Is print advertising still viable for B2B companies?

The answer is: it depends.

Last year, we shared the trends we thought publishers should pay attention to when it came to B2B advertising.

2019 has now come and gone. So how did our predictions stack up?

Throughout the year, we shared how B2B brands were looking to podcasts and even Instagram to share their message.

Marketing events came in strong.

But print?

Print isn’t taking priority for most B2B brands.

We break down the numbers on the state of print advertising for B2B brands (and where the ads are going instead).

MediaRadar Insights: 2019 B2B Print Ad Data

Over the last few years, we have seen B2B companies increasingly shift their ad placements from print to online.

In 2019, the trend continued.

MediaRadar research found that:

- Print spend is down 12% in B2B.

- The # of B2B Companies buying print ads is down 7%.

- Over 300k pages of B2B print ads were sold in 2019.

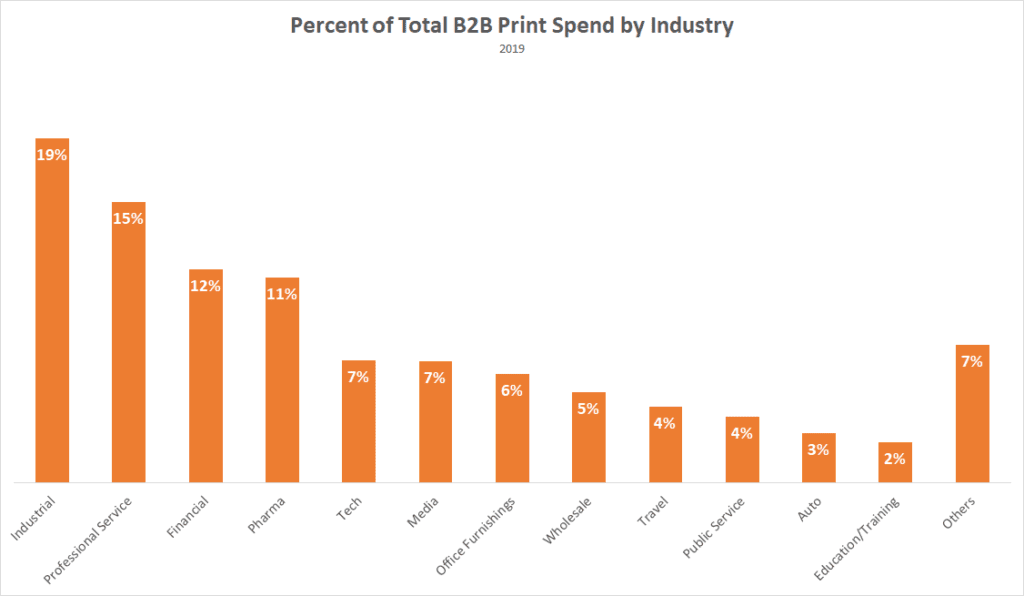

Certain industries continue to pay for print advertisements more than others.

The top four categories of B2B industries that spend on print ads include:

- Industrial

- Professional Service

- Financial

- Pharmaceutical

Top companies buying print ads in B2B magazines include:

- Bayer

- Berkshire Hathaway

- Merck & Co

- AT&T, etc.

Surveys of publishers back this data up. When asked about revenue growth in a recent Folio survey, B2B publishers placed print 4th behind Digital Media, Events/Tradeshows and Marketing Services (whitepapers, lead-gen, etc).

“We see open space in our market for news podcasts and in-depth, narrative podcasts,” explained CEO of Government Executive Media Group Tim Hartman. “I believe most B2B companies should consider their play in the podcasting space.”

Another survey confirmed that digital media was at the forefront of publisher minds. While publishers have a variety of strategies within digital, there is a consensus that most publishers want to meet viewers where they are at, make ads more accessible and enhance customer experiences.

So where are the B2B print ads going?

B2B brands want to meet their audience where they are at, and publishing is shifting to meet that demand.

So that means that ad spend is being devoted to a variety of digital mediums.

Podcasts

Podcasts are powerful because they can capture a specific niche audience for B2B publishers. Once they have a following, they can sell ads to brands in the space who are hoping to reach the audience.

B2B advertisers have been active in podcasting for a while now. Numerous B2B brands, such as Ziprecruiter, Stamps.com, Indeed, LinkedIn, and Salesforce all spent over $1M in advertising on B2B focused podcasts.

Ziprecruiter is the top advertiser across both B2B & B2C podcasts.

MediaRadar data found that 57% of advertisers bought podcast ads over the course of multiple months in 2019. This implies that B2B advertising is ongoing in this space and can help generate steady streams of revenue for publishers.

Digital

Publishers have been shifting to digital for many years, and the budgets allocated to this area have remained steady.

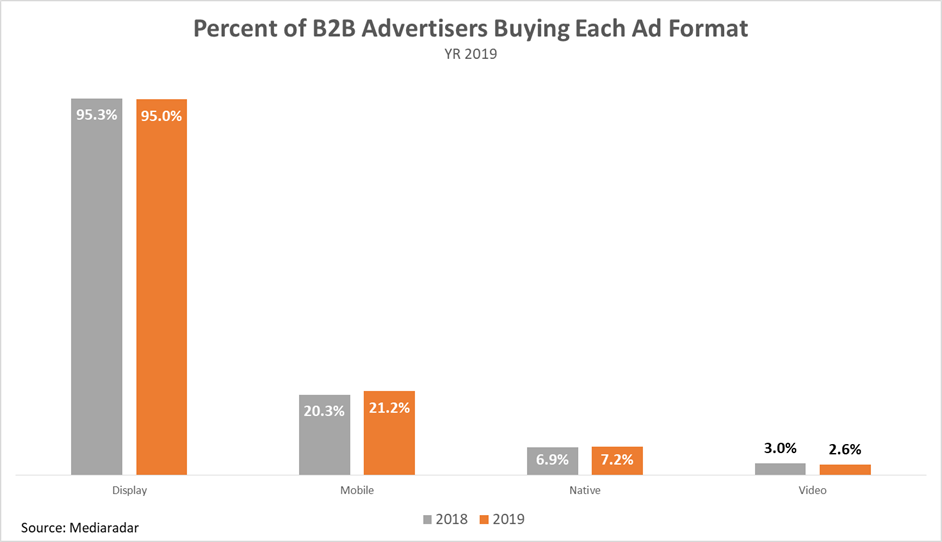

MediaRadar data found that:

- B2B digital spend increased slightly in 2019 (1% growth).

- Biggest spend: In 2018, display accounted for 95% of all B2B online ad sales. In 2019, it was up to 96%.

- Highest growth: Of all ad formats, mobile ads saw the highest growth (+5.6%), but it remains the smallest part of B2B advertising budgets (around 1% of all spend).

Interestingly, more B2B companies used native ad formats in 2019, although growth was slow. In 2018, only 6.9% of B2B advertisers used the format, compared to 7.2% in 2019.

Events

B2B companies find events and trade shows valuable for personal connections, industry thought leadership and innovation discovery. That’s what makes these events profitable for publishers.

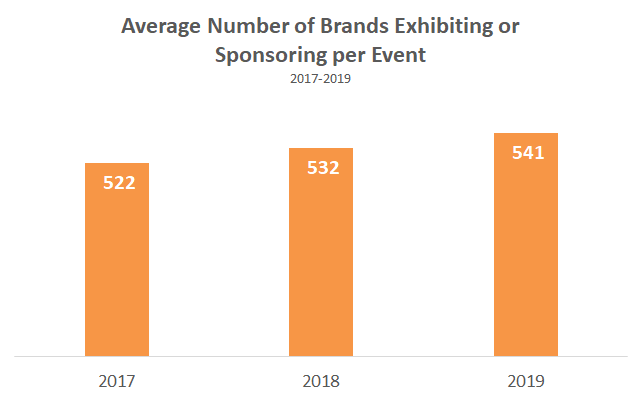

MediaRadar research found that:

- 14% of B2B brands who bought an event sponsorship/exhibit space did so at multiple events in 2019, up from 12% in 2017.

- B2B events and trade shows have an average amount of 541 sponsoring or exhibiting brands.

While the amount has gone up 4% across the board, that amount of increase varies across events based on their size.

Large events like the NAB Show, IMEX America and HIMSS had on average over 2,800 brands per event (+3% since 2017).

Mid-Size events averaged 450 sponsors, remaining flat since 2017.

Small events had over 90 brands, representing the largest increase in sponsorships. Sponsorships and exhibitors at these small trade shows have increased by a significant 40% since 2017.

While we do not know exactly why smaller events are seeing such faster growth, one factor to consider is the price to be a sponsor. The average cost to be an event sponsor is over $20k.

B2B advertisers continue to spend a portion of their advertising budget on print, but it is not a driving force. Instead, digital and event marketing are where B2B brands are looking to advertise.