As we swing full-force into 2021, many people are making resolutions for the new year. Among the most popular? Getting fit.

Fitness advertising traditionally spikes in January. And in the COVID era, fitness apps and websites become particularly important as users plan to get fit at home without breaking the bank.

Even though fitness brands are running campaigns across multiple channels, most seem to shy away from the new and relatively unproven OTT format. So just what does this category’s spending data look like in the OTT advertising scene?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

OTT Campaigns are Still Largely Experimental

OTT ad campaigns are characterized by shorter run times and fewer brands per industry.

It makes sense that advertisers aren’t relying on OTT for the bulk of their work quite yet, despite the immense and growing popularity of OTT content (60% of Americans say they would rather watch free content with ads than pay for an ad-free entertainment platform). It’s a relatively new advertising format, and there are many who would rather spend their limited marketing budgets on more tried-and-true methods such as linear television.

Others, though, are taking the plunge.

Media brands, in particular, are leaders in exploring OTT advertising. Media is responsible for 19% of all spend in OTT advertising—though, it is a broad category that includes books, music, television and streaming programming, video games, mobile apps, and website publishers.

Advertising from websites is the largest driver.

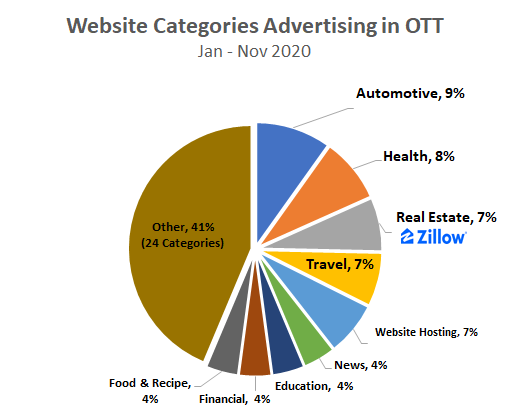

Diving deeper into website marketing reveals a highly fragmented segment made up of 33 sub-categories. The top 3 are Auto, Health, and Real Estate websites (such as Zillow).

No individual category is responsible for more than 9% of spend; 24 categories make up less than 3%.

Even when a brand is spending on OTT, it’s likely that they’re only doing so short-term.

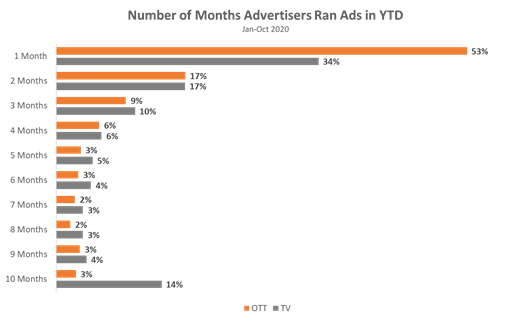

In all of 2020, 53% of campaigns ran ads for just one month using OTT and 17% of brands placed ads for 2 months. This reinforces just how new OTT is for most brands—they’re still experimenting before investing more money.

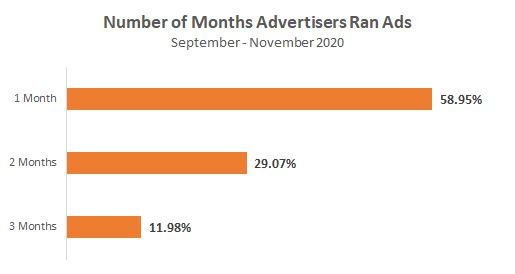

A look at a shorter period, from September through November of 2020, reveals the possibility that these runs are extending. For example, in these three months 29% of advertisers ran for two months, a significant increase from the 17% that ran for two months in the year as a whole.

Additionally, 59% of advertisers ran for just one month. This number could be misleadingly high though, as many November advertisers are marketing during the holidays and will continue into December. December is not included in our analysis here.

Fitness Apps and Websites Ads Are Hard to Find on OTT

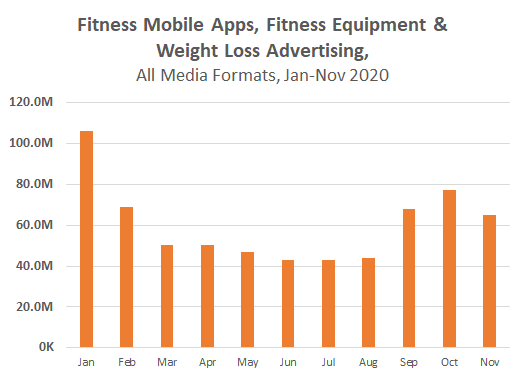

Even though fitness brands spend millions of dollars across all media formats on a monthly basis, OTT typically represents 1% or less of the spend. On top of that, there are between 200 to 500 brands that place advertising per month in the category, and OTT is winning just 8-10 of these. This indicates that OTT advertising for Fitness Mobile Apps, Fitness Equipment & Weight Loss Advertising is just getting started.

In this early stage of OTT advertising, there are some leading brands willing to test the waters.

Fitness company, Peloton was an early adopter of OTT. After a marketing fiasco in 2019, Peloton needed to change people’s minds about the brand’s image and priorities. This, combined with booming financial success in 2020, caused Peloton to advertise heavily across all marketing formats, including OTT.

OTT offers a wide range of benefits for brands, but it’s so new that many brands are waiting to see what happens with early adopters—will early adopters hold on to the channel and extend their campaigns this year? As ad-supported OTT becomes more mainstream, will it make sense to shift linear TV dollars to the format?

Our OTT data solution will be expanding this year. As we begin to track more OTT channels, we’ll be excited to share insights on brand strategy, category spending, and insights on creative strategies.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.