COVID-19 is putting the ad-tech ecosystem into a tight crunch.

With the steep drop in activity across travel, entertainment and events, advertisers have entirely cut ad campaigns or made significant cuts. Ad tech supply chains (and payment terms) are complex — and massive swings in the economy can disrupt the status quo.

With this uncertainty, advertising leaders are wondering how smaller exchange partners will survive this restrictive market.

We dive into what some experts have to say about COVID-19 and its impact on the ad-tech ecosystem.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Delayed payments disrupt the entire ad tech ecosystem

2020 was already predicted to be a brutal year for ad tech consolidation, but coronavirus has raised the heat.

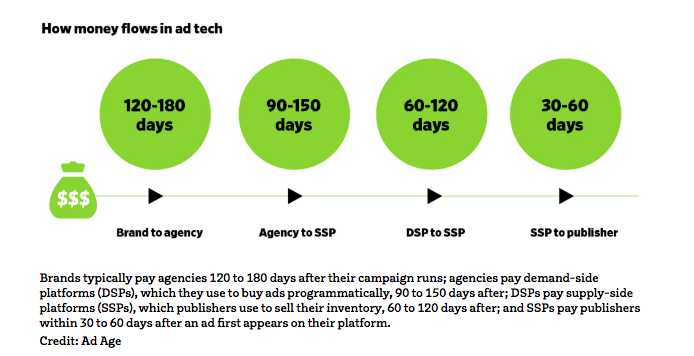

The cash flow system between agencies, SSPs, DSPs and publishers is complex: though an ad is placed in a split-second, it is not paid for until several months later. This creates intense pressure when sudden financial crises happen: non-payments can upend the entire ecosystem.

Advertisers are already delaying payments and this loss will be passed onto DSPs and possibly those who fall in line after them. IAB reported that 25-50% of brands plan to cancel or scale back their spend this quarter. Slashed spending puts smaller DSPs and SSPs at risk.

“If it’s like what happened in 2000 with the dot-com bubble, we’re going to see massive failures, fire sales and wholesale landscape change,” explained an anonymous CEO of a large ad tech company. On the other hand, if this financial crisis is more akin to the 2008 recession, companies may have more chance of survival — or to join forces with someone else.

“Rival platforms are coupling up, while other platforms are seeking ways to round out their offerings in an effort to offer a more integrated data hub,” wrote Taylor Peterson last year before the virus broke out. This could possibly still hold true as companies ride out the storm.

‘Massive failure’ or more consolidation?

Ad tech consolidation is nothing new. In recent years, we have seen some major mergers and acquisitions. Amazon bought Sizmek’s ad servers. Taboola and Outbrain joined forces. MediaMath raised $225 million to fund tech and acquisitions, to name a few.

But proving unique value in a very crowded field is tough.

Not only that, brands and agencies used to work with 50 to 100 different organizations. Now, many try to make this process more efficient with Supply Path Optimization (SPO).

MediaRadar found that programmatic ad spend overall was down 10% month-over-month in March, while the number of brands who advertised using programmatic ads was down 6% compared to the year before.

Last year, travel and retail brands accounted for just over 20% of all programmatic ad dollars. These industries were hit hard by COVID-19, and it was reflected in their ad spend. In March, their programmatic ad spend was down 18.3% month-over-month.

There is no doubt that these market conditions will put pressure on smaller companies to merge together or sell to survive. The trick is that pricing proposals will likely be low and companies may want to make it through this uncertain season. If they can make it through this downturn, they will have a better market to join forces with competitors or get a better exit price.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.