Domestic travel hit its lowest COVID levels in mid-April. As people came out from their homes, local exploration was on the rise. Now, with the recent surge in COVID cases, time spent traveling is dropping once again.

Here we share how this turbulent ride is impacting travel advertising.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

The Increase in Local Travel Wanes

With cabin fever and few options to travel internationally, Americans have been hitting the road to visit domestic tourist locations.

AirBnB reported that it had more US bookings between May 17 and June 3 than it did the previous year. CEO Brian Chesky said that most bookings were within 200 miles of the visitors’ homes.

Now, with the latest spike in infections, people are more hesitant to travel and some states have reversed their reopening plans.

Apple Maps reported that there was a clear drop in requests for driving, walking and transit directions in July, reversing the steady increase it had seen since mid-April. The decline is most noticeable in states which have had the largest coronavirus outbreaks, such as California, Texas, Arizona and Florida.

Likewise, airline travel that had been steadily rising since April dropped last week.

“The near-term rise in COVID cases and quarantine measures appear to be now manifesting in the data and disrupting positive trends,” said analyst Savanthi Syth at Raymond James. Although many consumers want to travel after the last four months, growing unease may curb vacations until the outbreaks subside.

What do these shifts mean for advertisers and publishers?

MediaRadar Insights

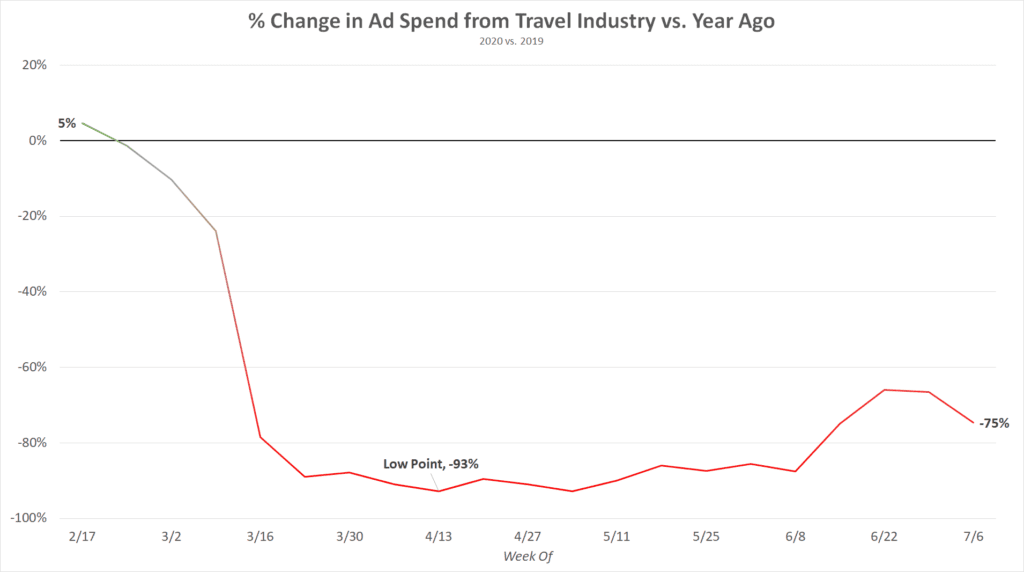

When we look back to the beginning of the pandemic, ad spend from the travel industry was dropping off even before the U.S. declared a national emergency. In late February spend was flat compared to the same point a year ago, but by mid-April spend had cratered, down 93% YoY.

There was a resurgence in spending in June—spend levels quadrupled since the low point. However, with the new surge in cases throughout much of the country, spending in early July began to fall.

- In April and May of 2019 average weekly ad spend from the travel industry was $38M per week.

- In April and May of 2020, that figure was $4M per week.

Before declining again in July, spend levels reached as high as $11M per week.

The largest driver of the recent recovery had been hotel brands. In April and May these brands averaged just a hair over $1M per week in ad spending. However, in the most recent four weeks average weekly spend has been over $4M per week.

Brands like Choice Hotels are leaning into the road-tripping trend with new creative.

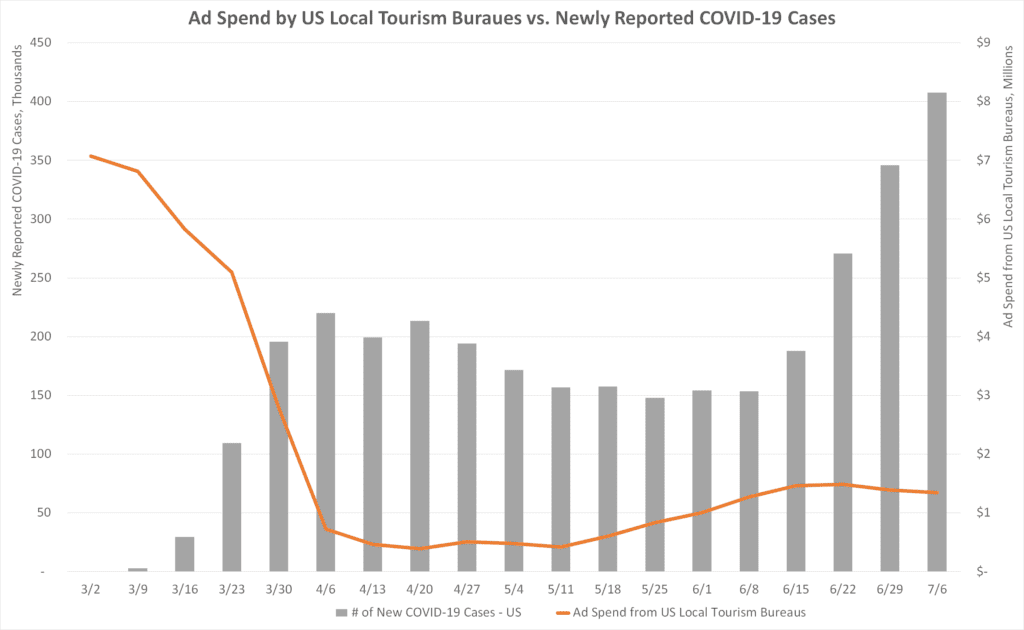

However, with the rise in cases, advertisers are losing steam. For example, ad spend from US Local Tourism Bureaus (e.g. Visit Orlando, NYC Tourism, etc.) hit their highest levels in three months in late June, but have stagnated since, and have even begun ticking back down as states reinstate lockdowns and restrictions.

The ad data suggests that travel plans are up in the air for Americans depending on their risk tolerance and the state of new infections. In response, advertising spend continues to ebb and flow.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.