Whether it’s about the vaccine or prescription medication, consumers are now frequently accessing health information online, instead of at the doctor’s office.

And despite a complicated history of regulations, the pharmaceutical industry needed to shift ad dollars into digital during the pandemic.

How much is direct-to-consumer pharma spending, and which brands are spending the most?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Though Slower Than Others, Direct-to-Consumer Pharmaceutical Shifts to Digital

The role of direct-to-consumer advertising (DTCA) in the pharmaceutical industry has a long history of being controversial.

Advocates argue that honest and balanced DTCA educates consumers and empowers individuals to have more control over their health.

Opponents claim that advertisements can undermine the doctor-patient relationship, as patients become less confident in their doctors’ clinical judgement. Individuals tend to underestimate generic drugs compared to branded ones.

Because of its critical role in consumer health, pharmaceutical advertisements are heavily regulated under the FDA. “Much of our compliance and enforcement activity is spent trying to ensure that companies don’t low-ball risks in the ad and provide inflated expectations of benefit,” says Janet Woodcock, M.D., deputy FDA commissioner for operations.

Because of regulations, the pharmaceutical industry is typically slow to change. But the pandemic pushed pharmaceutical companies to increase their digital spend. Pharmaceutical reps weren’t (and still aren’t) allowed into hospitals with COVID-19 protocols in place, so communication between physicians and pharmaceutical companies had to go digital. Though this change is more evident in the B2B space, it can also be seen in DTCA.

A significant portion of these dollars were spent on COVID education campaigns, but analysts predict that the shift to digital will continue after the nation is vaccinated and messaging changes.

MediaRadar Insights

Pharmacies

Due to strict regulations around messaging, the industry tends to move much slower than others. It doesn’t seem that the pandemic changed that tradition.

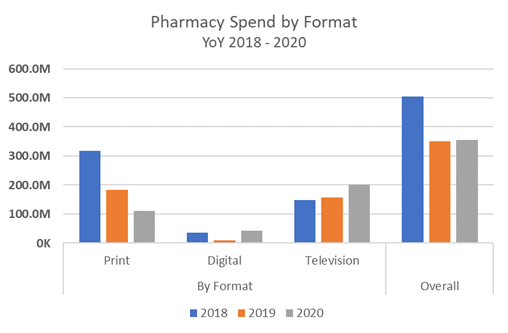

Overall ad spend from pharmacies increased just 1% between 2020 and 2019. The shift away from print advertising (down 40%) was buffered by the increase in digital (up 306%) and television (up 29%).

Pharmaceutical industry predictions suggest that though digital ad spend is a small portion of total ad spend (12% in 2020), the shift towards digital advertising will continue to gain traction.

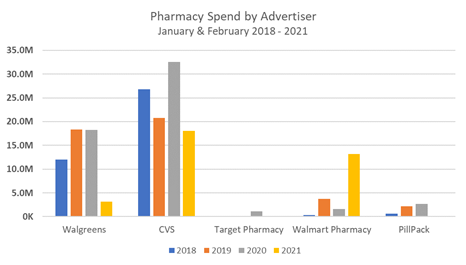

The biggest shift we see in pharmacy ad spend is the 70% overall drop from 2018 to 2019. For context, the meteoric ad spend in 2018 was not predicted to return in 2019 due to CVS’s merger with Aetna (October 2018), Cigna’s acquisition of Express Scripts (September 2018), and Amazon’s purchase of PillPack (June 2018).

CVS is the clear frontrunner in pharmacy ad spend. (Note: CVS operates the pharmacies in Target, explaining the tiny Target spend).

Walmart didn’t start to become competitive in ad spend until 2021. But their January and February ad spend outpaced Walgreens who typically comes behind CVS in spending.

Pharmaceuticals

Oncology and Diabetes Prescription Drugs

In January and February 2021, cancer prescription drugs spent $104mm across TV (72%), print (24%), and digital (4%). Overall, this is up 57% over January and February of 2020.

Advertisers with the largest amount of digital spend include:

Their digital spend in January and February 2021 accounts for 57% of all digital spend (within the pharmaceutical category).

Diabetes prescription drugs

Diabetes prescription drug spend ad spend is up 55% in January and February 2021 YoY, at $142.87mm compared to $92.16mm in January and February 2020. Digital spend is up 737% from 2020, where there was less than $1mm spent over the first two months of the year.

Advertisers with the largest amount of digital spend include:

Trulicity accounted for 28% ($40mm) of all ad spend in January – February 2021.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.