Move over intermittent fasting, breakfast is back.

Unsurprisingly, this month people are stockpiling “shelf-stable” food.

General Mills and Kellogg’s are working at full capacity to get their products into stores where sales are spiking. Overall sales are still unclear, but General Mills expects constant-currency adjusted profit per share in 2020 to increase 6-8%.

Sales for cereal products are up, so what does that mean for breakfast food advertising?

MediaRadar assesses the data.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Americans love breakfast cereal right now

Let’s face it: stress, boredom and a world of unknowns are changing eating patterns.

“The change of pace on consumer habits and the spread of the virus has been the likes of which we have never seen,” explained General Mills CEO Jeff Harmening to AdAge. “As people look for things they know in times like these, our brands tend to do fairly well because it offers comfort.”

A sign that people need some extra comfort in this time is that it’s not just cereal sales that are up: snacks, baked goods and vanilla sales have also increased.

Kellogg’s also experienced a surge in its stock value once the World Health Organization declared COVID-19 a pandemic. People are grabbing food with a long shelf life (in theory, that is. If your Cocoa Puffs don’t last long on your shelves, we don’t judge).

Aside from comfort and needing food that will last, people are simply eating more food at home. With restaurants closed, many Americans need something quick and easy to grab from their own kitchen.

Cereal companies respond to cravings with more ads

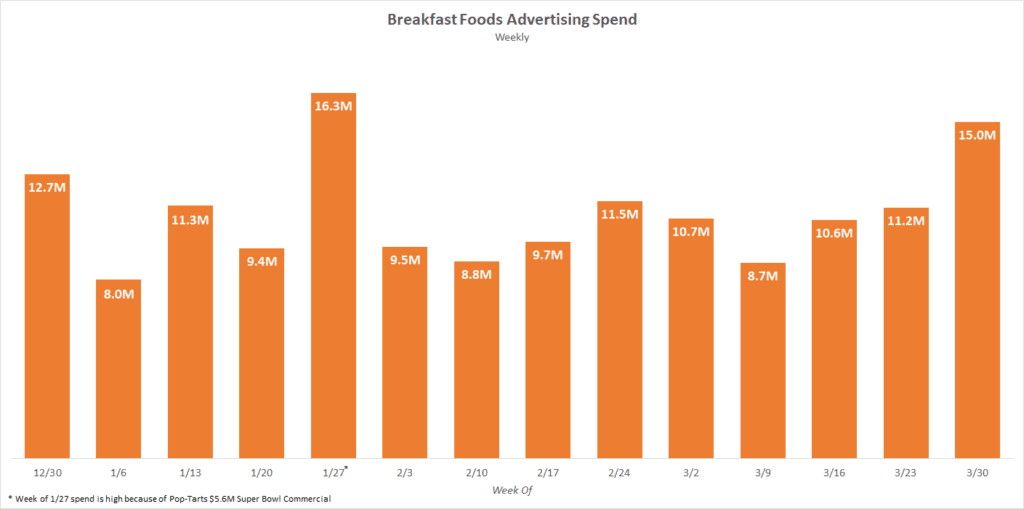

According to MediaRadar research, ad spend for breakfast products is up.

- In February, companies spent an average of $9.8M per week on breakfast products. In March, it was up to $11.1M per week (+13%).

- Ad spend for breakfast products in March ($53M) was 19% higher than the average month in 2019.

- Over 90% of the ad dollars from this category year to date have been spent on TV.

- We can see how much brands increased their ad spend on particular cereals:

- Kellogg’s Rice Krispies was up 76%

- Honey Bunches of Oats was up 46%

- Cheerios was up 40%

- Pop-Tarts was up 29%

Harmening, when speaking to AdAge, said that General Mills aims to promote marketing that is appropriate for a time such as this, by keeping a sense of normalcy and by avoiding themes that point to stocking up.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.