After more than two years of unpredictability and unprecedented events, the COVID-19 pandemic appears to be nearing its end.

Understandably, a lot has changed through it all.

Dining rooms became home offices.

Online shopping accelerated faster than anyone thought possible.

Mental health got the spotlight it deserved.

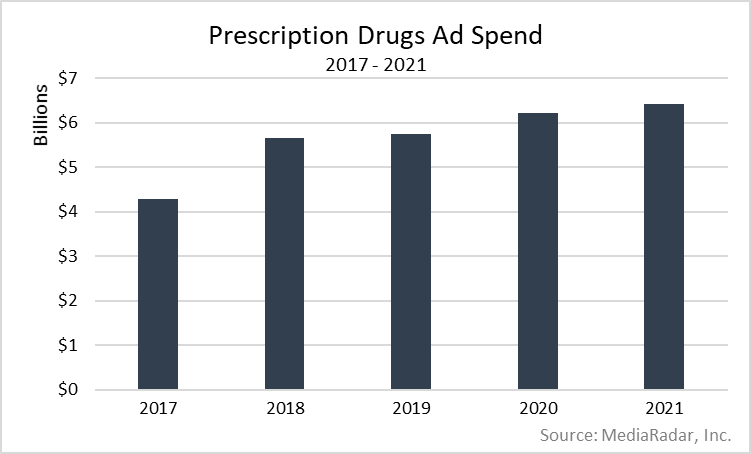

However, what didn’t change was how much pharma companies were willing to spend on ads promoting prescription drugs.

After increasing by 32% YoY in 2018, prescription drug ad spending stood relatively still, despite more companies buying ads.

In 2021, the number of pharma companies investing in ads increased by 17% YoY, while the number of drugs they advertised rose by 15% during the same period.

Given these companies’ relatively unchanged spending habits, one may think there’s nothing significant to highlight.

That’s not the case.

While the overall industry has had a rather uneventful few years in terms of how it approaches its advertising, some intriguing tales emerge if we dive below the surface.

One of those tales involves how pharma companies are spending to promote drugs used to treat HIV and AIDS, which accounted for 6% of the total ad spend dedicated to prescription drugs in 2021.

(Other top spending categories include Diabetes, Psoriasis, Arthritis and Breast Cancer. Pharma companies combined to spend more than $2.7b on ads to promote prescription drugs.)

HIV/AIDS Drug Advertising in 2021

In 2021, HIV/AIDS prescription drug ad buys remained relatively stable, increasing by just 2% YoY.

Yet while total spending didn’t change much in 2021 compared to 2020, we see a different story in Q4 where there was a significant increase in spending.

In the last 3 months of the year, ad buys for HIV/AIDS drugs increased by 78% YoY.

Helping drive this increase was Cabenuva (GlaxoSmithKline or GSK), which the FDA approved in January 2021.

GSK spent all of its ad dollars in Q4 2021, buying ads on ABC, A&E, CBS, CNN, Fox, NBC, and the USA network, all of which were more than $1mm and accounted for 75% of every penny the company spent on TV ads.

A two-company race: Gilead Sciences and GSK account for nearly 100% of spending

The spend allocated to HIV/AIDs prescription drug ads comes almost entirely from Gilead Sciences and GlaxoSmithKline (GSK), with the industry giants accounting for nearly 100% of the ads.

Despite nearly every penny coming from only two companies, HIV/AIDS prescription drug ads had the highest percentage of digital spending, accounting for 28% of digital ad buys used to promote drugs to treat any condition.

For reference, the other conditions we looked at, including Diabetes, Psoriasis, Arthritis and Breast Cancer, ranged from between 5% and 16% of total digital spending.

When we look at how these two companies are spending, we see that they’re fighting for market share differently.

For starters, Gilead and GSK both invest in TV spots; however, Gilead decreased its investment by 45%, while GSK upped its by 22% YoY. (TV accounted for 66% of spending in 2021 after accounting for 83% in 2020.)

The drop from Gilead is likely the result of the company’s increase in digital spending, which increased by 147% YoY.

However, the fact that GSK increased its spending on digital by almost 400% YoY doesn’t support that.

It could mean that GSK has a bigger budget and could increase spending across the board, whereas Gilead had to offset the increase in digital with a decrease in TV.

The opposing strategies continued when we looked at how they spent on print ads.

Gilead decreased its spending on print by 16%.

Combine this drop with a similar one to TV buys and it’s clear that the company is shifting its advertising strategy to include more digital tactics.

Meanwhile, GSK increased its spending on print ads by 105%, with the majority of its dollars—89%—going to 10 publications, including The New England Journal of Medicine (28%) and The Journal of the American Medical Association (17%).

Everyone, meet digital advertising

There’s no denying that pharma companies have historically been hesitant about digital advertising and more comfortable sticking to traditional tactics.

That’s beginning to change.

The majority of the digital spending went to video.

In 2021, video ad spending increased by 189% YoY, accounting for 88% of the digital dollars allocated to HIV/AIDS ads.

Gilead and GSK, in particular, increased their investment in video ads by 191% and 44%, respectively.

Unsurprisingly, spending on YouTube was up considerably.

In Q4 of 2021, Gilead increased its YouTube ad spend by 750% YoY.

In August 2021, Gilead began investing at least 93% of its video ad buys with YouTube.

In Q4, that number jumped to 97%.

This increase is worth noting due to the fact that in January of the same year, YouTube accounted for just 54% of the company’s video ad investment.

When looking at how these companies spent their YouTube ad dollars, most went to content on channels related to Music (25%) and Society & Culture (20%).

Meanwhile, Beauty channels received 11% of spending, Comedy got 9%, while Gaming and Entertainment & Movies both got 8%.

The remaining dollars went to Lifestyle channels (3%) and Others (.9%).

Despite the growth across the board in digital ads, Facebook didn’t receive much love.

In 2020, spending declined by over half of the 2020 investment (54%).

Looking Toward the Future of Pharma Ad Spending

No one can fault the pharma industry for shying away from digital advertising tactics in the past.

The strict privacy regulations in healthcare, coupled with the historically lax ones in digital advertising, made for a risky recipe no one wanted to experiment with.

Still, there was bound to come a time when the performance benefits and cost-efficiency of digital advertising outweighed the concerns.

It looks like we’re getting there (or at least getting close).

While pharma companies are still holding on to their traditional ways of promoting HIV/AIDS prescription drugs, the recent uptick in digital spending is undoubtedly a sign of what’s to come.

Will digital ever surpass traditional as the preferred avenue for ad dollars?

It could, but that’s years away.

That said, as pharma companies realize the power of digital advertising–especially as the healthcare world becomes even more digital and the Internet adopts a more privacy-first approach–there’s no question digital ads will encroach on traditional advertising’s once hallowed ground.

For more insights like this, sign up for our blog.