Coronavirus is throwing a curveball at B2B event organizers, making events risky or even impossible to carry out.

Last week, we covered how trade shows were suffering due to coronavirus. Since then, the situation has only escalated.

“Three weeks ago this was a blip on the radar screen, two weeks ago it became something real, a week ago it was all anyone was spending their time on,” says Nick Hayman, chief customer officer at Winsight. Winsight is a B2B media and information company that organizes more than 30 conferences a year.

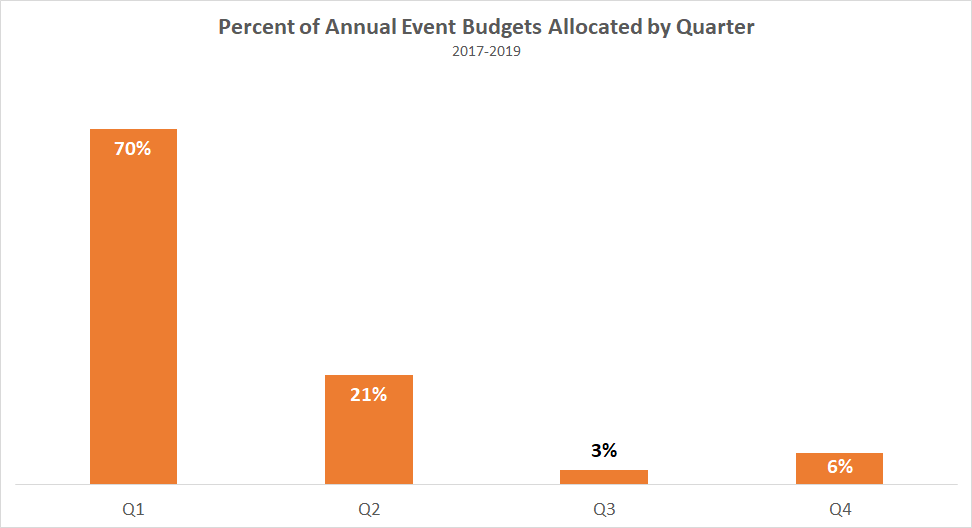

The timing of this pandemic is hitting organizers particularly hard as the first half of the year is event season for B2B events.

Here is an update on B2B events affected by coronavirus and the ad spending that will be impacted.

We encourage you to subscribe to our Blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Events continue to wane

The first major event to cancel was Mobile World Congress back in February. Other events followed suit, albeit hesitantly.

SXSW was ordered to cancel last week, only one week before it was set to take place. The annual tech, film and music festival, which brings in 400,000 international travelers and over $355M for the city, was set to take place March 13-22.

SXSW is just one event that shows just how fast these decisions are happening. The American Physical Society cancelled its largest meeting of 10,000 people from all around the world with less than 34 hours before the event.

The world’s largest exhibitions organizer, Informa plc, has delayed or canceled more than 100 events due to coronavirus. This is about $520 million in unrealized revenue. Most of these gatherings have been rescheduled, with only 13 completely cancelled. This makes sense, considering events account for 65% of the company’s revenue.

As events cancel, we see a prime example as to why. The Biogen Leadership Conference, held in Massachusetts in late February, is now linked to 78 different cases.

Even an event about coronavirus was cancelled due to coronavirus.

The general consensus is that B2B event organizers are proceeding with caution — heeding public officials’ warnings and finding ways to offset lost event revenue.

MediaRadar insights on B2B event spending

To be able to predict how much this will affect ad spending over the next year, we first have to look at the past standards for B2B events.

For starters, the timing of this pandemic was not favorable for event organizers.

The first half of the year is key to events. We found that 70% of all event spending happens during Q1, and another 21% occurs in Q2.

While many events are being switched to an online format and others are being rescheduled for later in the year, it is certain that there was significant revenue lost in Q1.

MediaRadar data shows that:

- Nearly 1 in 5 B2B event advertisers also advertise in B2B print and digital.

- Over 500 brands on average attend an event.

- Over 70k companies sponsored or exhibited at an event in 2019.

The average B2B event revenue varies by industry. In retail, for example, the average B2B event generated over $6M in revenue from exhibitor/sponsorship fees.

The number of B2B event advertisers that also advertised in B2B print and digital has started to decrease. In 2017, 23% of companies that advertised in both events and print and digital compared to 20% in 2019.

With event cancellations, however, much remains unknown of how advertisers plan to spend their budget. In light of conference cancellations, marketers are turning to digital events, webinars and direct mail.

As society is encouraged to practice social distancing, it doesn’t appear like business will be going back to normal anytime soon. MediaRadar will continue to cover B2B ad spending and provide the latest data for publishers in times of uncertainty.