People watch more videos on YouTube than on any other social media platform.

According to Google and Ipsos Connect, nearly four times as many people prefer watching video on YouTube compared to other social platforms. And on average, during Prime Time, YouTube reaches more American adults than any cable network.

With that type of viewing, the company is raking in the ad dollars. In their latest quarterly earnings report YouTube announced $7.3 billion in ad revenue—a new quarterly record for the company.

As Google has gone through several major policy changes over the last two years, its ad revenue has fluctuated. Here is a timeline of some of the most impactful changes for creators and how they’ve correlated with ad revenue.

YouTube: A Policy Timeline

Before diving into how YouTube’s advertising numbers have grown, here’s a snapshot of some of the most significant changes they’ve launched over the last two years.

- January 2020: Ads are no longer targeted based on audience for any kid-related content.

- April 2020: Content that references or features COVID-19 can now be monetized. After Q1, YouTube’s CFO and CEO were optimistic about content changes and ad revenue sales going forward.

- June/July 2021: YouTube changes the way it monetizes content: they now run ads on any video that does not participate in the YouTube Partner Program (YPP), and do not pay creators for any revenue generated from those ads. Any payments to content creators are now considered royalties and subject to US tax law.

- June 2021: YouTube puts in place an explicit ban prohibiting facial recognition software to scrape data for targeted advertising.

At the same time, the platform faced two separate antitrust fights in the European Union and the United States. While ad revenue grew overall, these developments caused dips in YouTube’s revenue over the past year.

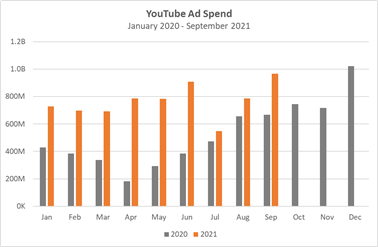

Overall, between January and September 2020, advertisers spent $3.8 billion.

Between January and September 2021, that number increased to $6.89 billion—a 81% increase year-over-year.

Looking at annual changes, we see a dip in the beginning of Q3, as YouTube was feeling some heat surrounding the antitrust probes. However, they were able to recover and September was their strongest month since December 2020.

Growth in September was driven by top spenders like: Verizon Wireless, J.Crew, Liberty Mutual Insurance and Walt Disney World. These four companies spent over $82 million in September alone.

YouTube is expected to pull in even more advertisers who are looking to increase their digital presence this year. And revenue won’t only be driven by new advertisers—advertiser retention is high and top spenders are increasing their investments. As changes in the ad tech ecosystem approach quickly, we expect to see YouTube’s ad revenue continue to climb.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.