types of items as affordable luxuries. And who didn’t need some extra self-love this past year?

Vogue dove into the most-searched for beauty trends that were born out of COVID-19. These ranged from an increased attention to skin-care to divided camps on makeup approaches.

While we aren’t beauty gurus, we do have advertising data to back up which brands you should consider partnering with this upcoming year.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

1. Secret

Women’s deodorant brand, Secret, owned by P&G, launched a strong campaign last year championing women’s strength: “All strength, no sweat.” The campaign featured a diverse and powerful line-up of celebrities and social media influencers crossing industries and settings. From fitness leaders, coaches, and mothers, Secret continued its history of being a brand for strong women.

Its 2020 advertisers included:

- Television: NBC, ABC, CBS, Fox, Bravo

- Print: People, Us Weekly, InStyle, Shape, Cosmopolitan

- Digital: Huffington Post, CNN, Sam’s Club, AOL, Adult Swim

Secret anticipates RFPs in February and peak spending for print and digital is Q2, Q3 for TV.

2. Finishing Touch, Flawless Collection

With salons closed, people sought ways to remove facial hair without a wax. This ‘dry shave’ product is marketed to remove hair from cheeks, lips, and chins. It is supposed to make the face smoother and makeup application flawless.

2020 advertisers included:

- Television: HGTV, Bravo, Hallmark, Univision, Nick@Nite

- Print: Star, OK! Weekly, InTouch Weekly, National Enquirer, Soap Opera Digest

Interested in contacting this brand? MediaRadar has more than 40 contacts at Church & Dwight, the distributor of the Finishing Touch Flawless Collection, complete with insider tips on which agencies and teams handle their various campaigns.

3. Luminess Silk

Makeup brand Luminess Silk offers foundation products—which is a product still in demand with the amount of video calls taking place.

2020 advertisers included:

- Television: WE Network, Travel Channel, ION Television, TLC, HGTV

- Digital: Wondery (Podcast), Yahoo!, Kongregate, People, WebMD

Peak spending for television was Q3, especially in June.

4. Garnier Green Labs Collection

The push for sustainability only grows stronger year after year, impacting how products are produced and marketed. This new skincare line is made in a plant that is powered by 59% renewable energy. Launched in Q4 2020, it has only invested in television so far.

2020 advertisers were made up of:

- Television: ABC, MTV, CBS, Telemundo, NBC

5. Colgate Optic White Toothpaste

While on Zoom, you’re constantly seeing your face and may notice the color of your teeth. That’s why we’re including Colgate’s Optic White Toothpaste. It’s one of the biggest advertisers in its category.

Its 2020 advertisers were:

- Television: WE Network, Travel Channel, ION Television, TLC, HGTV

- Digital: Wondery (Podcast), Yahoo!, Kongregate, People, WebMD

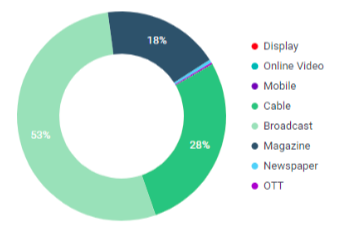

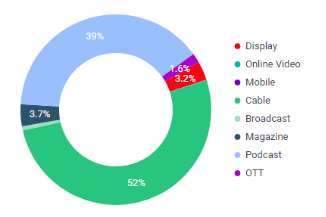

Here’s the spending break down:

Broadcast advertising was its biggest advertising channel, making up 53% of spending. Cable made up 28% of spending, while magazines made up 18%. Other channels made up only a small percentage of this product’s advertising profile.

6. FabFitFun

FabFitFun is a subscription service that sends boxes filled with fitness, beauty, and self-care products each season.

2020 advertisers included:

- Television: Bravo, E!, VH-1, HGTV, Travel Channel

- Digital Advertisers: YouTube, Girls Gotta Eat (Podcast), Wondery (Podcast), Audioboom (Podcast), CNN

For those interested, this brand has an upcoming RFP in April.

7. Pantene Pro-V

The “Miracle Rescue” Collection is marketed as a way to treat and redeem damaged hair. This product might come in handy for many people continuing to experiment with purples and blues, or those who might have to go back to the office once vaccinated.

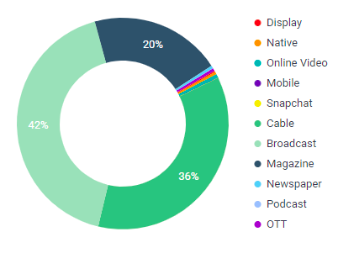

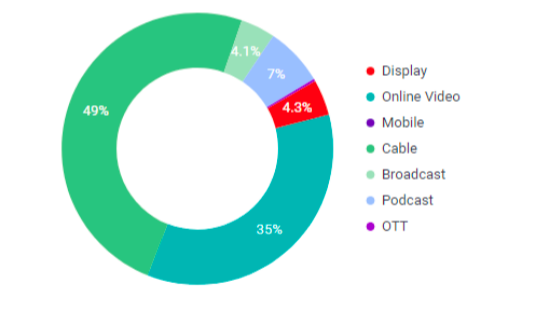

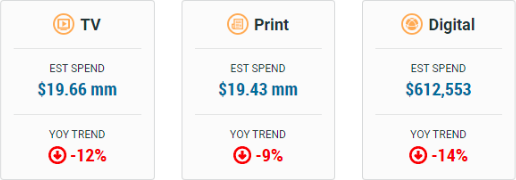

Its 2020 advertisers were:

- Television: NBC, ABC, CBS, Bravo, Fox

- Digital Advertisers: iHeartRadio (Podcast), Target, YouTube, MTV, Sam’s Club

- Print: People, Better Homes & Gardens, InStyle, Good Housekeeping, Cosmopolitan

8. Hims, Inc.

Hims is an “all things men’s wellness” telemedicine company that offers products and services for primary care, hair, sex, skin, mental health, and skin care. Men can have their prescriptions and other products delivered to their doorstep.

The fast-growing unicorn that also owns Hers (the women’s equivalent) was a winner in 2020. In October, it announced it will merge with a SPAC and go public. The combined company is valued at $1.6 billion.

2020 advertisers included:

- Television: ESPN, History, TruTV, FOX Sports 1, CBS

- Digital Advertisers: YHM Studios, ESPN, Armchair Expert, All Things Comedy, Loud Speakers Network

It also spent a bulk of its ad dollars on podcasts.

9. Shea Moisture

Shea Moisture is a personal care company that produces shampoos, conditioners, and body washes. It was founded by Nyema Tubman and Richelieu Dennis, who were part of the Liberian Diaspora to the U.S. Its customer base and audience is primarily black women. The company focuses on investing in communities and scholarships.

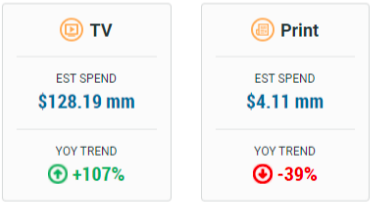

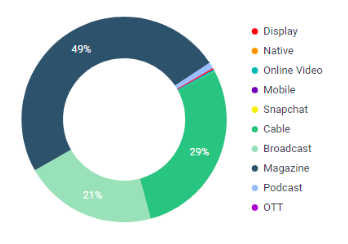

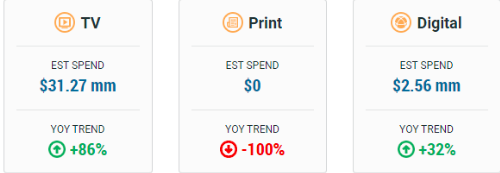

Its 2020 advertisers include:

- Television: NBC, ABC, CBS, Bravo, Fox

- Digital Advertisers: IMDB, Allure, Target, Allure, Youtube

10. Quip

People can improve their oral health with smart toothbrushes and dental products. Quip is the brand to watch in this category.

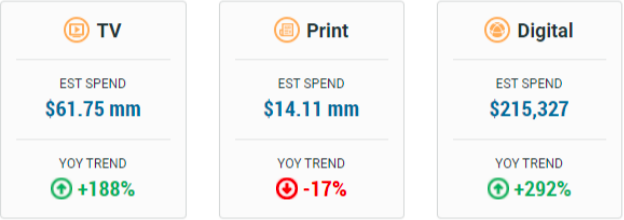

Its 2020 advertisers include:

- Television: TNT, CNN, Hallmark, History, AMC

- Digital Advertisers: Crooked Media, Casefile Presents, Maximum Fun, Wondery, All Things Comedy

Its two biggest channels for advertising were cable and podcasts.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.