The $473.42 billion that the Apparel and Accessory industry is expected to make in 2022 won’t magically appear.

Sure, the biggest players will rely on brand equity to drive sales, but that’s not the only cog in their engine.

Advertising will play a role, too, and it’s off to a hot start in 2022.

Here’s what you need to know about how Apparel and Accessories advertisers spent in Q1 2022:

The State of Advertising in the Apparel & Accessories Industry

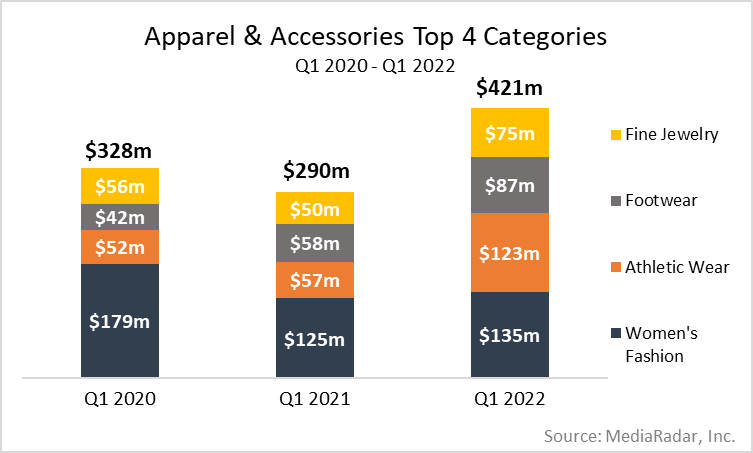

In Q1, advertisers spent 50% more YoY from 2021 as 6.5k companies bought ads for more than 8k brands.

While this represents a 6% decrease from Q4, that’s to be expected as the shopping surge during the holidays waned.

Of the 8k brands advertising in Q1, more than 2k (25%) didn’t do so in 2021.

That said, nearly 5k companies (37%) that advertised in 2021 did.

Of the 16.5k brands that advertised in 2021, 6k were back in Q1, with 21 of them spending more than 1,000% Q1 YoY from the same time last year.

Top spending categories in Q1 2022

In Q1, almost half of the ad dollars from the industry came from advertisers in a few categories:

- Women’s Designer Fashion

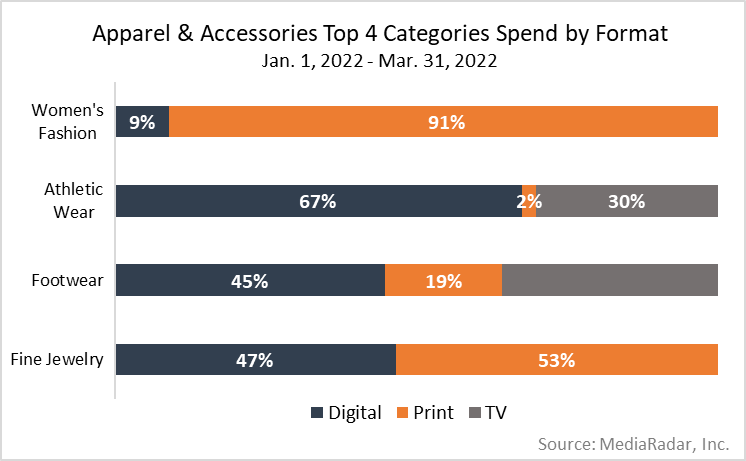

Women’s Designer Fashion advertisers spent nearly $123mm on print ads (91% of its total spend), in publications like Elle and Vogue.

Companies such as Chanel, Kering (Gucci, Balenciaga, etc.), and LVMH Moet Hennessy Louis Vuitton (LVMH) accounted for 50% of the spending.

- Athletic Wear

Spending from Athletic Wear brands—think Champion and Lululemon—increased by 117% Q1 YoY.

Companies in this category opt primarily for digital ads, which increased by 132% YoY in the first quarter.

Meanwhile, TV spending increased by 250% Q1 YoY.

- Footwear

The Footwear category increased spending by 50% from Q1 2021 as it upped its buys on TV (33% increase), digital (82% increase) and print (26% increase).

Digital ads comprised 45% of total spending, with over half of that going to Facebook.

The rest went to video, display, native, OTT, podcasts and Snapchat.

- Fine Jewelry

Ads for Fine Jewelry increased by 51% in the 1st quarter YoY as these advertisers split their budgets just about evenly on digital (47%) and print (53%).

Looking specifically at digital, spending increased by 135% from Q1 2021, with 65% going to Facebook.

Digital Advertising and Traditional Advertising Trade Places as Apparel & Accessory Industry’s Favorite

Historically, print and TV ate the most ad dollars from these brands.

Not anymore.

In Q1, digital ads accounted for 57% of spending, compared to 30% in Q1 2020, a spike that’s undoubtedly the result of the pandemic-fueled boost to online shopping.

According to IBM, the pandemic accelerated the shift to digital shopping by roughly 5 years.

Now, digital accounts for more than print and TV combined, a flip flop to the age-old strategy of pouring everything into traditional tactics.

To put this into perspective, print was 53% of total spending in Q1 2020.

In Q1 2022, print spending dropped to 27%. (Although it increased by 6% Q1 YoY.)

TV spending also increased as advertisers spent 42% more than they did during the same time last year.

What this tells us is that traditional ads are old news, even if some advertisers aren’t letting go.

So, where did these digital dollars go?

A lot went to Facebook—and with roughly 2.93b monthly active users (MAUs) as of the first quarter of 2022—that’s not surprising.

Video advertising was also popular, increasing by 122% Q1 YoY to nearly $87mm.

Of that, YouTube received almost 100% of the investment, which makes sense given its popularity—in March 2021, people spent an average of 29 minutes and 37 seconds per visit.

The top spenders on YouTube included Adidas, Adore Me and Gigi Pip, accounting for over $40mm (46%) of the ad buys in Q1.

In 2022, the top 5 content channels are Music, Society & Culture, Kids, Sports and Beauty, which accounted for 52% of spending.

Outside of Facebook and YouTube, display, native and Snapchat got attention, albeit much less.

Of these channels, native grew the most, increasing by 900% Q1 YoY, which could have a lot to do with an effort to provide more thoughtful advertising experiences or the ad format’s proven performance—native ads get 20-60% higher engagement rates than banner ads.

10 Companies Responsible for a Third of Spending

- Richemont

Richemont—think Cartier, Van Cleef & Arpels and Chloe—increased ad buys by 34% YoY compared to Q1 2021.

Of that spending, 29% went to digital, 70% to print and the remaining 1% to TV.

Richemont designated 82% of its advertising to Accessories brands, 13% to Apparel and 4% to Luxury.

- Nike

Nike increased spending by 142% Q1 YoY, allocating 74% to digital, 25% to TV and 1% to print.

A whopping 88% of Nike’s ad dollars went to Athletic Wear, 5% to Apparel, 5% to Athletic Footwear and the remaining for Footwear and the Brand campaigns.

- Tapestry

Spending was up over 500%, which already propelled the company past what it spent all of last year.

The majority of Tapestry’s ad spend went to showcasing Coach and Kate Spade.

Nearly 100% of this spending went to digital (96% went to Facebook). The few dollars that didn’t go to digital went to print.

- Gap

Spending was up 32% Q1 YoY compared to 2021 and is 12% of last year’s spending.

Gap has a nearly 50/50 split between TV, with a fraction going to print.

Digitally, 70% went to Facebook, followed by 16% to video and the rest mixed between display, OTT and native.

- TechStyle Fashion Group

TechStyle Fashion Group had 540% Q1 YoY investment growth.

More than half of the company’s spending went to Fabletics (56%), while Rihanna’s Savage X Fenty (23%) and Fab Kids (21%) got a good chunk as well.

The boost to Fabletics is undoubtedly a result of the growth of athleisure and TechStyle Fashion Group’s quest to fend off the competition.

- Under Armour

Q1 spending was up 129% YoY from the same period last year and 65% of the company’s total 2021 investment.

In Q1, Under Armour spent 58% of its dollars on digital ads, 41% on TV and 1% on print.

Retail Media: The Future is Here

Accessories and Apparel go together with retail just about as well as a nice suit and a pocket square.

They make sense together, which is why we’re not surprised that more than 1k companies invested more than $60mm in retail media in Q1.

Although advertisers for Accessories brands decreased spending by 15% from Q4, they were still the largest investors in Q1 as companies like Coolife, Showkoo and TravelPro—all luggage companies—combined to invest over $9mm as millions of people started traveling again.

Apparel advertisers also invested a lot, buying $5.3mm of ads–thanks to big investments from Boxed Gifts, Kenneth Cole, Levi Strauss, L.L. Bean and Lulucleaf, which accounted for 41% of this category’s spending.

Despite representing just 5% of retail site buys, workwear increased spending by 117% in Q4, a welcome signal that the world is fighting to go back to normal as companies ask employees to return to the office.

While retail sites received ad dollars from just 21% of the companies from Q3 to Q1, there’s no doubt it’ll continue to rise—likely substantially—as advertisers realize the unprecedented power of retail media.

When you combine the adoption of technology and eCommerce with the staggering size of the Apparel & Accessories industry, it’s not hard to see why these advertisers are spending so much.

Based on our data from Q1, it’s clear that they’re shifting their thinking—and their ad dollars—away from traditional tactics and onto digital ones that take the continued rise of online shopping into account.

The chance of this trend continuing is the same as the chance of these advertisers increasing their spending during the holidays.

It will happen, especially as retail media continues to gain steam.

The only question that remains: How much will they spend in Q2, Q3 and Q4?

For more insights like this, sign up for our blog.