The 2020 virtual shift was particularly challenging for beauty brands, as consumers typically want to try new products before they buy.

But the pandemic made going digital-first necessary.

With the help of in-app assistance features and increased social presence, beauty brands were able to drive online sales. Brands also began to invest significantly more in programmatic advertising to increase their eCommerce activity.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Beauty Tech and Digital Marketing Drives eCommerce Sales

It’s one thing for shoppers to buy a trusted shampoo or skin cleanser online, but it’s a completely different experience for them to buy a new eyeshadow, foundation, or lipstick.

For this reason, beauty brands needed to build trust with new clients in creative ways. For L’Oreal India, this meant building brand awareness by using content rich social ads and AR tools to drive their eCommerce efforts.

“Everything that we do is with a digital-first mindset. The intent here is really to bring the best of beauty tech,” said Anil Chilla, chief digital officer of L’Oréal India. “We had been seeing the rise of e-commerce even before the pandemic, and the pandemic only accelerated the whole phenomenon.”

According to Chilla, about 20% of customers bought beauty products online for the first time during the pandemic.

Similarly, DTC anti-aging skincare brand Bluelene was set to enter brick and mortar stores in 2020, but had to rearrange their plans. Instead, the brand doubled down on digital advertising and new online channels.

“This approach has been successful to grow our direct-to-consumer business 100% during a difficult time,” said CEO Jasmin El Kordi.

Across the board, beauty brands increased their digital marketing investments. Social media, customer loyalty and referral programs, email marketing, and apps became particularly important for brands to build awareness and trust.

Here at MediaRadar, we also saw a surge in programmatic spending from beauty brands.

MediaRadar Insights

Since the beginning of the pandemic, more beauty advertisers have invested in programmatic.

In the first quarter of 2021, 2.1k beauty advertisers spent $13.9mm in digital programmatic ad space. This is a 56% increase in the number of advertisers YoY and a 34% increase in ad spend YoY.

In the same time period last year, 1.4k advertisers spent $10.4mm.

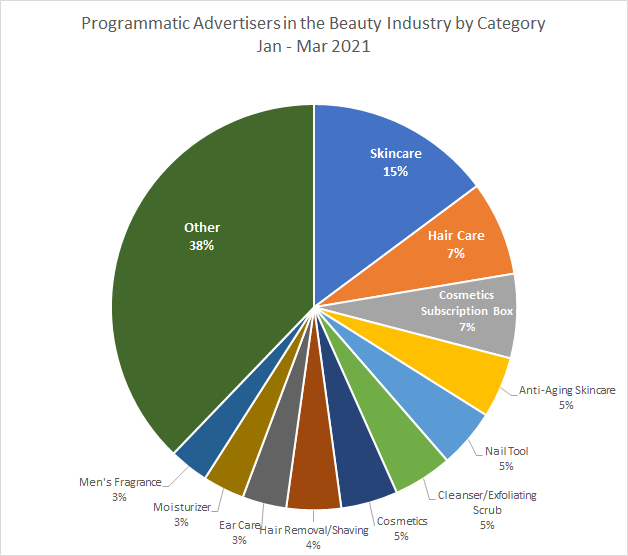

There is significant fragmentation in the beauty category—38% of brands don’t even fit into a common category.

But of the non-miscellaneous products, the top spending subcategories of beauty are:

- Skincare: Nue Co. and Stacked Skincare spent the most in this category.

- Haircare: Pantene Pro-V and Folliboost spent the most.

- Beauty subscription boxes: Harry’s USA and Ipsy are the top spenders here.

Together, these three subcategories spent over $4mm in Q1 2021, and account for 29% of ad spend of the entire beauty category.

As people begin to feel safe again, physical stores will be important for beauty shopping again. But digital technology will likely continue to enhance the experience.

For now, ad dollars continue to be invested in digital channels significantly more than they were pre-pandemic and don’t show any sign of dropping.

For more updates like this, stay tuned. Subscribe to our blog for more insights.