HBO Max comes out this week to join the competition between streaming services.

TV viewership rose in March and began to level off in April during stay-at-home orders. After months of watching cable TV, Netflix and Youtube, many viewers are excited for the new content HBO Max has to offer.

Some of the most anticipated content includes a Friends reunion special and the fabled “Snyder Cut” of Justice League.

In March, when the crisis hit, we covered how digital streaming ads surged due to stay-at-home orders. We wanted to check back in to see what’s going on in light of this new launch.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

HBO Max Enters the Streaming Wars

HBO will now have three products: HBO Max, HBO Now and HBO Go. They will all coexist at the same time, at least for now.

Here’s a simple break down:

- HBO Go: If you have HBO via cable or satellite, this is the app that lets you watch HBO on other devices.

- HBO Now: This is the HBO app for people without cable who want to watch HBO content.

- HBO Max: This is like HBO Now, but amped up. It will include old hits, plus new exclusive and original content.

HBO Now will continue, but customers will be paying the same price for less content. Many HBO customers will be automatically upgraded to HBO Max, but the details are still hazy.

While some agreements are still unfolding, HBO Max has many distribution partners set in place before the launch.

“Through our expansive distribution pipeline, millions of customers will have immediate access to a best-in-class streaming experience come May 27,” said president of WarnerMedia Distribution Rich Warren. Xbox, PlayStation, Cox, Verizon and Samsung are some of the largest partners to recently come on board.

HBO Max will feature shows like Friends, The Big Bang Theory, South Park and original movies. It will also feature new kid-friendly shows, like a talk show hosted by Sesame Street’s Elmo.

Some of HBO’s own employees have doubted this new move, wondering if it will tarnish HBO’s brand marked by pushing TV boundaries. Leaders are not concerned.

“We’re going to have Tiffany aisles within a larger store,” HBO Max boss Kevin Reilly said. The original content on HBO Max is designed to complement, rather than replicate HBO.

HBO doesn’t own the edgy and high-quality corner of media any more. Competitors like Netflix, Amazon and Hulu make similar content. In response, HBO seems to be widening its audience reach by creating lighter shows and movies. There will be over 10,000 hours of content, so viewers probably don’t have to worry about finding something suitable to their interests.

MediaRadar Insights

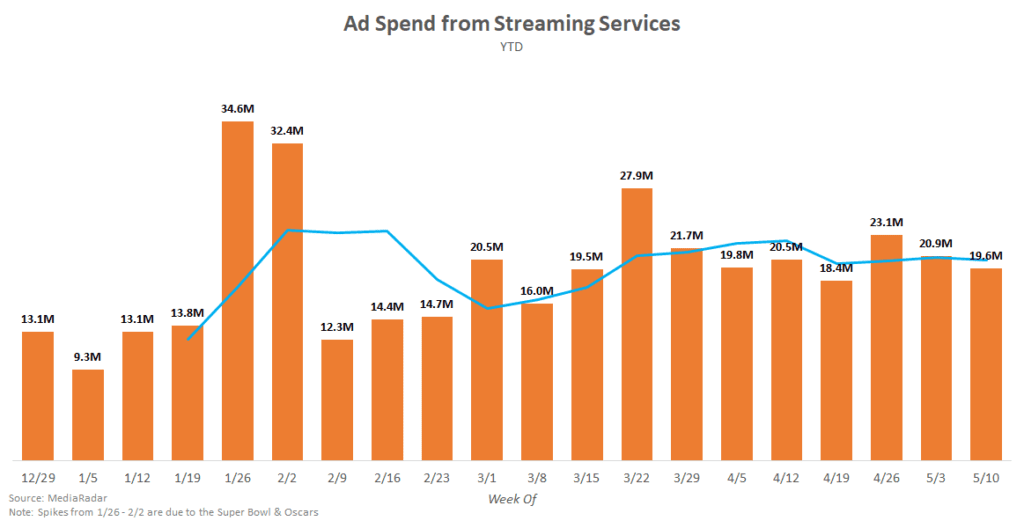

Since March, there has been no explicit change in creative among streaming service advertisers, though there has been an increase in spend.

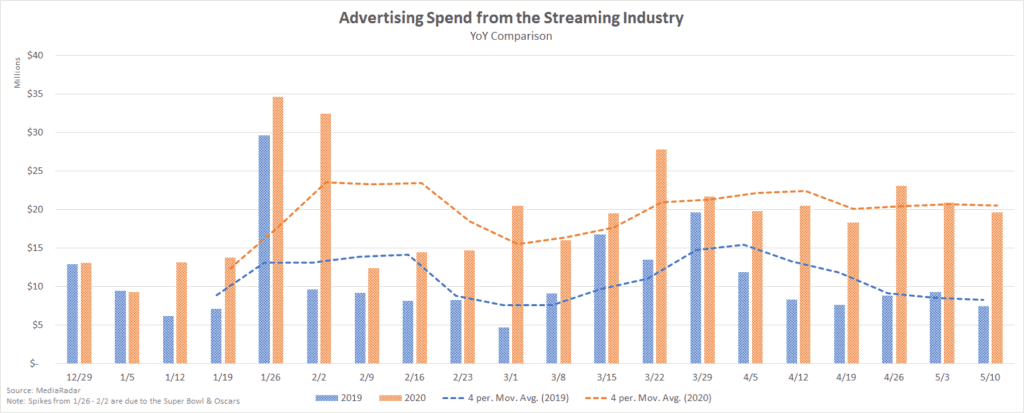

Spending has remained higher and only boosted by the launch of Quibi and HBO Max in recent weeks. The increase can be seen even more clearly when we look at year-over-year data.

Spend was already higher due to increased competition like Disney+, and with COVID has only risen higher.

One interesting note is that spending from Quibi has fallen off since its launch. Over the last 4 weeks, its average weekly spend has been down 82% compared to the 4 weeks prior (4/19 – 5/16 vs. 3/22 – 4/18).

When we check in on the major players, this is what we see:

- Netflix has not shifted advertising amid the pandemic or the new competition.

- Disney (making up Disney+ & Hulu) has upped spending amid the pandemic. Their average weekly spend since the week of 3/15 has been 74% higher than the weeks prior (excluding their Oscars ads).

- Amazon prime video has upped their ad spending in recent weeks. Spending the week of 5/10 is nearly double where it was the week of 4/19.

- HBO Max began advertising week of 4/19. But their spend really began the week of 5/10 (it was more than triple where it was just the week prior). We expect a large push right around their launch.

Aside from the drop from Quibi, it seems that the advertising competition between most streaming services has intensified. We will continue to watch the advertising approaches of these brands as HBO Max launches and people start relaxing their social distancing behaviors.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.