It’s not news that Google is sunsetting cookies sometime next year. And though it means change for both B2C and B2B marketers, most of the conversation has focused on consumer facing companies.

But how are B2B companies thinking about the loss of third party cookies and what changes are taking place ahead of time?

What will the move away from cookies look like for B2B marketers?

Headlines make the removal of cookies seem like the apocalypse of the internet. But in reality, the internet is fueled by advertising—and it’s inevitable that adtech leaders and publishers will find a clear path forward.

And the good news is brands already have plenty of data.

Advertisers will have access to first-party data, contextual data, intent data and more.

Sophisticated companies like Bombora and Hivestack can bring B2B intent data to programmatic digital out of home (DOOH). Many other companies, like Metadata, already enable B2B marketers to deliver ads to the right buyer at a specific company by using data apart from cookies.

Additionally, marketers will have alternatives to cookies—perhaps too many alternatives.

For starters, there’s Google’s alternative: the Federated Learning of Cohorts (FLoC). Google claims that it delivers 95% of the conversions per dollar spent compared to cookies.

And then there’s The Trade Desk’s Unified ID 2.0, which is “built from hashed and encrypted email addresses.” It’s designed to enable targeting, but with enhanced consumer privacy. It’s open-sourced and independently governed.

Other alternatives include:

Not a single one has hit the critical mass among publishers to seem like the clear winner. With plenty of data companies and cookie alternatives to utilize, many B2B marketers feel uncertain about what their digital strategy will be in the future.

Moving into unchartered territory, B2B marketers are decreasing their programmatic buying.

MediaRadar Insights

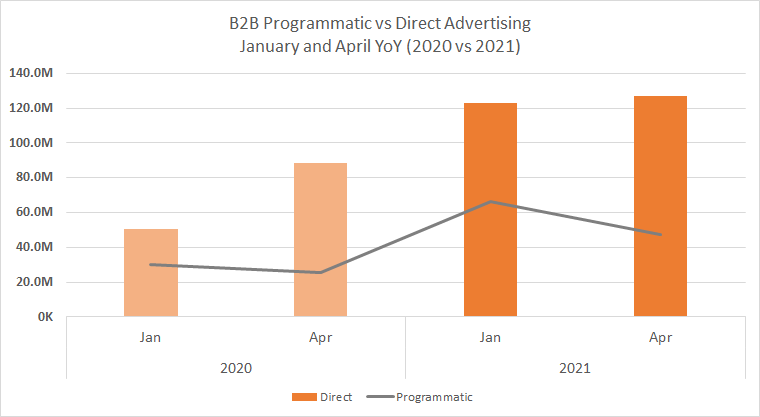

Programmatic ad spend in the month of April accounted for 27% of all digital ad placements in B2B media. This is down from 35% in January, where 15.9k advertisers spent $66.24mm in the programmatic B2B media space.

Pre-pandemic, programmatic advertising accounted for 37% ($30mm) of all digital spend (January 2020) in B2B digital media.

The most spend we’ve seen in B2B programmatic placements was in January of 2021. However, this was already slower by April 2021 where 15.6 thousand advertisers spent $47.1mm.

Comparatively, in April 2021, 7.3 thousand advertisers spent $126.9mm on direct placements. There are less brands buying directly, but their spends significantly outweigh programmatic buys.

The B2B industry is concerned with the loss of cookies just like other industries are. But as we can see by the shrinking amount of programmatic spend, they may be preparing for it by investing in other formats ahead of time.

For more updates like this, stay tuned. Subscribe to our blog for more updates.