It’s no surprise that Facebook continues to be a go-to for advertisers looking to engage audiences. With its granular targeting capabilities and massive audience, it makes sense that ad spend would be on the rise.

According to our research – so far in 2022 (through April), nearly 44 thousand advertisers have invested $4.7 billion for Facebook ads to showcase their brands.

Using MediaRadar you can reach out to these top brands and see if they’re a fit for you!

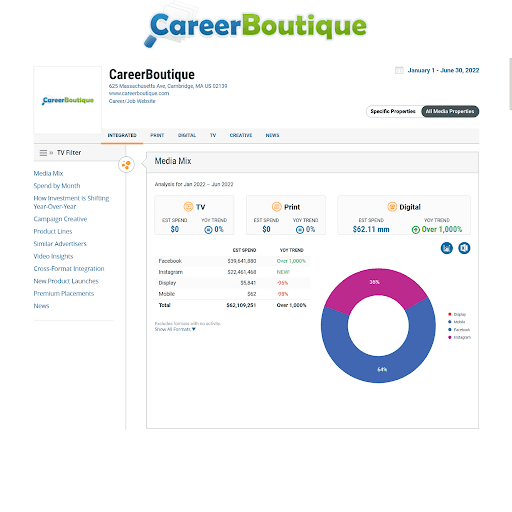

1. CareerBoutique, is a career site that “hand-selects job listings and career trends” to help job searchers. In 2022 (through April), this career destination invested in Facebook – 19x its entire 2021 ad spend. Instagram was a strong social media investment in 2022 as well – with over $16m spent there. This career matchmaker is leaning into social media platforms as a go-to advertising opportunity.

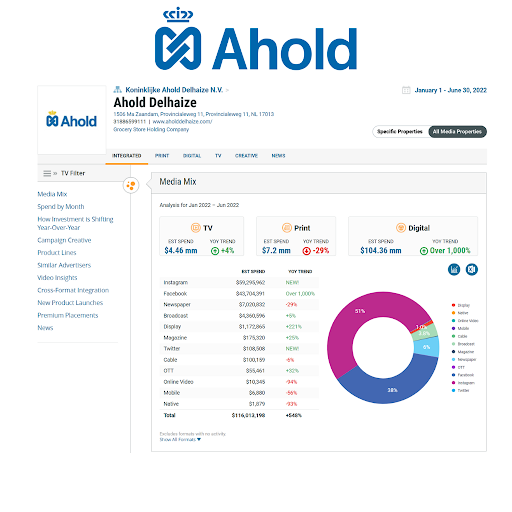

2. Ahold Delhaize is one of the largest food retail companies in the world. It chooses Facebook to advertise its U.S. supermarket brand, Food Lion. The food retailer also invests in other digital (including Instagram), print and TV. Through April, 89% of its over $86m ad spend was invested in social media platforms, Facebook and Instagram.

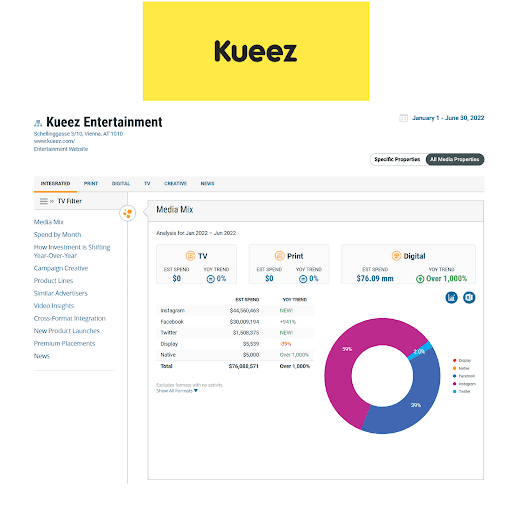

3. Kueez Entertainment is a full cycle publishing technology platform that helps publishers optimize the entire publishing journey. The company provides content and deals through games, stories, quizzes and more. The company solely used Facebook (42%) and Instagram (58%) of its total ad investment in 2022 through April.

4. Mail.ru Group’s MY.GAMES uses partner-studios to develop games across various genres. Its Facebook spend alone the 1st four months of 2022 is already 38% of its total ad investment during 2021. This spend was split between Facebook ads (80%) and Instagram (18%) – with the remaining invested in display, native, and online video.

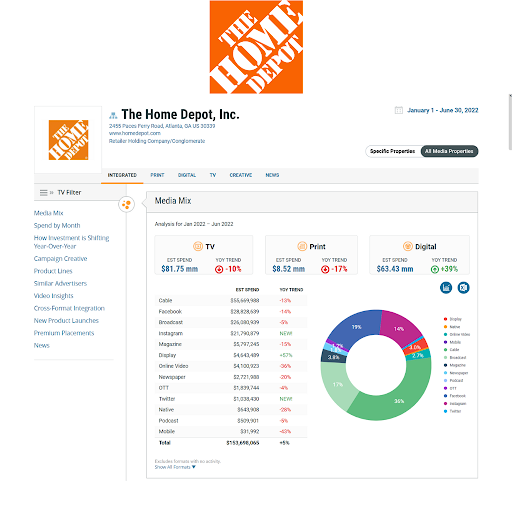

5. The Home Depot is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services. This home improvement chain’s 2022 advertising strategy is a mix of digital (~50%), print (<3%) and TV (47%). The data shows a trend of digital spend increasing while other formats shift. Compared to the same period (Jan. – Apr.) in 2021, The Home Depot’s ad mix was digital -30%, print – 5%, and TV – 65%.

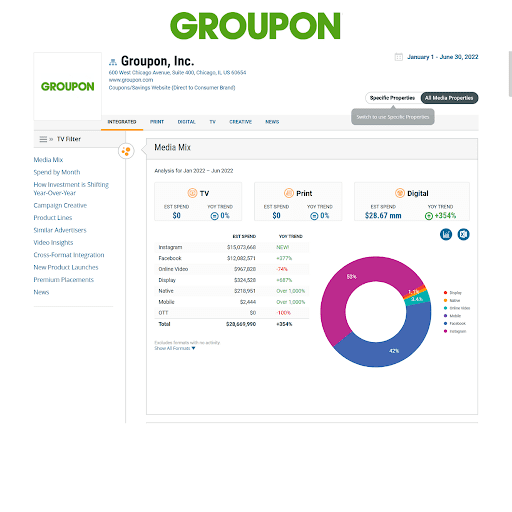

6. Groupon is an American global e-commerce marketplace connecting subscribers with local merchants by offering activities, travel, goods and services. The marketplace invested in print and TV during 2021. Both formats were around 13% of its total ad spend for the year. Neither have been utilized yet in 2022. All spend has been placed with digital advertising: 52% with Instagram, 43% through Facebook, and the remaining with online video, native and display ads.

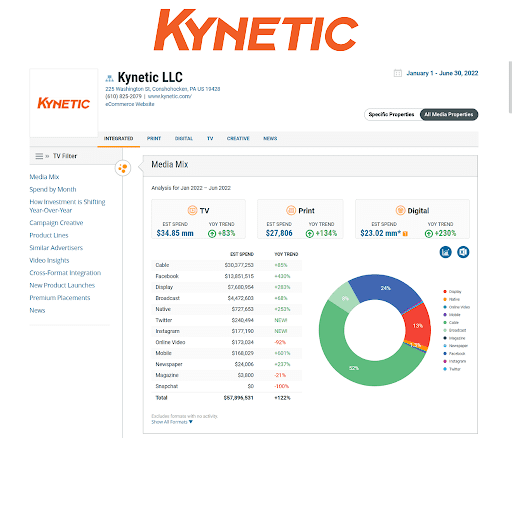

7. Kynetic is a commerce company consisting of three consumer internet businesses: Fanatics, Rue La La and ShopRunner. It utilized Facebook (24% of its total spend) to advertise its Fanatics and MLB Ship brands during 2022. Compared to Jan. – Apr. of 2021, Facebook’s ad spend was up nearly 500%. Through April, TV was 59% of Kynetic’s total ad spend, while digital display was 14% with the remaining spend going to native.

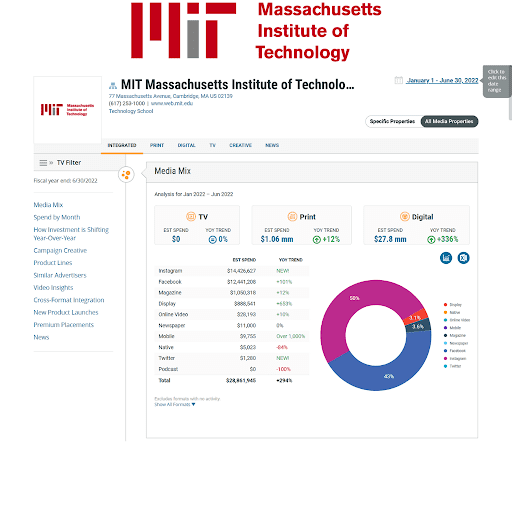

8. Massachusetts Institute of Technology is a private land-grant research university based in Cambridge, Massachusetts. In 2022, MIT focused its Facebook advertising on its MIT Professional Education, MIT Sloan Executive Education, and MIT Open Learning programs, among others. This year’s investment was all digital with the exception of ~2.5% invested in magazine ads.

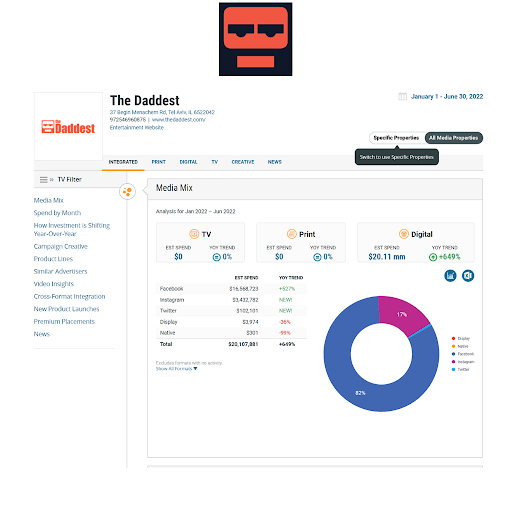

9. The Daddest creates and uncovers content and stories that matter to Dads through a lens of originality, inclusivity and conversation. In 2021, digital made up 100% of its ad spend. So far this year – 91% of spend has been dedicated to Facebook and the remaining went to Instagram.

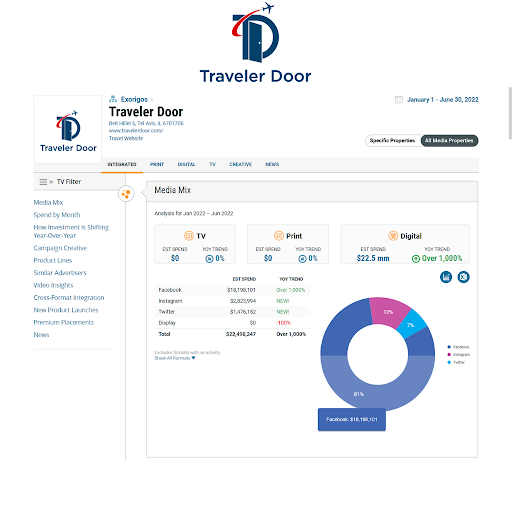

10. Traveler Door provides high-quality content about the most interesting places in the world to its online readers. During 2021, ad investment was 100% invested in Facebook. In 2022, the spend has been 100% digital to date with 92% dedicated to Facebook, 7% going to Twitter, and the remaining investment went to Instagram ads.